Financial Statements, CF, and Taxes. Build a Model

advertisement

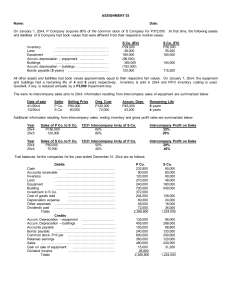

4/6/2004 Chapter 3. Solution for Ch 3-2 Cumberland Industries December 31 Balance Sheets (in thousands of dollars) 20x4 20x3 Assets Cash and cash equivalents Short-term investments Accounts Receivable Inventories Total current assets Fixed assets Total assets $91,450 $11,400 $103,365 $38,444 $244,659 $67,165 $311,824 $74,625 $15,100 $85,527 $34,982 $210,234 $42,436 $252,670 Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity $30,761 $30,477 $16,717 $77,955 $76,264 $154,219 $100,000 $57,605 $157,605 $311,824 $23,109 $22,656 $14,217 $59,982 $63,914 $123,896 $90,000 $38,774 $128,774 $252,670 a. The company’s 20x4 sales were $455,150,000, and EBITDA was 15 percent of sales. Furthermore, depreciation amounted to 11 percent of net fixed assets, interest charges were $8,575,000, the state-plus-federal corporate tax rate was 40 percent, and Cumberland pays 40 percent of its net income out in dividends. Given this information, construct Cumberland's 20x4 income statement. Key Input Data for Cumberland Industries Sales Revenue EBITDA as a percent of sales Depr. as a % of Fixed Assets Tax rate Interest Expense Dividend Payout Ratio $455,150 15% 11% 40% $8,575 40% Sales Expenses excluding depreciation and amortization EBITDA Depreciation (Cumberland has no amortization charges) EBIT Interest Expense 20x4 $455,150 $386,878 $68,273 $7,388 $60,884 $8,575 (in thousands of dollars) 20x3 $364,120 $321,109 $43,011 $6,752 $36,259 $7,829 EBT Taxes (40%) Net Income $52,309 $20,924 $31,386 $28,430 $11,372 $17,058 Common dividends Addition to retained earnings $12,554 $18,831 $6,823 $10,235 b. Next, construct the firm’s statement of retained earnings for the year ending December 31, 20x4, and then its 20x4 statement of cash flows. Statement of Cash Flows (in thousands of dollars) Operating Activities Net Income Adjustments: Noncash adjustment: Depreciation Due to changes in working capital: Increase in accounts receivable Increase in inventories Increase in accounts payable Increase in accruals Net cash provided by operating activities -$17,838 -$3,462 $7,652 $7,821 $32,947 Investing Activities Cash used to acquire fixed assets -$32,117 Financing Activities Decrease in short-term investments Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities Net increase/decrease in cash Add: Cash balance at the beginning of the year Cash balance at the end of the year $3,700 $2,500 $12,350 $10,000 -$12,554 $15,995 $16,825 $74,625 $91,450 $31,386 $7,388 c. Calculate net operating working capital, total net operating capital, net operating profit after taxes, operating cash flow, and free cash flow for 20x4. Net Operating Working Capital NOWCx4 = = = Operating current assets $233,259 $172,021 - Operating current liabilities $61,238 NOWCx3 = = = Operating current assets $195,134 $149,369 Total Net Operating Capital TOCx4 = NOWC = $172,021 = $239,186 Operating current liabilities $45,765 - + + Fixed assets $67,165 + + Fixed assets $42,436 Net Operating Profit After Taxes NOPATx4 = EBIT = $60,884 = $36,531 x x (1-T) 60% Operating Cash Flow OCFx4 = NOPAT = $36,531 = $43,919 + + Depreciation $7,388 TOCx3 = = = NOWC $149,369 $191,805 d. Calculate the firm’s EVA and MVA for 20x4. Assume that Cumberland had 10 million shares outstanding, that the year-end closing stock price was $17.25 per share, and its after-tax cost of capital was 12 percent. Additional Input Data Stock price # of shares (in thousands) A-T cost of capital $17.25 10,000 12% Market Value Added MVA = Stock price = $17.25 = $14,895 x x # of shares 10,000 - Total common equity $157,605 Economic Value Added EVA = NOPAT = $36,531 = $7,828 - Operating Capital $239,186 x x After-tax cost of capital 12%