09-may-part-2-assignment-w-sol

advertisement

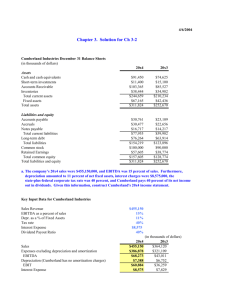

University of Wales External Program ACF 102 Assignment Instructions: Answer the Multiple choice questions on the answer sheet provided and the Essay questions on A4 size papers. Write your English and Pinyin names clearly with your class. Section A: Multiple Choice Questions 1. Cash payments to suppliers would appear on a statement of cash flows using the direct method as a(n): a. financing activity b. operating activity c. investing activity d. debt activity e. equity activity L.O.: 2 2. The a. b. c. d. e. Type: Moderate Solution:b issuance of stock for cash would be classified as a(n): investing activity on the statement of cash flows equity activity on the statement of cash flows operating activity on the statement of cash flows would not appear on the statement of cash flows financing activity on the statement of cash flows L.O.: 2 Type: Moderate Solution:e 3. All of the following would be included in a company's operating activities except: a. dividend payments b. collections from customers c. cash payments to suppliers d. income tax payments e. interest and dividends collected L.O.: 2 4. Type: Easy Solution:a All of the following activities would be included in a company's operating activities except: a. payments to employees b. payment to a local government for property taxes c. payment to suppliers d. payment to the bank to reduce loan balance e. payment to landlord for rent L.O.: 2 Type: Moderate Solution:d Table 5-1 Stratton Company Balance Sheet December 31, 20X4 and 20X3 Current Assets: Cash Accounts Receivable Inventory Supplies Prepaid Insurance Total Current Assets Long-term Assets: Fixed Assets Accumulated Depreciation Patent Total Long-term Assets Total Assets Current Liabilities: Accounts Payable Wages Payable Interest Payable Taxes Payable Total Current Liabilities Long-term Liabilities: Bonds Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 12/31/X4 12/31/X3 $ $ 4,600 9,600 17,500 1,200 1,400 34,300 3,100 7,900 18,600 2,100 1,000 32,700 71,000 (30,400) 6,000 46,600 $ 80,900 58,000 (26,500) 7,100 38,600 $ 71,300 $ $ 6,100 2,200 800 2,300 11,400 20,300 31,700 22,700 26,500 49,200 $ 80,900 4,900 2,600 1,000 1,600 10,100 24,000 34,100 20,000 17,200 37,200 $ 71,300 Stratton Company Income Statement For the Year Ended December 31, 20X4 Sales Cost of Goods Sold Gross Profit Less Operating Expenses: Wage Expense Supply Expense Insurance Expense Depreciation Expense Amortization Expense Rent Expense Operating Income Interest Expense Income before Taxes Income Tax Expense Net Income $147,600 (63,800) 83,800 $40,100 3,600 3,000 3,900 1,100 5,400 57,100 26,700 (2,600) 24,100 (10,800) $ 13,300 5. Referring to Table 5-1, what was the cash collected from customers by Stratton Company in 20X4? a. $138,000 b. $145,900 c. $147,600 d. $149,200 e. $157,200 L.O.: 5 6. Solution:e Type: Difficult Solution:b Referring to Table 5-1, what was the cash paid to employees by Stratton Company in 20X4? a. $40,500 b. $39,700 c. $40,100 d. $38,000 e. $42,300 L.O.: 5 9. Type: Difficult Referring to Table 5-1, what was the cash paid to suppliers of inventory by Stratton Company in 20X4? a. $63,800 b. $61,500 c. $63,700 d. $63,900 e. $66,100 L.O.: 5 8. Solution:b Referring to Table 5-1, how much inventory did Stratton Company purchase in 20X4? a. $81,300 b. $63,800 c. $64,900 d. $46,300 e. $62,700 L.O.: 5 7. Type: Moderate Type: Moderate Solution:a Referring to Table 5-1, what was the cash paid for supplies by Stratton Company in 20X4 (Assume all purchases of supplies were for cash)? a. $3,600 b. $4,500 c. $2,400 d. $2,700 e. $4,800 L.O.: 5 d Type: Moderate Solution: 10. Referring to Table 5-1, what was the cash paid for income taxes by Stratton Company in 20X4? a. $7,100 b. $11,700 c. $10,100 d. $10,900 e. $8,600 L.O.: 5 Type: Moderate Solution:c 11. Referring to Table 5-1, what was the cash flow from operations for Stratton Company in 20X4? a. $18,300 b. $19,500 c. $8,200 d. $14,500 e. $13,000 L.O.: 