-:l* '=:'fzt

advertisement

Bxam 2

(175 pts)

FIN 4303/5970

D) +Yy

Fall2009 S. Linn

YourName

__

t>l

ftndQ-44 DM' rr\m

Instructions: This is a closed noteslclosed book exam. You must show your work to receive credit. The

exam is worth a total of 175 points. Present value factor tables are attached to the quiz. Some useful

equations appear on the last page of the exam. Good luck!

1. Assume the Capital Asset Pricing Model is the correct model for computing expected returns

on a stock. The risk-free rate of return is 4% and the market risk premium is 8%. What is the

expected rate of retum on a stockfrIth-iEEiftf t.2g?

A. 9.12%

B. 10.24%

c. 13.12%

fE.

t ZsQ"a )

.oq

r+.2+x

15.36%

2. Assume the Capital Asset Pricing Model is the correct model for computing the expected

return on a stock. The common stock of Flavorful Teas has an expected return of 14.42oh.The

return on the market is l0% and the risk-free rate of return is 3.5%. What is the beta of this

stock? Round off to the second decimal place.

A. .65

B. 1.09

c.

1.32

D.

1.44

Rtr -- )

$roa

"l(Aw

r n(,, -,oD

,ons | ,{V - ,DlrbY

.= ,o!i,

-"ottr* ,il

'=:'fzt

{.\"

-:l*

'*tN

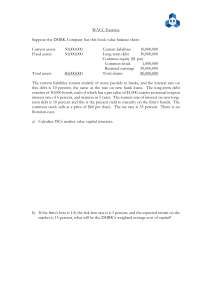

Jack's Construction Co. has 80,000 bonds outstanding that are selling at par value (meaning

Yachbond has a market value of $1,000). The yield-to-maturity on the bonds is 8.5%. The

company also has 4 million shares of common stock outstanding. The stock has a beta of 1.1 and

,ffi

sells for $40 a share. The U.S. Treasury bill is yielding 4Y, and the market risk premium is 8%.

Jack's tax rate is 35%. What is Jack's weighted average cost of capital?

A. 6.669 %

@

o'* -

6ok

''

vQv.=+'.l.

J

--I L-. 2?S'1"

6.5

4rn Cf

@ 1o lg.,c.,s-

orl + t,l (ois)

i{osa)Q

;d-!{rz<)*:

,a.d",|,

n oOVd-Z

'

jr

'I

":fl

expects its operations will produce a perpetuity of $2,100 in

earnings before interest and taxes. Investors also hold these same beliefs. The comp'any has an

unlevered cost of capital of 74o/o and a tax rate of 34o/o. The company also has $2,800 of

perpetual debt that carries a 7o/o cotpon. The debt is selling at par value, meaning each bond sells

for its par value of $1,000. What is the value of this firm? Assume there are no costs of

4. The Winter Wear Company

bankruptcy or financial distress or costs associated with managerial or equity holder incentive

E $ro,ss2

c.$11,748

lec?

e^(ef\ = ZLrt'-'rt'-z

L!,\tu't-

b'-gCo

D. 512,054

E. $12,700

Y/ a(n

\

,(cu)=(zy"u4

\ ,8,s= -4tzgLo

,r{

0r,

Tc

I 5. Anderson's Furniture Outlet has an unlevered cost of capital of 10o/o, a tax rate of 34oh, and

\grfected eamings before interest and taxes of $1,600. EBIT is a perpetuity. The company has

$3,000 in perpetual bonds outstanding (face value) that have anSo/o coupon and pay interest

annually. The bonds are selling at par value (meaning the market value of the bonds is equal to

the face value). What is the cost of equity for this firm? Assume there are no costs of bankruptcy

or financial distress or costs associated with managerial or equityholder incentive problems (that

is, none of the costs described in Chapter l6 are not present). Round off your answer.

A. 8.670/,

",

i'rlY;

ut\'&

D.9.99%

E.

10.460/0

tt@

@=7Y- sl.

