SFM L05 - WordPress.com

advertisement

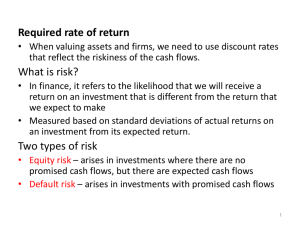

STRATEGIC FINANCIAL MANAGEMENT Hurdle Rate: Cost of Equity KHURAM RAZA ACMA, MS FINANCE First Principle and Big Picture Cost of Equity CAPM Approach Risk Free Rate Risk premium Risk Parameter: Beta Historical Market Betas Beta Fundamentals Business Risk Operating Leverage Financial Leverage o Bottom Up Betas Accounting Betas Own bond yield –plus –judgmental Risk Premium Approach Discounted Cash Flow (DCF) Approach Inputs required to use the CAPM The Risk free Rate and Time Horizon The Bottom Line on Risk free Rates What if there is no default-free entity? Risk Premium The risk premium in the capital asset pricing model measures the extra return that would be demanded by investors for shifting their money from a riskless investment to an average risk investment. It should be a function of two variables Risk Aversion of Investors: As investors become more risk averse, they should demand a larger premium for shifting from the riskless asset. Riskiness of the Average Risk Investment: As the riskiness of the average risk investment increases, so should the premium. This will depend upon what firms are actually traded in the market, their economic fundamentals and how good they are at managing risk Estimating Risk Premiums Historical Premiums There are three ways of estimating the risk premium in 1. It begins by defining a time period for the estimation theIt then capital asset pricing model 2. requires the calculation of the average–returns on a stock index and average returns on a riskless security over the period Large investors can be surveyed about their 3. it calculates the difference between the returns on stocks and the riskless return and uses it as a risk premium looking forward. expectations for the future, The actual premiums earned over a past period can Estimation Issues be obtained from historical data and There are no constraints on reasonability; individual money managers Time Period Used could provide expected returns thatextracted are lower thanfrom the riskcurrent free rate, for The implied premium can be Choice of Risk free Security instance. Arithmetic and Geometric Averages market data. Survey premiums are extremely volatile; the survey premiums can change dramatically, largely as a function of recent market movements. Survey premiums tend to be short term; even the longest surveys do not go beyond one year. Risk Parameter: Beta Historical Market Betas The standard procedure for estimating betas is to regress stock returns (Rj) against market returns (Rm) – Rj = a + b Rm Rj-Rf= a + b (Rm-Rf) Regression Interpretation: Estimation Issues Slope length of the estimation Intercept period return interval R squared market index Standard error Fundamental Betas The beta for a firm may be estimated from a regression but it is determined by fundamental decisions that the firm has made on what business to be in, how much Operating Leverage: operating leverage to use in the business and the The degreeto of operating leverage is auses function of the cost structure of a degree which the firm financial leverage. Financial Leverage firm, and is usually defined in terms of the relationship between fixed costs and total costs. A firm thatforhas leverage high of the The beta value a high firm operating depends upon the (i.e., sensitivity Financial leverage the risk the have stockholders that caused an fixed costs relative to total costs) willtoalso higher in to by demand forisits products and services andvariability of itsis costs macoperating The beta ofroeconomic athan isfactors determined by variables – increase infirm debt and in three aoverall company's capital income would apreferred firm producing similar product with lowstructure. that equities affecta the market. a company increases debt and preferred equities, interest payments operatingAs leverage (1) the type of business or businesses the firm isis in increase, reducing EPS. As a result, risk to stockholder return increased. Cyclical companies have higher betas than non‐cyclical firms (2) Degree Operatingof Leverage = % Change in EBIT/ in % Change in Sales theofdegree operating leverage the firm and Degree of financial leverage = % Change in EPS/ % Change EBIT Firms which sell more discretionary products will in have (3) The firm's financial leverage. higher betas than firms that sell less discretionary Bottom Up Betas Breaking down betas into their business, operating leverage and financial leverage components provides us with an alternative way of estimating betas, where we do not need past prices on an individual firm or asset to estimate its beta. The bottom up beta can be estimated by doing the following: 1. 2. 3. 4. Find out the businesses that a firm operates in Find the unlevered betas of other firms in these businesses Take a weighted average of these unlevered betas Lever up using the firm’s debt/equity ratio The bottom up beta is a better estimate than the top down beta for the follo wing reasons a) b) The standard error of the beta estimate will be much lower The betas can reflect the current (and even expected future) mix of businesses that the firm is in rather than the historical Asset Beta = ß equity (Equity/Debt + Equity) + ß Debt ( Debt/Debt + Equity) ß unlevered = ß levered (1/1+Debt/Equity) (1-t) + 0 ß unlevered (1+Debt/Equity) (1-t) = ß levered Accounting Betas A third approach is to estimate the market risk parameters from accounting earnings rather than from traded prices. Thus, changes in earnings at a division or a firm, on a quarterly or annual basis, can be regressed against changes in earnings for the market, in the same periods, to arrive at an estimate of a “market beta” to use in the CAPM. While the approach has some intuitive appeal, it suffers from three potential pitfalls. a) accounting earnings tend to be smoothed out relative to the underlying value of the company b) accounting earnings can be influenced by non-operating factors, such as changes in depreciation or inventory methods c) accounting earnings are measured, at most, once every quarter, and often only once every year Own bond yield –plus –judgmental Risk Premium Approach Some analysts use a subjective, ad hoc procedure to estimate a firm’s cost of common equity: They simply add a judgmental risk premium of 3% to 5% to the interest rate on the firm’s own long-term debt. Discounted Cash Flow (DCF) Approach Marginal investor expects dividends to grow at a constant rate and if the company makes all payouts in the form of dividends (the company does not repurchase stock), then the price of a stock can be found as follows: P0 = D1 / ( ke – growth ) Solving for ke such that ke = ( D1 / P0 ) + growth Where g = ROE( Retention Ratio) If g = 0 ke = ???