Chapter 1 – Auditing and Assurance Services

advertisement

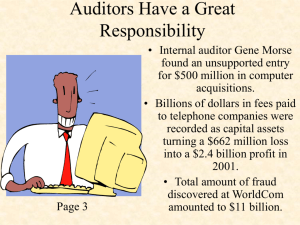

Chapter 1 – Auditing and Assurance Services Presentation Outline I. The Demand for Reliable Information II. Understanding Assurance Services III. Management Assertions IV. Sarbanes-Oxley Act of 2002 V. Becoming a CPA I. The Demand for Reliable Information A. Understanding a Client’s Business B. Environmental Conditions C. Information Risk A. Understanding a Client’s Business Business risk is the risk that an entity will fail to meet its objectives. Failing to reach objectives can eventually result in temptation to misstate financial statements to avoid business failure. B. Environmental Conditions I lost my savings in a bad investment! • Complexity – Decisions makers are not trained to collect, compile, and summarize the key operating information themselves. • Remoteness – Investors are not able to personally visit locations to check on investments. • Time sensitivity – Decisions must often be made on a moment’s notice. • Consequences – A drop in investment value can wipe out one’s life savings. C. Information Risk Information risk is the probability that the information circulated by a company will be false or misleading. Client management has an incentive to make the business appear better than it actually may be. This can create a conflict of interest between client management and investors. Financial Statements II. Understanding Assurance Services A. Definition of Assurance Services B. Definition of Attestation Services C. Definition of Auditing D. Overview of Financial Statement Auditing E. Graphical Representation of Assurance Services A. Assurance Service Elements Assurance services are (1) independent (2) professional services that (3) improve the quality of information, or its context, (4) for decision makers. Assurance services include many areas of information, including nonfinancial areas. (See examples on page 7 of text) B. Definition of Attestation Services Attestation involves an engagement resulting in the issuance of a report on subject matter or an assertion about the subject matter that is the responsibility of another party. Auditing is a specific type of attestation. (See examples on p. 6 of text) C. Definition of Auditing (See Auditing Insight on p. 5 of text) Financial Statements (including footnotes) Persons who rely on the financial reports •Creditors •Investors Auditing is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between the assertions and established criteria GAAP and communicating the results to Auditor's Report/ interested users. Other Reports Source: American Accounting Association Committee on Basic Auditing Concepts. 1973. A Statement of Basic Auditing Concepts, American Accounting Association (Sarasota, FL). D. Overview of Financial Statement Auditing E. Graphical Representation of Assurance Services The Relationships Among Auditing, Attestation, and Assurance Engagements Assurance Services Any Information Attestation Services Primarily Financial Information Auditing Financial Statements III. Management Assertions A. Presentation and Disclosure B. Existence or Occurrence C. Rights and Obligations D. Completeness E. Valuation or Allocation A. Presentation and Disclosure Footnote disclosure of important accounting policies must be relevant and reliable. Transactions must be classified in the correct accounts. Information must be transparent (i.e., understandable to a reasonably sophisticated person). B. Existence or Occurrence Assets, liabilities, and equities on the balance sheet actually exist. Each of the revenue and expense transactions actually occurred. C. Rights and Obligations Amounts reported as assets of the company represent its property rights. Amounts reported as liabilities represent its obligations. D. Completeness All transactions, events, assets, liabilities, and equities that should have been recorded have been recorded. All disclosures that should have been discussed in the footnotes are there. Cutoff refers to accounting for revenue, expense, and other transactions in the proper period (neither postponing some recordings to the next period (i.e., completeness) nor accelerating next period’s transactions into the current year accounts (i.e., existence or occurrence)). The cutoff date refers to the client’s year-end balance sheet date. E. Valuation or Allocation Determine whether proper values have been assigned to assets, liabilities, and equities. Examples include collectibility of receivables, recalculating depreciation, obtaining lower of cost or market data, etc. IV. Sarbanes-Oxley Act of 2002 (SOX) A. Major Provisions of Sarbanes-Oxley B. Management Responsibility Under SOX C. Prohibited Services to Audit Clients A. Major Provisions of Sarbanes-Oxley Congress passed the Sarbanes-Oxley Act in an attempt to address a number of weaknesses found in corporate financial reporting in the wake of the recent accounting scandals. The Act’s major provisions include: Requirement of CEO/CFO certification of financial statements (Section 302) Requirement of auditor examination of company internal controls Creation of the Public Company Accounting Oversight Board (PCAOB) to serve as an auditing profession “watchdog.” Prohibition of certain client services by firms conducting a client’s audit. B. Management’s Responsibility Under SOX One of its most important provisions (Section 302) states that the key company officials must certify the financial statements. Certification means that the company CEO and CFO must sign a statement indicating: 1. They have read the financial statements. 2. They are not aware of any false or misleading statements (or any key omitted disclosures). 3. They believe that the financial statements present an accurate picture of the company’s financial condition. Source: U.S. Congress, Sarbanes-Oxley Act of 2002, Pub. L. 107-204, 116 Stat/ 745 (2002). C. Prohibited Services to Audit Clients SOX and the PCAOB prohibit professional service firms from providing any of the following services to an audit client: bookkeeping and related services design or implementation of financial information systems appraisal or valuation services actuarial services internal audit outsourcing management or human resources services investment or broker/dealer services legal and expert services (unrelated to the audit) Professional service firms may provide client tax services (with some restrictions) and other non-prohibited services to audit clients if the company’s audit committee has approved them in advance. SOX prohibits professional service firms from performing any client services where auditors may find themselves making management decisions or auditing their own firm’s work. V. Becoming a A. Education B. Examination C. Experience Note that successful candidates actually receive a CPA certificate from their State Board of Accountancy. Reciprocal CPA certificates for other states are also possible. A. Education Most states require 150 semester hours of college education to sit for the exam. Continuing professional education of 120 contact hours (not college semester or quarter hours) over three year reporting periods with no less than 20 hours in any one year is a common requirement in most states. B. Examination The AICPA Board of Examiners administers the Uniform CPA Exam as a computer-based examination in four parts 1. Auditing and attestation—4.5 hrs 2. Financial accounting and reporting—4 hrs 3. Regulation—3 hrs. 4. Business environment—2.5 hrs Consists of multiple-choice testlets (24-30 questions each) and simulation problems where students electronically research a solution to a problem. Revealing exam material can result in certifications being revoked. Testing is on demand with 75% considered a passing score. C. Experience Although not a requirement to sit for the CPA exam, accounting experience supervised by a competent accountant is required to become certified. Generally 2 years for persons with a bachelors degree and 1 year for those with a masters. Some states require the experience to be in public accounting. Summary Audit process considers business risk, information risk. Environmental factors result in need for audits. Understanding assurance, attestation, and auditing The effect of Sarbanes-Oxley on the audit process. CPA requirements include education, examination, and experience.