Group Work Solutions - Chapter 11 04/19/2010

advertisement

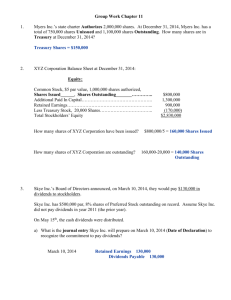

Group Work Chapter 11 1. Myers Inc.’s state charter Authorizes 2,000,000 shares. At December 31, 2007, Myers Inc. had a total of 750,000 shares Unissued and 1,100,000 shares Outstanding. How many shares were in Treasury at December 31, 2007? Treasury Shares = $150,000 2. Skye Inc.’s Board of Directors announced, on March 10, 2007, they would pay $130,000 in dividends to stockholders. Skye Inc. has $500,000 par, 8% shares of Preferred Stock outstanding on record. Assume Skye Inc. did not pay dividends in year 2006 (the prior year). On May 15th, the cash dividends were distributed. a) What is the journal entry Skye Inc. will prepare on March 10, 2007 (Date of Declaration) to recognize the commitment to pay dividends? March 10, 2007 Retained Earnings 130,000 Dividends Payable 130,000 b) What is the journal entry Skye Inc. will prepare on May 15th (Date of Dividend Payment) to recognize the cash payment to stockholders? May 15, 2007 Dividends Payable Cash 130,000 130,000 c) If the Preferred Stock is Cumulative, what portion of the dividend distribution would go to the Preferred Stockholders? What remaining portion will go to Common Stockholders? Cumulative Preferred Stock - $40,000 + $40,000 = $80,000 Common Stockholders $50,000 d) If the Preferred Stock is Non-Cumulative, what portion of the dividend distribution would go to the Preferred Stockholders? What remaining portion will go to Common Stockholders? Non-Cumulative Preferred Stock - $40,000 Common Stockholders $90,000 3. Padilla Inc. issued 5,000 shares of stock at a market price of $36 per share. The Corporate Charter for Padilla Inc. requires a PAR value of $1 per share. Prepare the journal entry to record this sale of stock for Padilla Inc. Cash 4. $180,000 Common Stock Paid In Capital in Excess of Par $ 5,000 $175,000 a) On February 12, 2007, Berry Inc. purchased [reacquired] 5,000 shares of its $10 par value common stock outstanding, paying $25 per share. Prepare the journal entry to record this purchase of Treasury Stock. Treasury Stock $125,000 Cash $125,000 b) On May 20, 2007, Berry Inc. reissued [sold] 1,000 shares of the Treasury Stock that was acquired on February 12, 2007. The Treasury shares were sold at $35 per share. Prepare the journal entry to record this reissue [sale] of the Treasury stock. Cash $35,000 Treasury Stock Paid in Capital in Excess 25,000 10,000 c) On May 20, 2007, Berry Inc. reissued [sold] 1,000 shares of the Treasury Stock that was acquired on February 12, 2007. The Treasury shares were sold at $20 per share. Prepare the journal entry to record this reissue [sale] of the Treasury stock. Cash 20,000 Retained Earnings 5,000 Treasury Stock 5. 25,000 Pearce Inc. reported total Stockholders’ Equity at 12/31/2008 of $406,000. During 2009, Pearce Inc. reported Net Income of $48,000. Also during 2009, Pearce Inc. declared and paid Cash Dividends to stockholders of $50,000, and they issued additional Common Stock during 2009 of $30,000. Based on this information, what would be the balance of Stockholders’ Equity for Pearce Inc. at 12/31/2009? Stockholders’ Equity Beginning Balance Net Income Cash Dividends Common Stock Stockholders’ Equity Ending Balance $406,000 $ 48,000 $( 50,000) $ 30,000 $434,000