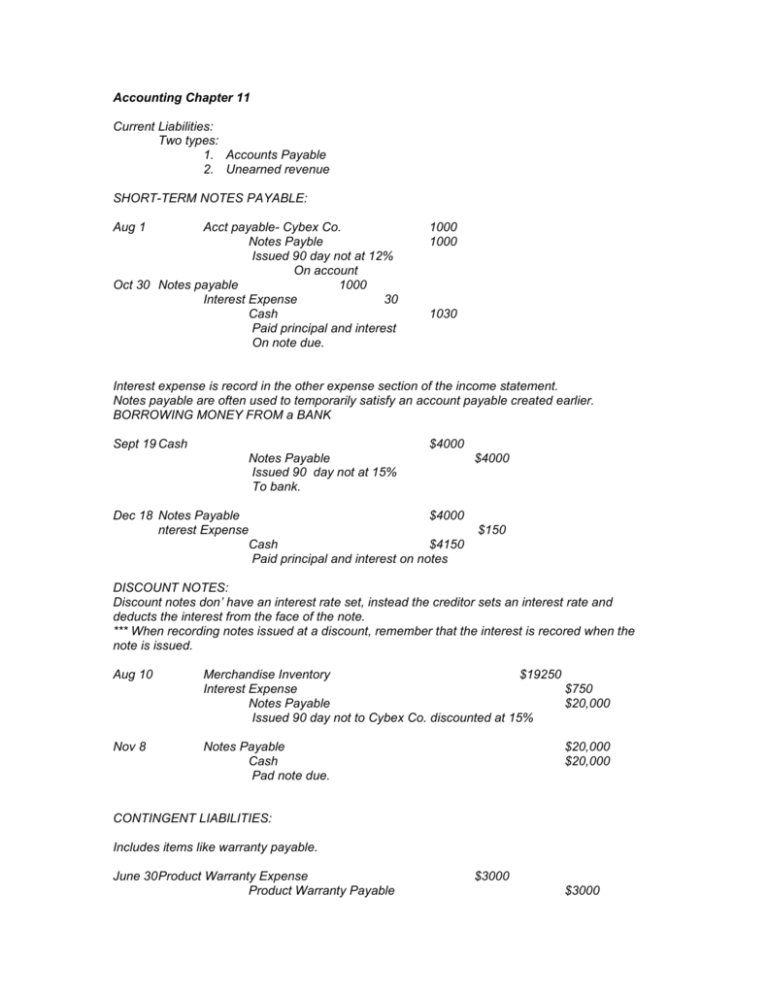

Accounting Chapter 11

advertisement

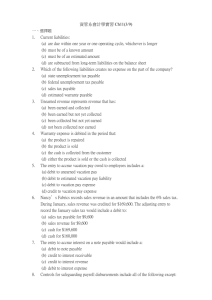

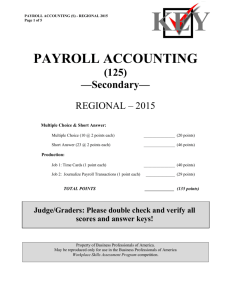

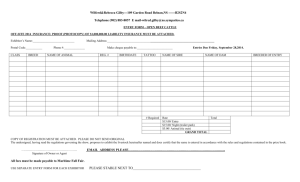

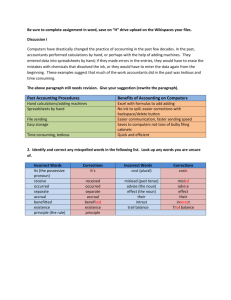

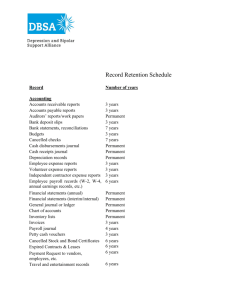

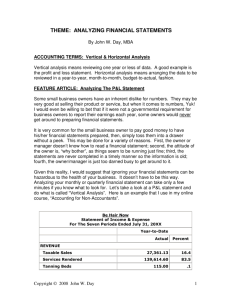

Accounting Chapter 11 Current Liabilities: Two types: 1. Accounts Payable 2. Unearned revenue SHORT-TERM NOTES PAYABLE: Aug 1 Acct payable- Cybex Co. Notes Payble Issued 90 day not at 12% On account Oct 30 Notes payable 1000 Interest Expense 30 Cash Paid principal and interest On note due. 1000 1000 1030 Interest expense is record in the other expense section of the income statement. Notes payable are often used to temporarily satisfy an account payable created earlier. BORROWING MONEY FROM a BANK Sept 19 Cash $4000 Notes Payable Issued 90 day not at 15% To bank. Dec 18 Notes Payable $4000 nterest Expense Cash $4150 Paid principal and interest on notes $4000 $150 DISCOUNT NOTES: Discount notes don’ have an interest rate set, instead the creditor sets an interest rate and deducts the interest from the face of the note. *** When recording notes issued at a discount, remember that the interest is recored when the note is issued. Aug 10 Merchandise Inventory $19250 Interest Expense $750 Notes Payable $20,000 Issued 90 day not to Cybex Co. discounted at 15% Nov 8 Notes Payable Cash Pad note due. $20,000 $20,000 CONTINGENT LIABILITIES: Includes items like warranty payable. June 30 Product Warranty Expense Product Warranty Payable $3000 $3000 Warranty Expense for june 5% x $60,000 Aug 16. Customer needs a $200 part replaced. Aug 16 Product Warranty Payable Supplies Replaced defective part under warranty $200 $200 *** Professional judgment is necessary to determine which liabilities are contingent and which ones are probable. PAYROLL and PAYROLL TAXES There is no need to record each payroll check separately in the journal because all details are provided in the payroll register. **the reason for using a separate bank account for payroll is that it makes reconcillzation much easier. A payroll bank account establishes control over payroll checks by preventing theft, misuse, or uncashed payroll checks. FRINGE BENEFITS Vacation Pay. May 5 Vacation Pay Expense Vacation Pay Payable Vacation pay for week ended May 5 $2000 $2000 Pensions **defined contribution plan=requires that a fixed amount of money be invested for the employees behalf during the employees working years. The employee bears the investment risk for a defined contribution plan. The amount the employer contributes is a fixed percentage and is debited to Pension Expense and credited to CASH. Dec 31 Pension Expense Cash Contributed 10% of annual salaries to pension Plan. $50000 $50,000 Defined Benefit Plan= the employer bears the investment risk of a defined benefit plan and therefore most companies are switching to a defined contribution plan. Dec 31 Pension Expense Cash Unfunded Pension Liability To record annual pension cost and contribution To pension plan $80,000 $60,000 $20,000 POSTRETIREMENT BENEFITS OTHER THAN PENSIONS: Financial statements should include footnotes as to what these other benefits are. FINANCIAL ANALYSIS and INTERPRETATION Quick Ratio= quick assets/ current liabilities The quick ratio is also known as the acid test. When the ratio approaches less than one that indicates that a company cannot cover its current liabilities with cash and near cash assets.. One way a company can change this ratio is to work with their bank to change short term debt into long term debt. Quick ratio is based on assets that can be converted to cash in 90 days Payroll taxes become a liability to the employer when the payroll is paid. When the employee earns the right to vacation, it becomes a current liability QUESTIONS The two types of transactions that cause the most current liabilities are; A. Receiving goods or services prior to making payment B. Receiving payment prior to delivering goods or services Short term notes Payable may be issued when: A. When merchandise is purchased B. Can also be issued to creditors to temporarily satisfy an account payable created earlier. Product warranty should be recorded in the accounts when the liability is both probable and can be reasonably estimated. What programs are funded by the FICA tax? They include” A. Social security for the aged and disabled B. Medicare for health care for senior citizens What are the federal taxes that most employers are required to hold from employees? Income, Social security, Medicare, unemployment The title of the accounts are: Social security tax payable Medicare tax payable Employees Federal Income tax payable Retirement Deduction payable United Way deductions payable The taxes on employee payroll are considered operating expenses for the employer. Payroll taxes become a liability for the employer when the payroll is paid. If an employer has the option to hire 1 person full time at $25000 or two part time people for a total of $25000 a year what payroll taxes would have a impact? Unemployment compensation at the federal and state level + anything else? What are the principal reasons for using a separate payroll account. A. Makes reconciliation easier B. Acts as an internal control that helps to prevent thief or misuse of checks. Constants a payroll data include: name, ss, marital status, income tax withholdings, srate of pay, payroll category Variables included: hours worked, days of sick leave with pay, vacation credits cumulative earnings and taxes withheld. To match revenues with expenses vacation should be expensed when it is earned not when it is taken. Factors of defined benefits plan include, employee life expectancy, employee turnover, expected employee compensation levels, and investment income on pension contributions. Unfunded pension liability may be located in two places on the balance sheet, the part to come do with in the year will be current liability, the part due past one year will be long term liability. Postreitirement benefits: Medical, dental, eye, life insurance, tuition assistance, tax services, legal services.