Auditing

advertisement

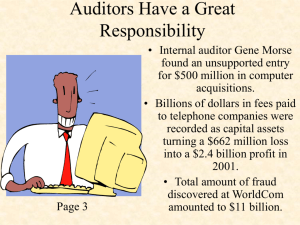

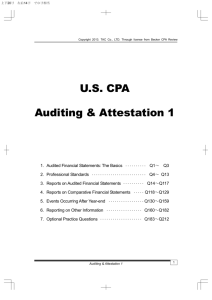

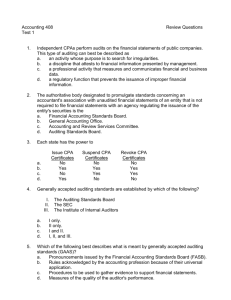

CH 1 Audit and Assurance services Auditing : Is the accumulation and evaluation of evidence about information to determine and report on the degree of correspondence between the information and established criteria. Auditing should be done by a competent independent person. To do an audit, there must be information in a verifiable form and some standards (criteria) by which the auditor can evaluate the information. Criteria : GAAP or IFRS. Accumulating Evidence and Evaluating Evidence Evidence is any information used by the auditor to determine whether the information being audited is stated in accordance with the established criteria. Types of evidence : (ch.7) • Electronic and documentary data about transactions. • Written communication with outsiders. • Observations by the auditor. • Oral testimony of the auditee(client). The auditor must be qualified to understand the criteria used and must be competent to know the types and amount of evidence to accumulate to reach the proper conclusion after the evidence has been examined. The competence of the individual performing the audit is of little value if he or she is biased in the accumulation and evaluation of evidence. To be independent Internal Auditors should report to the board of directors or top management . Audit Report The final stage in the auditing process is preparing the Audit Report, which is the communication of the auditor’s findings to users. • CH3 Distinguish between auditing and accounting. Accounting is the recording, classifying, and summarizing of economic events for the purpose of providing financial information used in decision making. • Auditing is determining whether recorded information properly reflects the economic events that occurred during the accounting period. • The auditor must possess expertise in the accumulation and interpretation of audit evidence. Economic Demand for Auditing Information risk reflects the possibility that the information upon which the business risk decision was made was inaccurate. • Auditing can have a significant effect on information risk. • Consequently the owners ability to obtain capital at a reasonable cost. causes of information risk • • • • Remoteness of information Biases and motives of the provider Voluminous data Complex exchange transactions reducing information risk User verifies information User shares information risk with management • Audited financial statements are provided • • Assurance Services • An assurance service is an independent professional service that improves the quality of information for decision makers. • They improve the reliability and relevance of information . • Valued because the provider is independent and unbiased. • Can be performed by CPA’s or by a variety of other professionals. Examples : consumer report, online reliability. • Attestation Services is a type of assurance service in which the CPA firm issues a report about the reliability of an assertion that is made of another party. Types of Attestation services : Audit of historical financial statements. 2. Audit of internal control over financial reporting. 3. Review of historical financial statements. 4. Attestation services on information technology. 5. Other Attestation services that may be applied to a broad range of subject matter. • 1. Audit of historical financial statements • Management asserts that the statements are fairly presented. • The Auditor issues a written report expressing an opinion about whether the financial statements are fairly stated in accordance with the applicable accounting standards. • Most common assurance services provided by CPA’s. • External users rely on those financial statements to make business decisions, they Auditors report is an indication of the statements reliability. Audit of internal control over financial reporting • Management asserts that internal controls have been developed following well established criteria . • Auditors attest the effectiveness of internal control over financial reporting. Review of historical financial statements Management asserts that the statements are fairly presented(as in Audits). • The CPA provides only moderate level of assurance compared to high level for audits. • Lower fees (less evidence ). • Usually non-public companies. • Attestation services on information technology Management makes various assertions about the reliability and security of electronic information. • Examples : Web Trust services. • Other Attestation services that may be applied to a broad range of subject matter • Extensions of historical audits. • Example : when a bank money to a company , the loan agreement may require the company to engage a CPA to provide assurance about the company’s compliance with the provisions of the loan. Other Assurance Services • • Is not required to issue a written report. Example : mystery shopping. Nonassurance Services Provided by CPAs 1. Accounting and bookkeeping services 2. Tax services 3. Management consulting services ATTESTATION SERVICES Audits Reviews Internal Control over Financial Reporting Other Attestation Services (e.g., WebTrust, SysTrust) Other Assurance Services Other Management Consulting Accounting and Bookkeeping Tax Services Types of Audit 1. 2. 3. Operational : evaluates the efficiency and effectiveness of any part of an organization’s operating procedures and methods. Compliance audit : determines whether the auditee is following specific procedures,rules,or regulations set by some higher authority.(Review wage rates for compliance with minimum wage laws). Financial statement audit. Three Requirements for Becoming a CPA • • • Educational requirement Uniform CPA examination requirement Experience requirement