required rate of return2

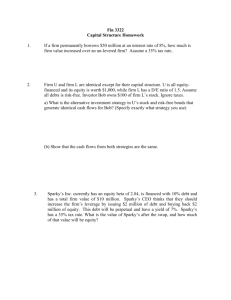

advertisement

Required rate of return • When valuing assets and firms, we need to use discount rates that reflect the riskiness of the cash flows. What is risk? • In finance, it refers to the likelihood that we will receive a return on an investment that is different from the return that we expect to make • Measured based on standard deviations of actual returns on an investment from its expected return. Two types of risk • Equity risk – arises in investments where there are no promised cash flows, but there are expected cash flows • Default risk – arises in investments with promised cash flows 1 Equity risk – Best measured by looking at the variance of actual returns around the expected returns. The greater the variance, the greater the risk. – Can be broken down into • Firm-specific risk – Also called idiosyncratic risk, asset-specific risk, diversifiable risk – Risk that affects one or a few investments – Can be diversified away so that investors are not rewarded for bearing this risk • Market risk – Also called systematic risk – Risk that affects many investments – Cannot be diversified away so that investors expect to be rewarded for bearing this risk. So how do we know how much “reward” to expect? 2 Expected return models The models described below attempt to relate equity risk to expected return. Note that from the firm’s perspective, this expected return represents the cost of equity. Capital Asset Pricing Model (CAPM) – All the market risk is captured in one beta measured relative to a market portfolio, which, in theory should include all traded assets held in proportion to their market value. The expected return on an asset can be written as E Ri R f i E Rm R f Arbitrage Pricing Model (APM) – Allows for multiple unspecified sources of marketwide risk. The expected return on an asset can be written as E R R f 1 E R1 R f 2 E R2 R f K E RK R f – where the subscripts 1 to K represent different sources (factors) of market risk. The number of factors, the factor betas, and the factor risk premiums can all be estimated using factor analysis. 3 Multifactor Models – Unlike the APM, multifactor models do attempt to identify the market factors that drive market risk. For example, Chen, Roll and Ross (1986) identified industrial production, changes in default premium, shifts in the term structure, unanticipated inflation, and changes in the real rate of return to be highly correlated with the factors that come out of factor analysis. – However, the economic factors in the model can change over time, as will the risk premium associated with each one. Using the wrong factor or missing a significant factor can lead to inferior estimates of expected return. Other models – Some models (e.g. Fama and French, 1992) look for firm characteristics such as size, that have been correlated with high returns in the past and use these to measure market risk. – The Fama-French (1993) three-factor model specify risk factors, in addition to market risk, that explain the return on stocks Ri R f 1 Rm R f 2 SMB 3 HML Where SMB is the excess returns on small stocks from big stocks and HML is the excess returns on stocks witsh high book-to-market ratios over stocks with low book-to-market ratios. 4 More on the CAPM – The CAPM is still the model for equity risk that is used in real-world applications. – To use the CAPM, we need three inputs • The riskless asset – For an asset to be riskless, it must be default-free and there must be no reinvestment risk. Zero-coupon bonds (e.g. US Treasury STRIPS) meet this criteria. – The maturity of the riskless asset has to match the time period over which you are projecting cash flows. Thus, yields on longer term treasury bonds would be more appropriate than yields on treasury bills. – When estimating cash flows in another currency, you have to use the risk-free rate in that currency. • The risk premium – There are different ways to measure the risk premium. Some of them are: 1) using historical risk premiums to estimate future risk premiums; 2) using regression analysis to link current market variables, such as the aggregate dividend-to-price ratio, to project the expected market risk premium; 3) using DCF valuation, along with estimates of return on investment and growth, to reverse engineer the market’s cost of capital – The risk premium will be estimated for us by the portfolio managers 5 • Beta – There are three approaches to estimating beta: 1) accounting approach, 2) using historical market betas, 3) using fundamental betas. The accounting approach is almost never used in practice. – Historical market betas – – – The conventional approach for estimating the beta of an investment is a regression of returns on the investment against