ACC570 CH 3 SOLUTIONS 37. a. Three. As a niece, Ida is a

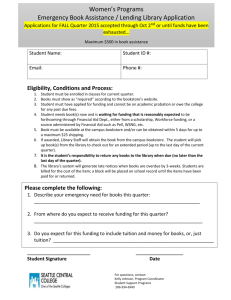

advertisement

ACC570 CH 3 SOLUTIONS 37. 43. a. Three. As a niece, Ida is a qualifying child. Under the qualifying child category, Ida does not have to meet the gross income test. In this regard, her age and student status does make a difference. b. One. Since Clint is not a qualifying child, the gross income test applies. c. Three. The parents need not live with Trent as they meet the relationship test. Though not stated, it is assumed that the gross income test is satisfied. d. One. Carol can claim a personal exemption. Because of Form 8332, the dependency exemptions for the children belong to Jack. Salary Short-term capital loss Cash prize AGI Less: Personal and dependency exemptions (7 × $3,650) Standard deduction Taxable income $80,000 (3,000) 1,000 $78,000 (25,550) (11,400) $41,050 Tax on $41,050 using surviving spouse rate schedule: $1,675 + 15%($41,050 – $16,750) = $5,320. The father does not fail the gross income test because tax-exempt income is not counted. The unused capital loss of $1,000 is carried over to the following year. 48. a. Wages Money market interest Bond interest (City of Boston bond interest is tax-exempt) Gross income Less: Standard deduction* Personal exemption** Taxable income $4,000 1,900 –0– $5,900 (4,300) (–0–) $1,600 b Money market interest Bond interest Total unearned income Minus: $950 + $950 standard deduction Income taxed at parents’ rate $1,900 –0– $1,900 (1,900) $ –0– Income taxed at Taylor’s rate $1,600 Total tax ($1,600 × 10%)*** $ 160 *A dependent’s standard deduction is limited to the greater of $950 or the sum of his or her earned income plus $300. **A dependent may not claim a personal exemption on his or her return. ***Since Taylor’s unearned income is not more than $1,900, her tax is determined without using her parents’ rate. Thus, Taylor’s 2010 tax liability is $160 ($1,600 taxable income × 10%). 52. a. Chester has a collectible gain of $6,000, a LTCG of $2,000, and a STCL of $4,000. Offsetting the STCL against the collectible gain leaves: $2,000 collectible gain and $2,000 LTCG. The tax liability is $860 [($2,000 28%) + ($2,000 15%). b. $300 [($2,000 15%) + ($2,000 0%)]. 54. Salaries ($51,000 + $39,000) Interest income (Note 1) Chevron bonds Wells Fargo Bank CD Gift from parents (Note 2) Loan repayment (Note 3) Bingo winnings (Note 4) Jury duty fees (Note 5) IRA contribution (Note 6) Adjusted gross income (AGI) Itemized deductions from AGI (Note 7) Medical [$1,800 – (7.5% × $89,000)] Taxes ($1,900 + $5,000) Interest on home mortgage Charitable contributions Bingo losses Campaign contributions (Note 8) Personal and dependency exemptions (6 × $3,650) (Note 9) Taxable income $90,000 $ 900 1,300 $ –0– 6,900 3,100 3,600 900 –0– Tax from Tax Table (Note 9) Less: withholdings ($4,100 + $3,000) Net tax payable (or refund due) 2,200 –0– –0– 1,000 800 (5,000) $89,000 (14,500) (21,900) $52,600 $7,059 7,100 ($ 41)* *The solution does not take into account the Making Work Pay credit. This credit is not discussed until Chapter 12 of the text. [Note: Had the credit been considered, the Fullers would have an additional refund of $800 (for a total of $841).] Notes (1) Interest on municipal bonds of $2,100 is an exclusion from income. (2) The gift of $26,000 is excluded from gross income. (3) As long as no interest is involved, the repayment of a loan is a nontaxable return of capital (i.e., the $10,000). (4) Gambling winnings (i.e., bingo of $1,000) are included in gross income. Losses (i.e., bingo of $900) can be claimed (to the extent of gambling income) as an itemized deduction from AGI. (5) The jury duty fees of $800 are included in gross income but related expenses of $60 cannot be deducted. (6) The IRA contribution of $5,000 is a deduction for AGI. (7) The Fullers should choose to itemize as $14,500 exceeds the standard deduction of $11,400. (8) The political contribution of $100 is not deductible. (9) Eva is a full-time student for the year although she graduated in May. Therefore, she is a qualifying child and her gross income makes no difference. CH 26: 36. a. Current-Year Method First Quarter Payment [$50,000 tax ÷ 4 payments × 90% required] Second Quarter Payment Third Quarter Payment Fourth Quarter Payment Prior-Year Method First Quarter Payment [($48,000 ÷ 4) × 110% required] Second Quarter Payment Third Quarter Payment Fourth Quarter Payment $11,250 11,250 11,250 11,250 $45,000 $13,200 13,200 13,200 13,200 $52,800 Thus, Trudy will use the current-year method for her estimates this year. The remaining tax [$50,000 – $45,000 = $5,000] is due with the return, but no underpayment penalty is assessed. b. Because Trudy’s prior-year AGI did not exceed $150,000, the underpayment penalty is avoided if she remits only 100% of the prior-year tax. Current-Year Method First Quarter Payment [$50,000 tax ÷ 4 payments × 90% required] $11,250 Second Quarter Payment 11,250 Third Quarter Payment 11,250 Fourth Quarter Payment 11,250 $45,000 Prior-Year Method First Quarter Payment [($20,000 ÷ 4) × 100% required] Second Quarter Payment Third Quarter Payment Fourth Quarter Payment $ 5,000 5,000 5,000 5,000 $20,000 Thus, Trudy now uses the prior-year method for her estimates this year. The remaining tax ($50,000 – $20,000 = $30,000) is due with the return but no underpayment penalty is assessed.