5 Type: Difficult Solution:b 12. Referring to Table 5-1, what was the cash (paid or received) from the purchase and/or sale of fixed assets by Stratton Company in 20X4? a. $(13,000) b. $(9,100) c. $(16,900) d. $9,100 e. Cannot be determined from the information given L.O.: 4 Type: Difficult Solution:a 13. Referring to Table 5-1, what was the cash flow from investing activities for Stratton Company in 20X4? c. $(9,100) d. $9,100 a. $(13,000) b. $(12,000) e. $2,000 L.O.: 4 Type: Difficult Solution:c 14. Referring to Table 5-1, what were the dividends paid by Stratton Company in 20X4? a. $11,900 b. $0 c. $22,600 d. $4,000 e. $9,300 L.O.: 3 Type: Difficult Solution:d 15. Which of the following items will not appear in the cash flow from operations section when using the direct method? a. collections from customers b. depreciation expense c. cash paid for income taxes d. payments to employees e. payments to suppliers L.O.: 5 Type: Moderate Solution:b 16. The indirect method: a. is seldom used by companies because of the extra effort required to gather cash flow information b. calculates only the cash effect of each operating activity c. is the method preferred by the FASB d. begins with net income; adds back non cash expenses; and adjusts for changes in the current asset and current liability accounts e. can be used to determine cash flows from operating, investing, and financing activities L.O.: 6 Type: Moderate Solution:d 17. When preparing the statement of cash flows under the indirect method, an appropriate procedure would be to: a. add a loss from the sale of a fixed asset b. add an increase in accounts receivable c. subtract depreciation expense d. subtract an increase in accounts payable e. determine cash received from customers L.O.: 6 Type: Moderate Solution:a 18. Which of the following transactions decrease cash? 1. reduce prepaid expenses 2. increase treasury stock 3. make a loan 4. recognize cost of goods sold 5. reduce long-term or short-term debt a. 1 and 4 b. 3 and 5 c. 1, 3, and 5 d. 2, 3, and 5 e. 1, 2, 3, 4, and 5 L.O.: 6 19. Type: Moderate Solution:d An increase in stockholders' equity can be calculated as: a. b. c. d. e. new issuance of stock plus net income plus cash dividends new issuance of stock plus net income less cash dividends new issuance of stock less net income less cash dividends new issuance of stock less net income plus cash dividends cannot be determined from the information provided L.O.: 8 Type: Moderate Solution:b 20. Which of the following statements is incorrect, regarding the effect of depreciation on a statement of cash flows using the indirect method? a. Depreciation expense is not an outflow of cash. b. Ignoring income tax effects, increasing depreciation expense will increase cash flows from operations. c. Depreciation expense is added in the cash flow from operations section. d. Depreciation expense is not a source of cash. e. Depreciation expense will reduce the net income used in determining cash flows from operations. L.O.: 7 Type: Moderate Solution:b 21. A written promise to repay a loan principal plus interest at a specific future date is: a. a promissory note b. a line of credit c. commercial paper d. a product warranty e. a returnable deposit L.O.: 1 Type: Easy Solution:a 22. A debt contract issued by prominent companies that allow the companies to borrow directly from investors is: a. a promissory note b. a line of credit c. commercial paper d. product warranties e. returnable deposits L.O.: 1 Type: Easy Solution:c 23. On January 1, 20X3, Davis Company issued $200,000 in longterm bonds at par. The bonds pay interest of 12% on January 1, and the principal will be paid in $25,000 annual increments, beginning on December 31, 20X7, and continuing every year thereafter for 8 years. What journal entry is necessary on December 31, 20X6? a. No journal entry is necessary. b. Cash 25,000 Long-Term Bond Payable 25,000 c. Long-Term Bond Payable 25,000 Cash 25,000 d. Long-Term Bond Payable 25,000 Current Portion of Long-Term Bond Payable 25,000 