Ch10_11

advertisement

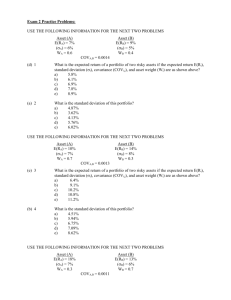

Ch 10 and Ch 11 Risk and Return 1 Ch 10 and 11 Dollar return and Percentage Return Measuring Return and Risk Capital market history Understanding Risk Systematic risk vs. Unsystematic risk Diversification Capital Asset pricing Model (CAPM) Historical returns and risk Expected returns and risk Security Market Line (SML) Beta Stock Market Efficiency 2 3 Dollars Return: Capital Market History $6,640.79 $10,000 $2,845.63 $1,000 Small-company stocks $100 $40.22 Large-company stocks Long-term government bonds $10 $15.64 $9.39 Inflation $1 Treasury bills $0.1 1925 1935 1945 1955 1965 1975 Year-end 1985 1995 1999 4 Risk: The Great Bull Market of 1982 – 1999, “Bumps Along the Way” Period % Decline in S&P 500 Oct. 10, 1983 – July 24, 1984 -14.4% Aug. 25, 1987 – Oct. 19, 1987 -33.2% Oct. 21, 1987 – Oct. 26, 1987 -11.9% Nov. 2, 1987 – Dec. 4, 1987 -12.4% Oct. 9, 1989 – Jan. 30, 1990 -10.2% July 16, 1990 – Oct. 11, 1990 -19.9% Feb. 18, 1997 – Apr. 11, 1997 -9.6% July 19, 1999 – Oct. 18, 1999 -12.1% 6 7 Calculating returns Dollar return = dividend income + capital gain (or loss) Percentage return = dividend yield + capital gains yield where, dividend yield = dividend income / beginning price capital gains yield = (ending price – beginning price) / beginning price. Example: $ Return, % Return $14 $1 $13 -$10 8 Measuring Return and Risk Historical return and risk Expected return and risk 9 10 Historical returns Example: Find the average returns and standard deviation of the stock for given four years data. Assume that at Year 0, the price was $100. Year Actual Return 1 15% 2 9% 3 -6% 4 12% Price $115.00 $125.35 $117.83 $131.97 Historical return and risk Historical average return ¯r = ri / N = (15 + 9 + (-6) + 12 ) / 4 = 30 / 4 = 7.5% 11 What is investment risk? Typically, investment returns are not known with certainty. Investment risk pertains to the probability of earning a return less than that expected. The greater the chance of a return far below the expected return, the greater the risk. Risk = volatility of returns = standard deviation of returns 12 Standard Deviation: “Rolling a Dice” Suppose Michelle, Jennifer, and Christine play at the Rolling Dice Contest. Each contestant rolls a dice four times. Michelle: 1, 6, 6, 1 Jennifer: 3, 4, 4, 3 Christine: 2, 5, 5, 2 Which contestant’s outcomes shows the highest standard deviation? 13 Picturing Risk: Frequency distribution of returns on common stocks 13 12 4 1973 1966 1 1 1974 1957 1936 1937 1930 1941 2 0 -50 -40 -30 -20 11 1990 1981 1977 1969 1962 1953 1946 1940 1939 1934 1932 1929 -10 1994 1993 1992 1987 1984 1978 1970 1960 1956 1948 1947 0 13 1988 1986 1979 1972 1971 1968 1965 1964 1959 1952 1949 1944 1926 10 12 1999 1998 1996 1983 1982 1976 1967 1963 1961 1951 1943 1942 20 1997 1995 1991 1989 1985 1980 1975 1955 1950 1945 3 2 1938 1956 1936 1935 1954 1927 1928 1933 30 40 50 60 Return (%) 70 80 90 Risk can be pictured by constructing frequency distribution. The flatter the distribution is, the greater the risk. 14 Picturing Risk: Normal Distribution 15 Suppose average return on large common stocks is 13.3%, and standard deviation of returns is 20.1% Probability Low Risk 68% High Risk 95% >99% -3 -2 -1 0 +1 +2 +3 -47.0% -26.9% -6.8% 13.3% 33.4% 53.5% 73.6% Return on large common stocks Normal Distribution Of all observed values, 68.3 percent will occur within plus/minus one standard deviation of the mean Of all observed values, 95.7 percent will occur within plus/minus one standard deviation of the mean Of all observed values, 99.7 percent will occur within plus/minus one standard deviation of the mean 16 Historical return and risk Historical risk We measure risk by calculating standard deviation of returns. The greater the standard deviation, the greater the risk. Standard deviation = risk = volatility 17 Measuring Risk Variance - Average value of squared deviations from mean. A measure of volatility. We square them to give equal weights to negative returns. Standard Deviation – Standardized average value of squared deviations from mean. A measure of volatility. Historical return and risk r r Variance, 2 2 i N 1 (.15 .075) 2 (.09 .075) 2 (.06 .075) 2 ....... 