returns on a market index such as: Ri a bRm , where the coefficient estimate for b corresponds to the beta for the stock. However, regression betas will almost always be either too noisy (i.e., large standard errors) or skewed (i.e., biased) by estimation choices (such as the time period of estimation, the return interval (daily, weekly, etc), and the choice of market index to use) to be useful measures of the equity risk in a company. Service betas (such as those obtained from Bloomberg, Morningstar, Standard & Poor’s, etc) are estimated using the methodology just described, and make adjustments for what they feel are better estimates of future risk. 6 – Fundamental betas (which we will also call the bottom-up approach) – This approach estimates betas by looking at the fundamentals of the business. According to this approach, the beta of a firm is determined by: 1) the type of business or businesses the firm is in, 2) the degree of operating leverage of the firm, 3) the firm’s financial leverage. 7 Default risk – The risk associated with investments with promised cash flows (e.g., bonds), is default risk – i.e., that the borrower will not be able to repay interest and principal. – Default risk is a function of two variables: the firm’s capacity to generate cash flows from its operations, and, its financial obligations. – Most models of default risk use financial ratios to measure the cash flow coverage (magnitude of the cash flows relative to the obligation) and control for industry effects in order to evaluate the variability of the cash flows. – The most widely used measure of a firm’s default risk is its bond rating. 8 Estimating the default risk and the default spread – The cost of debt for a company is primarily determined by its default risk, in addition to the risk-free rate (the higher the riskfree rate is, the higher is the cost of debt) and the tax advantage associated with debt (the higher is the firm’s marginal tax rate, the greater the tax benefits associated with debt). – The easiest way to estimate the cost of debt is when a firm has long-term bonds outstanding that are widely traded. We can simply calculate the yield-to-maturity on these outstanding bonds. – However, most corporate bonds are not actively traded. In this case, we can get the ratings on the bonds (e.g. AAA, etc), and find the corresponding default spread. – A third way is to estimate synthetic ratings using financial ratios. – In the last two cases, we add the default spread to the risk-free rate to arrive at an estimate of the firm’s cost of debt. 9 Hybrid securities – Preferred stock – shares some of the characteristics of debt (the dividend is prespecified at the time of issue and is paid out before common dividends) and some of the characteristics of equity (the preferred dividend is not tax deductible). (see Illustration 8.13 on p. 213 for an example) – Convertible bond – a bond that can be converted into equity at the option of the bondholder. We usually break down these securities into their debt and equity components and assign the cost of debt and equity to each component. (see Illustration 8.14 on p. 213 for an example) 10 Estimating the cost of capital (WACC) – Thus far we have calculated the costs of a firm’s different sources of capital. Most firms will usually have a mix of the different components of capital. – To calculate the WACC, we need to weight each component (i.e. debt, equity, etc) by its market value and sum across the weighted components, that is, WACC ke we k d wd 1 t k p w p – Estimating market values of debt and equity • The market value of equity is straightforward, we multiply the stock price by the number of shares outstanding. 11 • The market value of debt is usually a little more difficult to obtain. – First we consider only interest-bearing debt (that is, we do not count accounts payable and other supplier credit) – A simple way would be to use the book value since, unlike equity, this typically does not diverge greatly from market value. – Another way is to treat the entire debt on the books as one coupon bond, with a coupon set equal to the interest expenses on all the debt, and the maturity set equal to the face-value weighted average maturity of the debt, and then to value this coupon bond at the current cost of debt for the company. (see Illustration 8.16 on p. 216) – We also have to capitalize operating leases and count that as debt. We do this by getting the present value of operating lease commitments in future years (these can be found in the footnotes to the financial statements), using the firm’s pretax cost of debt. 12 • Sources: – Damodaran, Investment Valuation, 2nd ed. – McKinsey & Company, Koller, Goedhardt, and Wessels, Valuation: Measuring and managing the value of companies, 5th ed. 13