TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition

advertisement

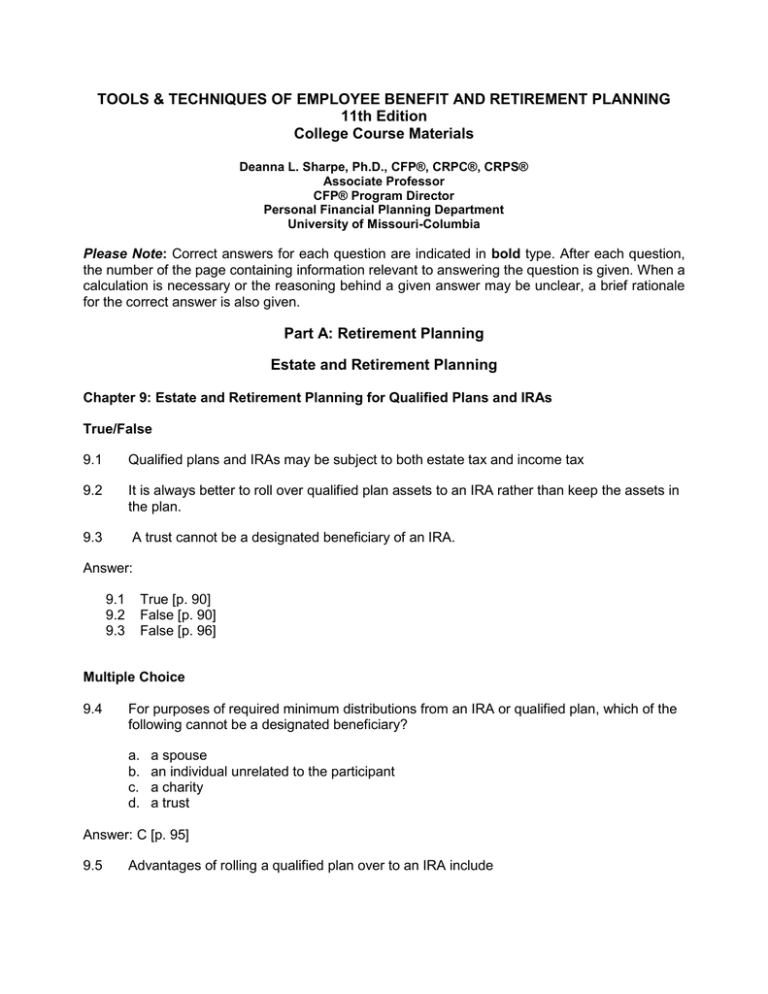

TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition College Course Materials Deanna L. Sharpe, Ph.D., CFP®, CRPC®, CRPS® Associate Professor CFP® Program Director Personal Financial Planning Department University of Missouri-Columbia Please Note: Correct answers for each question are indicated in bold type. After each question, the number of the page containing information relevant to answering the question is given. When a calculation is necessary or the reasoning behind a given answer may be unclear, a brief rationale for the correct answer is also given. Part A: Retirement Planning Estate and Retirement Planning Chapter 9: Estate and Retirement Planning for Qualified Plans and IRAs True/False 9.1 Qualified plans and IRAs may be subject to both estate tax and income tax 9.2 It is always better to roll over qualified plan assets to an IRA rather than keep the assets in the plan. 9.3 A trust cannot be a designated beneficiary of an IRA. Answer: 9.1 9.2 9.3 True [p. 90] False [p. 90] False [p. 96] Multiple Choice 9.4 For purposes of required minimum distributions from an IRA or qualified plan, which of the following cannot be a designated beneficiary? a. b. c. d. a spouse an individual unrelated to the participant a charity a trust Answer: C [p. 95] 9.5 Advantages of rolling a qualified plan over to an IRA include a. b. c. d. an IRA can invest in life insurance may be more investment flexibility with an IRA spousal consent is required for IRA distributions the ability to take loans from the IRA Answer: B [p. 90] 9.6 If a spouse is to be beneficiary of an IRA or a qualified plan, it is generally preferrable to leave the IRA or qualified plan a. b. c. d. to a bypass trust to a QTIP trust to the participant’s estate outright to the spouse Answer: D [p. 96-97] Application 9.7 Ann has a Roth IRA. She died this year. Her son, Jim, is the designated beneficiary. Jim is not required to start minimum distributions next year because Roth IRAs are not subject to the required minimum distribution rules after death. a. true b. false Answer: B [p. 93] 9.8 Bob died in 2009 at age 60. Bob named his spouse, Jessica (age 58), as beneficiary of his qualified plan. a. Jessica can roll over the qualified plan assets to a traditional IRA. If she does so, minimum distributions from the IRA must begin in 2010. b. If Jessica does not roll over the qualified plan assets to a traditional IRA, minimum distributions from the IRA must begin in 2010. c. Jessica can roll over the qualified plan assets to a traditional IRA. If she does so, minimum distributions from the IRA must begin when Jessica attains age 70½. d. If Jessica does not roll over the qualified plan assets to a traditional IRA, minimum distributions from the IRA must begin when Jessica attains age 70½. Answer: C [p. 93-94] 9.9 Tara designated a trust as beneficiary of her IRA. The following are beneficiaries of the trust at Tara’s death: her spouse (age 70), her brother (age 72), her daughter (age 50), and her son (age 48). The life expectancy of which trust beneficiary is used to determine required minimum distributions? a. the spouse b. the brother c. the daughter d. the son Answer: B [p. 96] 9.10 Jill is considering naming a bypass trust as beneficiary of her IRA after her death. Jill’s spouse is a discretionary income beneficiary of the bypass trust. Which of the following is a reason for not designating the bypass trust as beneficiary of her IRA? a. b. c. d. IRA assets will appreciate as income taxable minimum distributions are made Jill’s spouse can treat the IRA as his own part of the unified credit will be wasted on income tax a bypass trust is the best way to stretch income tax deferral over the life of Jill’s spouse and his designated beneficiary Answer: C [p. 97]