Ps1 ,, ol*eitqz il-.?+) * tt' 'og)

Iuco[r-.*tr$ "r K

3m'L

\

p6uo,dy {r':-T#"

:lu-z*

6. Margerit is reviewing a project with projected sales of 1,500 units a year, an after-tax cash

flow of $40 a unit and a three-year project life. The initial6st olthe project is $95,000. The

relevant discount rate is 75o/o.Margerit has the option to abandon the project after one year at

which time she feels she could sell the project for $60,000. If sales in units drop to 1000 per year

in years 2 and 3 should Margerit abandon the project. For purposes of computing your answer

assume that irrespective of the year in which they are produced each unit sold will generate an

after-tax cash flow of $40 per unit. Show your work.

QQ=

^u

?sk

="8'l-

l50O

Sd'tK

g'-

f lt'truit

x

=lro

rs=3

lStr<3

.-/

e'w fi.

)

goes directly to

has a new electronic answering machine ready to market. If the firm

producl.

the

for

the market now with the product, there is a 40 percent chance of high demand

1'2

However, the firm can conduct a market research study, which will take ayear and cost $

customers

potential

million. By completing the market research, ANS will be able to better target

to 60 percent. If

and will increase the piobability of high demand for the answering machine

goes

to the market

there is high demand for the product (irrespective of whether the company

the investment

now or *uitr;, the answering machine will bring a net present value (at the time

be

low the net

to

out

turns

in the project is made) of $ io rnillion. If on the other hand demand

pr"r"ri rulu. will be only $ 2 million (at the time the investment in the project is made). Should

in" n.,, conduct the mar-ket researgb-stu{y or go directly to market with the answering machine? .

7. ANS Inc.

rhe approp"ut. ai..orni;;,;

r'-@;b1s"how

\:_____-/

"

youi

/W$\t,'l)

q0

ylNAyCXl Ll\4f

Wgycyt

tlqr{ .Zfhz

fQ-tl)

,\rffi

;tl

{ *n^r4 do x\'a' \"NY \}/v-/t'oh

'b o\€iK'r

{\A{

bqlr,uaq-,

work)

l,'LV\

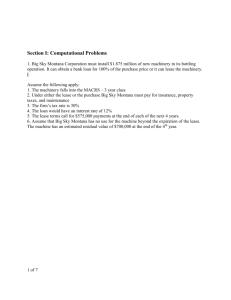

8. Assume the world conforms to the Modigliani and Miller conditions unde

personal taxes (MM proposition II, No Taxes). Graph the relationship between the w-tphtEd-ur"rug" cost of capital and leverage (in this case the debt/equity ratio), the relationship between

the coit of debt and leverage (the debt/equity ratio) and the relationship between the cost of

equity and leverage (the debtlequity ratio). Use the graph provided below. Label your lines

appropriately. What does this proposition say about how the weighted average cost of capital

changes as the debt/equity ratio changes?

dtur\

{D Jha,

w?w

Pntr.

bk,-t*fr')

'H.hfftr

M'n:.-fu

$tC lhry. ttl

sr,WJ#iX

t{

oll\,t^4

\

{u'tno

'\h

+ Kg

trtsffn

%{w

{na{ *t

rVLL

roo.rn,

ht trq,

M

\uiD,Pv[n? {L.

9. Assume the Capital Asset Pricing Model is the correct model for computing the expected

fr"r

qwA+(

t[\\,t{Afto\

I

,\ACIk\

.\l^o wLVbrt

ld ,ry,.utL 4I\ le@* Dh nna^kxt2 'lhd& i6

W,\"*o 6la2ro€a $Dwd vhW' 0tefui 0ntD

Woutd

q\,tkre( 4r'atr

on $DLf- , bnas +DW

eft -tQat\:.,sry;y

VP\ttW1

-*\a" (t\uv,n

{\tL t^sv ty,L, k-Wrtrhz.

)

EOUATIONS

Rs = R, + {prx(e(nr)-nr)}

Rmcc

:

Rs = -,

Vu=

[[*)**,

.

{[!)x(r-

ear(t - r")

Ro

Vl-=Vu+TsB

].

[[*),n"'(r

r"h(no - *")}

- r. l]