4 1 .0261 3 .0087 SD, 2 .0087 .0933 or 9.33% 19 20 Historical returns and risks of various instruments Series Large-company stocks Small-company stocks Average Standard Return Deviation 13.3% 20.1% * 17.6 33.6 5.9 8.7 5.5 9.3 5.4 5.8 U.S. Treasury bills 3.8 3.2 Inflation 3.2 4.5 Long-term corporate bonds Long-term government Intermediate-term government Distribution -90% 0% 90% Lesson from capital market history There is a reward for bearing risk The greater the potential reward, the greater the risk This is called the risk-return trade-off 21 Risk Premium Definition: The “extra” return earned for taking on risk The return on Treasury bills are considered to be risk-free rate The risk premium is the return over and above the risk-free rate 22 Historical Risk Premiums 23 Large stocks: 13.3 – 3.8 = 9.5% Small stocks: 17.6 – 3.8 = 13.8% Long-term corporate bonds: 5.9 – 3.8 =2.1% Long-term government bonds: 5.5 – 3.8 = 1.7% Expected returns: Using forecasted returns with probability 24 A stock analyst projects the future performance of a company XYZ’s stock. A today’s price is $100.00 State of Rate of Economy Probability Return Price Recession 30% -13% $87.00 Boom 70% 15% $115.00 25 Calculating the Expected Rate of Return ^ r = expected rate of return. r = n rP . i i i=1 ^ r = -13% (0.3) + 15% (0.7) = 6.6% 26 Calculating Standard Deviation using Probability Distribution Standard deviation Variance 2 2 ri r Pi i 1 n (.13 .066) 2 .3 (.15 .066) 2 .7 .0165 .128 or 12.8% Calculating return and risk of portfolio A portfolio is a collection of assets An asset’s risk and return is important in how it affects the risk and return of the portfolio The risk-return trade-off for a portfolio is measured by the portfolio expected return and standard deviation, just as with individual assets 27 Calculating return and risk of portfolio Example: Suppose you had $1 million to invest on stocks. You bought stock A for $500,000, stock B for $250,000, and stock C for $250,000, respectively. Your brokerage firm sent the following projections on these stocks. What are the portfolio’s expected returns and standard deviations? Returns State of Economy Probability Stock A Boom 0.4 10% Bust 0.6 8% Stock B 15% 4% Stock C 20% 0% 28 Calculating returns and risk of portfolio Step One: Calculate the weighted average of returns for each of given economy status Expected Return of portfolio for “Boom” Economy = (500K/1,000K)10% + (250K/1,000K)15% + (250K/1,000K)20% = 13.75% Expected Return of portfolio for “Bust” Economy = 5% Step Two: Compute the expected return of portfolio as we did for the single stock 29 Calculating Return and Risk: Portfolio Case State of Economy Boom Bust Probability 0.4 0.6 1 Rate of Return 13.75% 5.00% 30 Return Deviation Expected from Expected Squared Product Return Return Deviation Product 0.055 8.50% 0.0525 0.002756 0.001103 0.03 8.50% -0.035 0.001225 0.000735 8.50% 0.001838 4.29% Diversification Portfolio diversification is the investment in several different asset classes or sectors Diversification can substantially reduce the variability of returns This reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another Diversification is not just holding a lot of assets For example, if you own 50 internet stocks, you are not diversified However, if you own 50 stocks that span 20 different industries, then you are diversified 31 32 Correlation Returns Distributions for Two Perfectly Positively Correlated Stocks (correlation = +1.0) and for Portfolio MM’ Stock M’ Stock M Portfolio MM’ 25 25 25 15 15 15 0 0 0 -10 -10 -10 33 Correlation Returns Distribution for Two Perfectly Negatively Correlated Stocks (Correlation = -1.0) and for Portfolio WM Stock W . 25 . . 0 . . . 25 15 -10 Stock M . 25 . 15 15 0 0 -10 Portfolio WM . . -10 . . . . . Correlation 34 Total Risk Total risk can be decomposed into Unsystematic Risk Systematic Risk 36 Systematic Risk Risk factors that affect a large number of assets Also known as non-diversifiable risk or market risk Includes such things as changes in GDP, inflation, interest rates, etc. 37 Unsystematic Risk Risk factors that affect a limited number of assets Also known as unique risk, assetspecific risk, diversifiable risk, and company-specific risk Includes such things as labor strikes, part shortages, etc. 38 Pop Quiz: Systematic Risk or Unsystematic Risk? The government announces that inflation unexpectedly jumped by 2 percent last month. Systematic Risk One of Big Widget’s major suppliers goes bankruptcy. Unsystematic Risk The head of accounting department of Big Widget announces that the company’s current ratio has been severely deteriorating. Unsystematic Risk Congress approves changes to the tax code that will increase the top marginal corporate tax rate. Systematic Risk 39 40 Risk Reduction (3) Ratio of Portfolio Standard Deviation to Standard Deviation of a Single Stock (1) Number of Stocks in Portfolio (2) Average Standard Deviation of Annual Portfolio Returns 1 49.24 % 2 37.36 .76 4 29.69 .60 6 26.64 .54 8 24.98 .51 10 23.93 .49 20 21.68 .44 30 20.87 .42 40 20.46 .42 50 20.20 .41 100 19.69 .40 200 19.42 .39 300 19.34 .39 400 19.29 .39 500 19.27 .39 1,000 19.21 .39 1.00 41 Average annual standard deviation (%) 49.2 Risk Reduction Diversifiable risk 23.9 19.2 Nondiversifiable risk 1 10 20 30 40 Number of stocks 1,000 in portfolio The Principle of Diversification Diversification can substantially reduce the variability of returns This reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another However, there is a minimum level of risk that cannot be diversified away and that is the systematic portion 42 Diversifiable Risk Often considered the same as unsystematic, unique or asset-specific risk If we hold only one asset, or assets in the same industry, then we are exposing ourselves to risk that we could diversify away Diversifiable Risk = Unsystematic Risk 43 Total Risk Total risk = systematic risk + unsystematic risk The standard deviation of returns is a measure of total risk For well diversified portfolios, unsystematic risk is very small Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk. Conclusion: The reward for bearing risk depends only on the systematic risk of an investment. 44 So, the important question is how to measure systematic risk of a stock (or portfolio)? The answer is a beta. This is where Capital Asset Pricing Model and Security Market Line come in. 45 What is a beta? (the Greek Symbol ) A beta coefficient (or a beta shortly): the amount of systematic risk present in a particular risky asset relative to that in an average risky asset. 46 What does a beta tell us? A beta of 1 implies the asset has the same systematic risk as the overall market portfolio (or average asset) A beta < 1 implies the asset has less systematic risk than the overall market portfolio A beta > 1 implies the asset has more systematic risk than the overall market portfolio Note: A beta of the market portfolio (or average portfolio) is 1. Typically, we use S&P 500 Index as a proxy portfolio to represent the market portfolio. 47 48 Company Beta Coefficient McDonalds .85 Gillette .90 IBM 1.00 General Motors 1.05 Microsoft 1.10 Harley-Davidson 1.20 Dell Computer 1.35 America Online 1.75 (I) Beta and the Risk Premium Remember risk premium = expected return – risk-free rate The higher the beta, the greater the risk premium should be. Can we define the relationship between the return and beta (or risk)? YES! Capital Pricing Asset Model (CAPM) 49 Capital Asset Pricing Model (CAPM) Created by William F. Sharpe and others A Nobel Prize winner idea Widely used by Wall Street professionals Describes the relationship between return and risk (i.e., systematic risk) A beta (the Greek symbol, β) measures systematic risk of a stock or portfolio. 50 Capital Asset Pricing Model (CAPM) E(Ri) = Rf + (E(Rm) – Rf)i Rf = Risk-free rate, or Treasury bill return E(Rm) = Expected return on the market portfolio, often S & P 500 index return is used as a proxy. i = Beta 51 52 Security Market Line (SML) 30% Expected Return 25% E(RA) (E(RA) – Rf)/ A 20% 15% 10% Rf 5% 0% 0 0.5 1 1.5 A Beta E(Ri) = Rf + (E(Rm) – Rf)i 2 2.5 3 Example - CAPM Consider the betas for each of the assets given earlier. If the risk-free rate is 6.15% and the market risk premium is 9.5%, what is the expected return for each? Security DCLK KO INTC KEI Beta 4.03 0.84 1.05 0.59 Expected Return 6.15 + 4.03(9.5) = 44.435% 6.15 + .84(9.5) = 14.13% 6.15 + 1.05(9.5) = 16.125% 6.15 + .59(9.5) = 11.755% 53 Example: Portfolio Betas “What if we want to invest on many stocks, instead of single stock? “ Suppose you have $1 million to invest. You allocated your money as follows: What Stocks Allocations Beta CIN $300,000 0.47 MOT $500,000 1.69 CAG $200,000 0.62 is the portfolio beta? =(0.3)(0.47)+(0.5)(1.69)+(0.2)(0.62) = 1.11 54 What’s the Efficient Market Hypothesis (EMH)? Stock prices reflect new events efficiently. Therefore, securities are normally in equilibrium and are “fairly priced.” Stock prices follows “random” process. Therefore, one cannot “beat the market” except through good luck or inside information. If this is true, then you should not be able to earn “abnormal” or “excess” returns consistently. 55 Common Misconceptions about EMH markets DO NOT imply that you can’t make money from stock market They do imply that, on average, you will earn a return that is appropriate for the risk undertaken Efficient There is not a bias in prices that can be exploited to earn excess returns 56 What Makes Markets Efficient? There are many investors out there doing research 100,000 or so trained analysts--MBAs, CFAs, and PhDs--work for firms like Fidelity, Merrill, Morgan, and Prudential. These analysts have similar access to data and megabucks to invest. Thus, news is reflected in stock price (P0) almost instantaneously. Therefore, prices should reflect all available public information 57 58 59 60 61 An Example of Diversification If you invest individually, If you invest collectively, i.e., investing on 50-50 portfolio, Avg R of Starcents = 10% SD of Starcents = 20% Avg R of 50-50 P = 25% Avg R of jPhone = 40% SD of jPhone = 60% However, it is possible that SD of 50-50 P can be smaller than the avg of two SDs (40%) or even smaller than the smaller of two SDs (20%) !!! 62