Variable and Full Costing - University of North Florida

advertisement

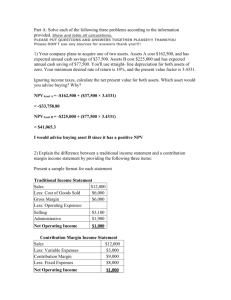

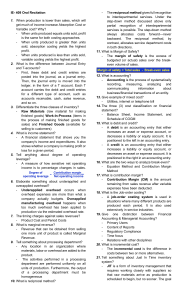

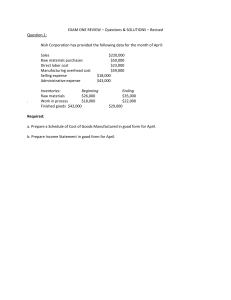

Chapter 3 Managerial Accounting Variable and Full Costing Prepared by Diane Tanner University of North Florida 2 Measuring Product Costs Includes all costs necessary to get products ready to sell Two methods to determine product costs Full (absorption) costing Required for GAAP reporting Emphasizes the cost function Variable costing Helps managers make product decisions as it is easy to predict how costs will behave in the future Used for internal decision making Emphasizes cost behavior Reporting Product Costs Merchandising companies Buy goods to sell Product costs reported Merchandise Inventory on the balance sheet Cost of Goods Sold on the income statement Manufacturing companies Buy materials to produce products to sell Product costs reported Raw Materials, Work in Process, Finished Goods on the balance sheet Cost of Goods Sold on the income statement 3 4 Components of Product Costs Full Costing Inventoriable costs include Direct materials Direct labor Variable manufacturing overhead costs Fixed manufacturing overhead costs Inventoriable costs include Variable Costing Direct materials Direct labor Variable manufacturing overhead costs Two Forms of Income Statements Full costing income statement Costs are reported based on function Product versus period Gross margin is the amount available to cover operating expenses and to go towards profit. Variable costing income statement Costs are reported based on behavior Variable versus fixed 5 Contribution margin is the amount available to cover fixed costs and to go towards profit. 5 GP Ratio vs. CM Ratio Contribution Margin (in $) Sales (in $) Interpretation Indicates the portion of every sales dollar available to cover fixed costs and to go towards profit Gross Profit (in $) Sales (in $) Interpretation Indicates the portion of every sales dollar available to cover operating costs and to go towards profit 6 7 Expanded GAAP Income Statement Sales Cost of goods sold: Variable product costs Fixed product costs Total cost of goods sold Gross margin (gross profit) Operating expenses: Variable period costs Fixed period costs Total operating expenses Net operating income Gross profit = Sales $100,000 $22,000 11,000 33,000 67,000 38,000 19,000 $67,000 $100,000 57,000 $10,000 = 67.00% Expanded Variable Costing Income Statement Sales Variable costs: Variable product costs Variable period costs Total variable costs Contribution margin Fixed expenses: Fixed product costs Fixed period costs Total fixed expenses Net operating income Contribution Margin Sales = $100,000 $22,000 38,000 60,000 40,000 11,000 19,000 30,000 $10,000 $40,000 $100,000 = 40.00% 8 9 The Contribution Approach Consider the following information developed by the accountant at Element Skateboard Co: Sales (500 skateboards) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 250,000 150,000 $ 100,000 80,000 $ 20,000 Per Unit $ 500 300 $ 200 Percen 100 60 40 CMR: = $200/$500 = 40% For each sales dollar generated by Element, profit will increase by $0.40. Fixed costs in total do not change. For each additional skateboard sold, profit will increase by $200. Fixed costs in total do not change. The End 10