The Auditor as a Strategic Business Partner

advertisement

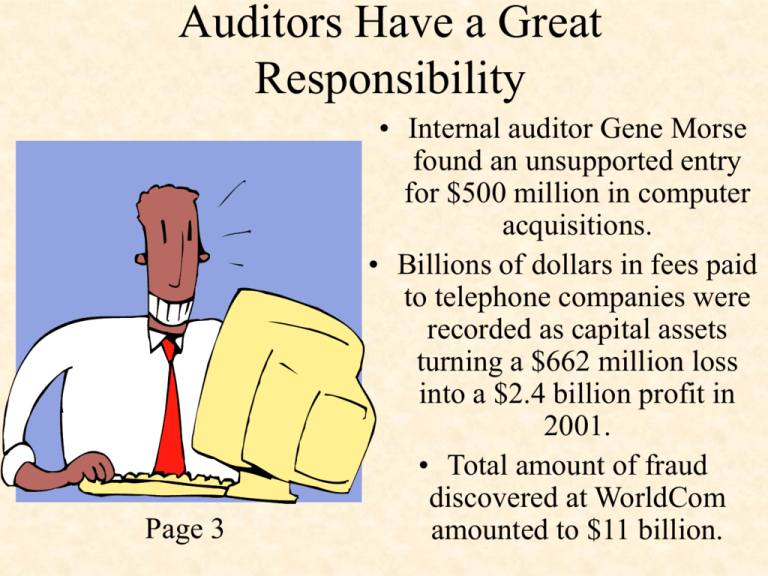

Auditors Have a Great Responsibility Page 3 • Internal auditor Gene Morse found an unsupported entry for $500 million in computer acquisitions. • Billions of dollars in fees paid to telephone companies were recorded as capital assets turning a $662 million loss into a $2.4 billion profit in 2001. • Total amount of fraud discovered at WorldCom amounted to $11 billion. Chapter 1 The Demand for Audit and Other Assurance Services Company Owners and Lenders Company Managers Presentation Outline I. The Nature of Auditing II. Auditing and Investor Risk III. Assurance Services IV. Requirements for CPA Certification I. The Nature of Auditing A. Auditing Defined B. The Distinction Between Accounting and Auditing C. Types of Audits D. Types of Auditors A. Auditing Defined Auditor accumulates and evaluates evidence to ascertain correspondence between the information and established criteria and communicates results to interested users B. The Distinction Between Accounting and Auditing Accounting is the recording, classifying, and summarizing of economic events for the purpose of providing financial information used in decision making. Auditing is determining whether recorded information properly reflects the economic events that occurred during the accounting period. C. Types of Audits Operational Audit Involves evaluation of any part of an organization’s operating efficiency and effectiveness. Not limited to accounting areas. Compliance Audit Determine whether the auditee has complied with specific procedures, rules, or regulations set by some higher authority. Financial Statement Audit Determine whether overall financial statements are stated in accordance with specified criteria. Generally accepted accounting principles are normally the criteria, although other basis of accounting are at times used. D. Types of Auditors External or Independent Auditors – CPAs are the only group permitted to provide financial statement audits. Such audits are required of all publicly traded companies. General Accounting Office Auditor – works for the Comptroller General who reports to and is solely responsible to Congress. They audit various governmental bodies. Internal Revenue Agents – evaluate taxpayer compliance with tax laws. Internal auditors – Auditors who are employees of the companies they audit. II. Auditing and Investor Risk A. The Cost of Debt B. Causes of Information Risk C. Ways of Reducing Information Risk A. The Cost of Debt Auditing has no effect on either the risk-free rate or business risk, but it can have a significant effect on information risk! When a bank makes a loan, it will charge a rate of interest determined by primarily three factors: Risk-free rate – return on U.S. Treasury notes for the term of the business loan. Business risk for the customer – risk associated with a particular business that may result in it being unable to repay a loan. Information risk – Improper business risk decisions resulting from inaccurate information. B. Causes of Information Risk Remoteness of information – information provided by others must be relied upon. Biases and motives of the provider – can result from honest optimism of intentional misstatement. Warning Voluminous data – the Thin Ice! amount of data grows with the organization. Important details can be lost. Complex exchange transactions – business transactions are becoming increasingly complex. C. Ways of Reducing Information Risk User verifies information – normally impractical for user to go to business and examine information. User shares information risk with management – although users may bring suit against management for supplying inaccurate information, it is often difficult to collect on losses. Provide audited financial statements – most feasible approach is to have an independent party check for completeness, accuracy, and removal of bias. III. Assurance Services A. Assurance Services B. Attestation Services C. Other Assurance Services D. Non-Assurance Services A. Assurance Services Decision makers seek assurance regarding the reliability information they use to make decisions. Assurance services are valued because the assurance provider is perceived as an independent and unbiased evaluator of information. Assurance services can be provided by CPAs and a variety of other professionals. B. Attestation Services Many other assurance services do not meet the criteria of attestation services: a CPA who issues a report about the reliability of an assertion that is the responsibility of another party. There are four categories of attestation services. ASSURANCE SERVICES ATTESTATION SERVICES 1. Audits of historical financial statements 2. Effectiveness of internal control over financial reporting 3. Review of historical financial statements 4. Other attestation services B1. Audits of Historical Financial Statements An audit of historical financial statements is a form of attestation in which the auditor issues a written report expressing an opinion about whether the financial statements are in material conformity with generally accepted accounting principles. Publicly traded companies in the United States are required to have audits under the federal securities acts. Ben Johnson Certified Public Accountant B2. Attestation on Internal Control over Financial Reporting Section 404 of the Sarbanes-Oxley Act requires public companies to report management’s assessment of the effectiveness of internal controls over financial reporting. The Act further requires auditors to attest to the effectiveness of internal control over financial reporting. B3. Review of Historical Financial Statements Many nonpublic companies want to provide assurance on their financial statements without incurring the cost of an audit. In comparison to an audit, less evidence is necessary to support the level of assurance provided by a review. B4. Other Attestation Services Other attestation services are natural extensions of financial statement engagements: Debtor compliance with loan agreement provisions. Forecasted financial statements. WebTrust and SysTrust for Internet sites (see p. 11) C. Other Assurance Services ASSURANCE SERVICES ATTESTATION SERVICES Audits Internal Controls Reviews Other OTHER ASSURANCE SERVICES Other assurance services differ from those involving attestation in that: The CPA is not required to issue a written report. The assurance does not have to be about the reliability of another party’s assertion about compliance with specified criteria. (see examples in Table 1-2 on p. 12) D. Non-Assurance Services CPAs also provide nonassurance services including: Accounting and bookkeeping Taxes Management consulting IV. Requirements for CPA Certification A. Educational Requirement B. Uniform CPA Examination Requirement C. Experience Requirement A. Educational Requirement Normally, an undergraduate degree with a major in accounting. Some states require 150 semester hours before the exam can be taken. Others require the hours before certification. B. Uniform CPA Examination Requirement A computer-based examination offered at various testing centers. The examination consists of the following four sections: Auditing and Attestation – 4.5 hours Financial Accounting and Reporting – 4 hours Regulation – 3 hours Business Environments and Concepts – 2.5 hours C. Experience Requirement Varies among states from no experience to 2 years experience. Some states include experience for working for governmental units or in internal auditing. Summary The Audit Process Types of Audits and Auditors Risk and the Need for Auditing Assurance and Attestation Becoming a CPA