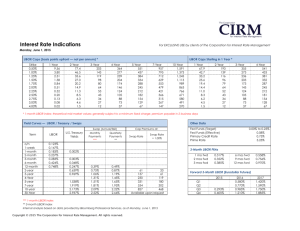

UDI/Libor Swaps

advertisement

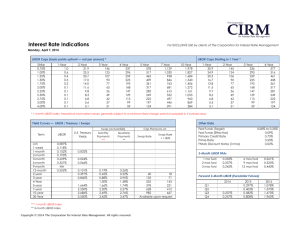

ISDA Conference: Derivatives and Risk Management in Mexico Workshop Session: Financial Innvoation Evolution and Growth in Local Interest Rate Swaps May 7, 2001 3:30 PM David Jasper Vice President, Emerging Markets Trading Goldman Sachs Interest Rate Derivatives in Mexico Background In recent years, the interest rate swap market was slow to develop in Mexico for a number of reasons including the following: --lack of long-term, fixed rate government bond issuance (few “benchmarks”) --underdeveloped interest rate futures market (compared with Brazil) --high interest rate volatility --limited investor appetite for fixed interest rate risk, particularly beyond 12 months For Mexican Corporates with limited access to the global bond markets, they were left with limited funding alternatives and borrowed primarily through local floating rate facilities linked to 28 day TIIE (Tasa de Interes Interbancaria de Equilibrio)—an interbank interest rate for 28 day term demand deposits. The rate is published daily by Banxico and is posted on Reuters Page MEX06. As a result, many corporates are exposed to significant interest rate volatility which can adversely impact their income statements in rising interest rate environments. Given 28 day TIIE has been as low as 14.40% (April 13, 2000) and as high as 51.40% (September 14, 1998) in just the last three years, interest rate movements can be a big contributor to income statement volatility for a local borrower (see graph on the following page). 2 Interest Rate Derivatives in Mexico Historical 28 Day TIIE Fixes: Since May 1998 55 50 45 40 35 30 25 20 15 10 1May98 1Jul98 Mexican 28 Day TIIE Rate 1Jan99 1Jul99 1Jan00 Source: Goldman Sachs 3 1Jul00 1Jan01 1May01 Interest Rate Derivatives in Mexico TIIE Fixed/Floating Swaps Although the market for TIIE swaps has been around for 2 years, liquidity and tenor have been somewhat limited with the vast majority of trades 12 months and shorter. Prices are quoted as a fixed rate to “pay” or “receive” versus 28 day TIIE, assuming a prespecified number of 28 day roll periods (i.e. 1 year swaps have thirteen 28 day periods) In recent months, there has been a significant increase in both tenor and liquidity in the TIIE Fixed/Float swap market due to a number of factors including the following: --issuance of longer-term government securities (yield benchmarks for 3 and 5 years) --customer demand for longer-term interest rate hedges (up to 15 years) --increase in the number of interbank counterparties quoting TIIE swaps --increase in the risk appetite of dealers to sustain yield curve risk The interbank market is relatively liquid out to 5 years (65 periods), and quotes for 7 years (90 periods) and 10 years (130 periods) are not uncommon. Much of the longer-dated activity (3 years and beyond) is driven by local corporates and banks looking to “fix” their borrowing costs and reduce their exposure to short-term interest rate volatility. 4 Interest Rate Derivatives in Mexico TIIE Fixed/Floating Swaps (cont.) The current shape of the swap curve is inverted--reflecting the market’s positive view on the direction of TIIE over the next few years. Interest Rate Curves 16.5 16.0 15.5 (%) 15.0 14.5 14.0 13.5 13.0 12.5 14May01 1Jan02 1Jul02 1Jan03 MXN Bid MXN Fwd-FwdBid MXN Ask MXN Fwd-FwdAsk 1Jul03 1Jan04 Source: Goldman Sachs 5 1Jul04 1Jan05 1Jul05 1Jan06 8May06 Interest Rate Derivatives in Mexico TIIE/Libor Basis Swaps In addition to an active TIIE fixed/floating swap market, the interbank market for TIIE/Libor basis swaps has also grown in recent months. TIIE/Libor basis swaps allow local borrowers to swap