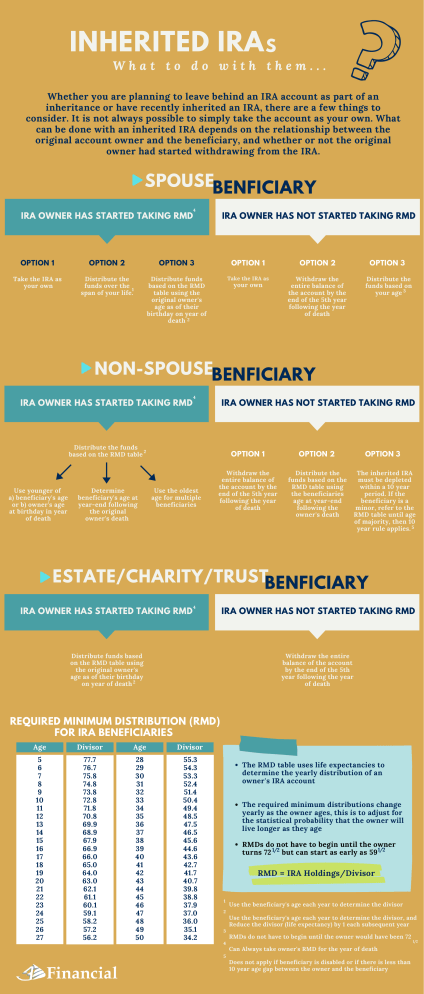

INHERITED IRA S What to do with them... Whether you are planning to leave behind an IRA account as part of an inheritance or have recently inherited an IRA, there are a few things to consider. It is not always possible to simply take the account as your own. What can be done with an inherited IRA depends on the relationship between the original account owner and the beneficiary, and whether or not the original owner had started withdrawing from the IRA. SPOUSEBENFICIARY IRA OWNER HAS STARTED TAKING RMD 4 IRA OWNER HAS NOT STARTED TAKING RMD OPTION 1 OPTION 2 OPTION 3 OPTION 1 OPTION 2 OPTION 3 Take the IRA as your own Distribute the funds over the 1 span of your life. Distribute funds based on the RMD table using the original owner's age as of their birthday on year of death 2 Take the IRA as Withdraw the entire balance of the account by the end of the 5th year following the year of death Distribute the funds based on your age 3 your own NON-SPOUSEBENFICIARY IRA OWNER HAS STARTED TAKING RMD 4 IRA OWNER HAS NOT STARTED TAKING RMD Distribute the funds 2 based on the RMD table Use younger of a) beneficiary's age or b) owner's age at birthday in year of death Determine beneficiary's age at year-end following the original owner's death Use the oldest age for multiple beneficiaries OPTION 1 OPTION 2 Withdraw the entire balance of the account by the end of the 5th year following the year of death Distribute the funds based on the RMD table using the beneficiaries age at year-end following the owner's death OPTION 3 The inherited IRA must be depleted within a 10 year period. If the beneficiary is a minor, refer to the RMD table until age of majority, then 10 year rule applies. 5 ESTATE/CHARITY/TRUSTBENFICIARY IRA OWNER HAS STARTED TAKING RMD 4 IRA OWNER HAS NOT STARTED TAKING RMD Distribute funds based on the RMD table using the original owner's age as of their birthday on year of death 2 Withdraw the entire balance of the account by the end of the 5th year following the year of death REQUIRED MINIMUM DISTRIBUTION (RMD) FOR IRA BENEFICIARIES Age Divisor Age Divisor 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 77.7 76.7 75.8 74.8 73.8 72.8 71.8 70.8 69.9 68.9 67.9 66.9 66.0 65.0 64.0 63.0 62.1 61.1 60.1 59.1 58.2 57.2 56.2 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 55.3 54.3 53.3 52.4 51.4 50.4 49.4 48.5 47.5 46.5 45.6 44.6 43.6 42.7 41.7 40.7 39.8 38.8 37.9 37.0 36.0 35.1 34.2 The RMD table uses life expectancies to determine the yearly distribution of an owner's IRA account The required minimum distributions change yearly as the owner ages, this is to adjust for the statistical probability that the owner will live longer as they age RMDs do not have to begin until the owner turns 72 1/2 but can start as early as 59 1/2 RMD = IRA Holdings/Divisor 1 2 3 4 5 Use the beneficiary's age each year to determine the divisor Use the beneficiary's age each year to determine the divisor, and Reduce the divisor (life expectancy) by 1 each subsequent year RMDs do not have to begin until the owner would have been 72 Can Always take owner's RMD for the year of death Does not apply if beneficiary is disabled or if there is less than 10 year age gap between the owner and the beneficiary 1/2