Early Withdrawals From

Your Traditional IRA

Withdraw As Intended or Pay Taxes & Penalties

Because IRA funds are to be used for retirement, the government discourages

you from taking IRA distributions before you reach age 59½. Consequently,

any taxable distributions you take from an IRA before reaching age 59½ are

generally subject to a 10% early distribution penalty tax.

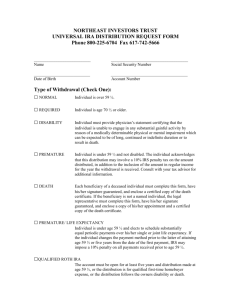

Q: When can I withdraw assets from my Traditional IRA?

A: You can withdraw funds from your Traditional IRA at any time. To avoid

a 10 percent early withdrawal tax penalty however, you may not withdraw

funds unless at least one of the following applies:

• Attained age 59½

• Become totally disabled

• Received your distribution in substantially equal installment payments

over your life expectancy or the life expectancy of you and your

beneficiary

• Certain medical expenses

• To purchase health insurance if unemployed

• Certain qualified higher education expenses

• First time home buying expenses capped at $10,000

If the 10 percent early withdrawal penalty is applicable, it is in addition to

ordinary income tax. Required minimum distributions must begin no later

than April 1 following the year in which you attain age 70½.

Q: How do I take distributions from my Traditional IRA?

A: Benefits may be paid in a lump sum, periodic installments or a lifetime

annuity. These distributions are taxed as ordinary income in the year you

receive them (plus the 10 percent early withdrawal penalty, if applicable).

Investment Insight

for Every Generation

Since 1854 sm

Early Withdrawals From Your Traditional IRA

Q: Who gets the money if I die before all benefits are paid?

A: You may name a beneficiary to receive these funds. The

beneficiary will determine the method of payment and will

pay income tax on the money as received. However, your

beneficiary will receive these benefits without penalty.

Q: If my Traditional IRA holds deductible and nondeductible

contributions, can I make a tax-free withdrawal from the

nondeductible portion?

A: No. You may not specify that your withdrawal be made

only from nondeductible contributions on which you have

already paid taxes. Instead, withdrawals will be taxed in the

same proportion that nondeductible contributions bear to

total Traditional IRA account values. Thus, you will owe

taxes on a portion of every withdrawal.

Check with your tax advisor

Under certain circumstances, an individual under 59½ may

take distributions from his or her IRA without incurring

a 10% early distribution penalty tax. Distributions are not

subject to the penalty tax if taken due to death or disability

of the IRA holder, or if taken under an exception discussed

above. Before taking any distribution from your IRA, you

should consult with your tax advisor.

J.J.B. Hilliard, W.L. Lyons, LLC | Member NYSE, FINRA & SIPC. Hilliard Lyons does not offer tax or legal advice. Please consult your tax advisor or

attorney before making any decision that may affect your tax or legal situation. ©2007 All rights reserved.

www.hilliard.com