Earnings only on a $400000 brokerage account are

advertisement

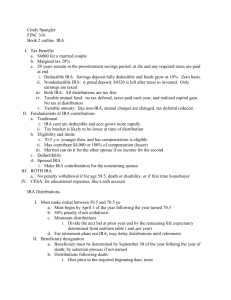

Facts and Assumptions A US citizen has entered early retirement with a healthy investment of $900,000 in taxsheltered savings. Assumptions are made as follows: *Earnings on all accounts will accrue at 4.5% throughout the term considered. *Earnings only on a $400,000 brokerage account are taxed as ordinary income; the principal itself is tax-free. *The rest of his savings is $500,000 in a traditional IRA. *Pensioner’s age is 55; asset dispersal is requested to conclude at the start of age 78. *Social security payout to him begins at age 68 in the amount of $24,000/year. *All age changes and receipts of monies are at year-begin; all calculations of growth and tax are made at year-end. All calculations are idealized as being annual. *Pensioner seeks to use the savings to receive a stable $70,000/year after taxes. *Inflation is 0%. *Income tax rates and deductions remain constant at 2009 levels. *Ad hoc additions to the 1040 declaration, e.g., the schedule M taxpayer credit, are not implemented, being considered transitory. *A Roth IRA will herein be referred to as a Roth. *Taxpayer has standard deductions, is single, no handicaps. The pensioner requests to compare three scenarios of account depletion: 1.. Default – actualize the requested dispersal of disposable income using the IRA ‘as is’. (see files ‘traditional1’ and ‘traditional62,000’) 2. Roll over the current IRA into a Roth by converting half in the current and next years (2010 & 2011). (see Roth1) 3.. Roll over the IRA immediately and fully into a Roth and proceed as otherwise to disperse funds. (see Roth2) Issues The controlling factor in each scenario is the relative ability to obtain deductions and to minimize the tax effect. While this may be an obvious observation, the attached spreadsheets fairly represent the story and highlight the manner in which this occurs. As the results show (traditional1 file), already at age 61 the brokerage account is emptied. At that point, pensioner can shift to the IRA without penalty. Deposits to the traditional IRA had been tax-exempt (§ 219); upon withdrawing them, the deferred tax is now called upon to be paid. Currently, restrictions on limits to how much can be shifted from the traditional IRA to the Roth version have been waived. (Publ. 590, pg. 56, 63) We are thus relieved of that limitation for considering the Roth-conversion cases. The IRS’ publication 575 specifically permits switching over “any part or all of an eligible rollover distribution paid directly to another qualified retirement plan…” The worksheets show the relative numerical effects of this action. Conclusions First, the traditional IRA path is clearly more advantageous. Second, the desired level of disposable income is unattainable given the assumptions of starting capital, deductions, and growth & tax rates. Third, a minor downward adjustment to about 11% less (about $62,200), if acceptable, would smooth and extend an annuity up to the target age of 78. For any higher payouts, the pensioner will have to adjust to living exclusively on Social Security before age 78. Analysis In the given circumstance, the Roth conversions, while tempting one with a stream of tax-free income, fall short of the flows the traditional IRA affords. The Roth, when tapped alone, does not give the recipient an opportunity to exploit the systemic deductions from income tax. Deductions are not refundable credits; they’re only applicable when they have a (taxable) stream upon which to act. Converting to a Roth, the pensioner here takes a large tax penalty early on and never recovers (see tables Roth1 and Roth2). Conversions to a Roth are "treated as a distribution" (408A (d)(3)(C) ), i.e., a taxable distribution, and the relative penalty from that tax outweighs the benefit of distributing the remainder tax-free. The winning strategy was to draw first from the brokerage account, exhausting it, then shifting to sourcing from the (conventional) IRA. Growth in the IRA continued throughout to grow tax-free (IRC § 408 (e)(1)) but pensioner, now receiving money from it, also receives a regular deduction as taxable income. Withdrawals from an IRA earlier than age 59 ½ incur a 10% penalty on the withdrawal amount (¶ 1370 Tax Handbook). The Roth option for this person’s situation is untenable. He must already begin to withdraw from it before age 59 ½. However, distributions must be made after a 5-year period 408A (d)(2)(B) to be qualified, i.e., receive the tax-free advantages of a Roth, or after age 59 ½ (§72 (t)(1)). “… the taxpayer’s tax … (for the amount) received shall be increased by an amount equal to 10% of the portion … includible in gross income.” However, this does not hold after age 59 ½ (§72 (t)(2)(A)(i)). This penalty is only one part of the detraction from using a Roth for this individual, as other points previously indicated flaws in its use here. Other situations could work to a Roth’s advantage. For instance, if a person were still working and made contributions or conversions to a Roth, the deduction/tax ‘buffer’ would still offer its advantages. Other reasons to prefer a Roth are that there are no minimum distributions amounts, or maximum distribution periods out of the plan, as there are with traditional IRAs. (Publication 590: minimum, pg.33; penalty excise tax, pg. 55; distribution period, appendix C) Though none of these are relevant to conditions established for the given case, they remain as potential matters of interest in Roth flexibility. Deductions and tax assessments were taken from the form 1040, US Individual Income Tax Return (2009), form 6251 (AMT), and accompanying booklets. Likewise, the Social Security worksheet therefrom yielded the supplemental deduction from taxable income. Sources, Attribution IRS publication 575 IRS publication 590 IRS instructional booklets & forms for 1040 & 6251 (AMT) IRC § 219, § 408, § 408A, (§72 (t)(1)) & (§72 (t)(2)) Federal Tax Handbook, ¶ 1370