liabilities between USD and MXN more efficiently than more traditional capital markets allow. For instance, if a Local Corporate is interested in reducing the USD portion of its outstanding debt, issuing local MXN securities to retire USD loans/bonds may take weeks to implement. Instead, the borrower can synthetically issue MXN debt through the TIIE/Libor basis swap market—paying TIIE on a MXN notional versus receiving Libor on a USD Notional. TIIE/Libor basis swaps are quoted as a spread to 1M Libor versus TIIE flat. The standard conventions for TIIE/Libor basis swaps are as follows: --28 day TIIE on the MXN notional payable every 28 days on an actual/360 daycount versus --1M Libor on the USD notional payable every 28 days on an actual/360 daycount --payments on “good” MXN and USD dates using the following business day convention --MXN business days for fixing TIIE --UK business days for fixing Libor --principal exchange on the effective and maturity dates 6 Interest Rate Derivatives in Mexico TIIE/Libor Basis Swaps (cont.) Market pricing for TIIE/Libor basis swaps are very much supply/demand driven—if local borrowers prefer USD funding to TIIE funding, spreads added to 1M Libor tend to move higher. The current shape of the curve is positively sloped as shown below. TIIE/Libor Basis Curve 1.20% Libor plus % 1.00% 0.80% Bid 0.60% Ask 0.40% 0.20% 0.00% 1 Year 2 Year 3 Year Tenor Source: Goldman Sachs 7 4 Year 5 Year Interest Rate Derivatives in Mexico UDI/Libor Swaps Another financing vehicle for Mexican Corporates that has become more prevelant in the last 12 months has been the issuance of real rate bonds—bonds that pay a fixed rate plus inflation (UDIs). Since the demand for these securities is entirely local, some Corporates utilize the UDI/Libor swap market to synthetically borrow USD on the back of local UDI issuance. Although the UDI/Libor swap market is much less liquid than the TIIE fixed/floating and TIIE/Libor basis swap markets, the interbank market is starting quote swap prices out to 5 years. The standard conventions for UDI/Libor swaps are as follows: --fixed rate on the UDI notional payable semi-annually on an actual/360 daycount versus --6M Libor on the USD notional payable semi-annually on an actual/360 daycount --payments on “good” MXN and USD dates using the following business day convention --all UDI payments are settled in MXN based on the MXN/UDI index on each payment date --principal exchange on the effective and maturity dates Pricing in the table below shows the interbank market as of May 4 for the UDI/Libor swaps most actively traded in the market. Tenor 2 Years 3 Years 5 Years Bid 7.75% 7.65% 7.50% Offer 8.15% 8.05% 8.00% Notional $10,000,000 USD $10,000,000 USD $10,000,000 USD 8 Interest Rate Derivatives in Mexico TIIE Caps and Floors On the back of the growth in the TIIE fixed/floating swap market, there has been increased customer interest in TIIE Caps and Floors—very similar to the Libor cap/floor market. With the resurgence in local mortgage lending, banks have offered borrowers both fixed rate term loans and floating rate mortgages (linked to TIIE) with TIIE imbedded TIIE caps. The latter is preferable for borrowers who share the view that TIIE will continue to fall, but want to be insulated from external market shocks that could push rates higher in the futures. TIIE Swaptions Another area of recent growth has been in TIIE swaptions—options which allow the buyer to enter into a TIIE swap at a guaranteed fixed rate at a prespecified date in the future. If fixed rate Corporate issuance in MXN continues to grow, the demand for TIIE swaptions will likely increase as issuers require “rate locks” to hedge interest rate risk in advance of debt issuance. 9