e. Prepaid Long-Term Bond Payable 25,000 Cash 25,000 L.O.: 1 Type: Difficult Solution:d 24. Unearned revenues: a. are considered to be a type of revenue b. are revenues that are collected before services or goods are delivered c. normally has a debit balance d. is credited when the sales revenue is finally earned e. include cash donations made to universities from wealthy alumni L.O.: 1 Type: Moderate Solution:b 25. Shelly Corp. publishes the Uptown Herald. In April, they collected $600 in advance for one-year subscriptions. The journal entry to record the delivery of the newspapers in May would be: a. Cash 50.00 Subscription Revenue 50.00 b. Prepaid Subscriptions 50.00 Subscription Revenue 50.00 c. Prepaid Subscriptions 50.00 Cash 50.00 d. Cash 50.00 Prepaid Subscriptions 50.00 e. Unearned Subscription Revenue 50.00 Subscription Revenue 50.00 L.O.: 1 Type: Moderate Solution:e 26. ________________ are subject to redemption before maturity at the option of the issuer. a. Debentures b. Mortgage bonds c. Callable bonds d. Sinking fund bonds e. Convertible bonds L.O.: 2 Type: Moderate Solution:c 27. Notes and bonds are often called ___________ financial instruments or securities because they can be transferred from one lender to another. a. private placements b. negotiable c. current liabilities d. long term liabilities e. sinking fund L.O.: 2 Type: Easy Solution:b 28. Bonds are typically sold through a. board of directors b. underwriters c. corporations d. commercial insurance companies e. none of the above L.O.: 2 Type: Easy Solution:b 29. The interest rate that determines the amount of cash paid for interest to the bondholder is referred to as the: a. effective rate b. market rate c. coupon rate d. daily rate e. imputed rate L.O.: 2 Type: Easy Solution:c 30. The cash proceeds received from issuing a bond are less than the face value of the bond. It is apparent that the bond was issued at: a. face value b. a premium c. a discount d. par value e. nominal value L.O.: 2 Type: Moderate Solution:c 31. The amount earned by an investor expressed as a percentage of the amount invested is called: a. discount rate b. rate of return c. present value d. future value e. expected past rate L.O.: 2 Type: Easy Solution:b 32. When the market interest rate is 7% and the coupon rate is 10%, a bond sells at: a. a discount b. a premium c. at par d. liquidation value e. cannot be determined without more information L.O.: 2 Type: Moderate Solution:b 33. What is the present value of $2,000 with 16% interest, to be received in 18 years? a. $161.61 b. $150.30 c. $155.83 d. $148.48 e. $138.20 L.O.: 8 Type: Moderate Solution:e 34. If Tome deposits $9,000 in an account that pays 10% yearly interest, compounded annually, how much will he have in the account at the end of three years? a. $8,990 b. $9,750 c. $10,909 d. $11,979 e. $12,500 L.O.: 8 Type: Moderate Solution:d Section B: Essay Problem Questions 1. Table 1-1 Greenwood Company Income Statement For the Year Ended December 31, 20X4 Sales Less Expenses: Cost of Goods Sold Wage Expense Depreciation Expense Rent Expense Income Tax Expense Net Income $624,000 $332,000 211,000 20,000 18,000 16,000 597,000 $ 27,000 Greenwood Company Balance Sheet December 31, 20X3 and 20X4 12/31/X4 12/31/X3 12/31/X3 Current Assets: Cash $ 8,100 $ 10,600 $ 59,900 Accts. Rec. 66,100 53,400 11,300 Inventory 27,700 35,900 8,200 Prepaid Rent 3,000 4,500 79,400 104,900 104,400 Long-term Assets: 74,000 Fixed Assets 165,500 147,700 43,500 Acc. Depre. (68,800) (55,200) 117,500 96,700 92,500 Total Assets $201,600 $196,900 $196,900 A. 12/31/X4 Current Liabilities: Accounts Payable $ 57,200 Wages Payable 17,500 Taxes Payable 7,100 81,800 Owners' Equity: Common Stock 75,000 Retained Earnings 44,800 119,800 Total Liabilities & Owners' Equity $201,600 Refer to Table 1-1. Determine the cash flows from operations for Greenwood Company, assuming the company uses the direct method. L.O.: 5 Type: Difficult Solution: Sales Less: increase in accounts rec. Cash received from customers $624,000 (12,700) $611,300 Cost of goods sold Less: decrease in inventory $ 332,000 (8,200) B. Add: decrease in accounts payable Cash paid to suppliers 2,700 $(326,500) Wage expense Less: increase in wages payable Cash paid for wages $ 211,000 (6,200) $(204,800) Rent expense Less: decrease in prepaid rent Cash paid for rent $ 18,000 (1,500) $(16,500) Income tax expense Add: decrease in taxes payable Cash paid for taxes $ 16,000 1,100 $(17,100) Net cash provided by operations $ 46,400 Refer to Table 1-1. Determine the cash flows from operations for Greenwood Company, assuming the company uses the indirect method. L.O.: 6 Type: Moderate Net Income Add: depreciation expense Less: increase in accounts receivable Add: decrease in inventory Add: decrease in prepaid rent Less: decrease in accounts payable Add: increase in wages payable Less: decrease in taxes payable Net cash provided by operations Solution: $27,000 20,000 (12,700) 8,200 1,500 (2,700) 6,200 (1,100) $46,400 2. Orchard Company has the following selected balance sheet and income statement information: Income Statement Accounts For The Year Ended December 31, 20X4 $ 15,000 164,000 523,000 88,000 Income Tax Expense Cost of Goods Sold Sales Wage Expense Balance Sheet Accounts 20X3 Accounts Payable Cash Income Taxes Payable Accounts Receivable Inventory Wages Payable At December 31, 20X4 $19,000 19,000 21,000 41,000 12,000 5,000 At December 31, $17,000 12,000 9,000 36,000 23,000 12,000 Determine the following items for the Orchard Company for the year ended December 31, 20X4: a. Cash received from customers b. Cash paid to suppliers c. Cash paid for wages d. Cash paid for income taxes L.O.: 5 Type: Moderate Solution: a. Sales Less: increase in A/R Cash received from customers $523,000 (5,000) $518,000 b. Cost of goods sold Less: decrease in Inventory Less: increase in A/P Cash paid to suppliers $164,000 (11,000) ( 2,000) $151,000 c. Wage expense Add: decrease in wages payable Cash paid for wages $88,000 7,000 $95,000 d. Income tax expense Less: increase in taxes payable Cash paid for taxes $15,000 (12,000) $ 3,000 3. Watson Company had a 6-year, 8%, $375,000 bonds ready to be sold on January 1, 20X4. The bonds will pay interest every June 30 and December 31. However, due to market conditions, the company did not sell the bonds until March 1, 20X4, at which time the bonds was issued at par. Given the information presented above, prepare the appropriate journal entry for Watson Company for each of the following dates: a. January 1, 20X4 b. March 1, 20X4 c. June 30, 20X4 d. December 31, 20X4 L.O.: 3 Type: Moderate a. No journal entry is necessary. b. Cash 380,000 Interest Payable Bonds Payable c. Interest Payable 5,000 Interest Expense 10,000 Cash d. Interest Expense 15,000 Cash Solution: 5,000 375,000 15,000 15,000 4. Blue Inc issued $1,000,000 of 6.5%, 8-year bonds dated June 1, 20X5, with semiannual interest payments on June 1 and December 1. 3/8. The bonds were issued on June 1, 20X5, at 103 a. Were the bonds issued at a premium, a discount, or at face value? b. Was the market rate of interest higher, lower, or the same as the coupon rate of interest? c. How much cash was received by Blue Inc upon issuance of the bonds? L.O.: 3 Type: Moderate Solution: a. The bonds were issued at a premium. b. The market rate of interest was lower than 6.5% since the bonds were issued above face value. c. $1,000,000 X 1.03375 = $1,033,750 5. Croy Enterprises issued 9-year, 8%, $750,000 bonds on January 1, 20X5. The bonds pay interest every June 30 and December 31, with the principal to be paid in 9 years. The effective interest rate on the bonds is 10%, and the company uses the effectiveinterest method of amortization. a. Compute the initial selling price of the bonds on January 1, 20X5. b. Prepare the entry needed on June 30, 20X5. L.O.: 3 Type: Difficult Solution: a. The initial selling price of the bond: $750,000 x .4155 = $311,625 $ 30,000 x 11.6896 = 350,688 (n=18,i=5) $662,313 b. Interest Expense 33,116 Cash Discount on Bonds Payable 30,000 3,116