ch13-solutions13

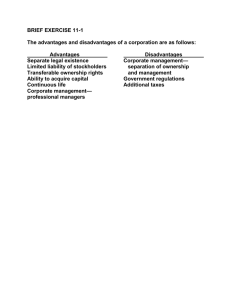

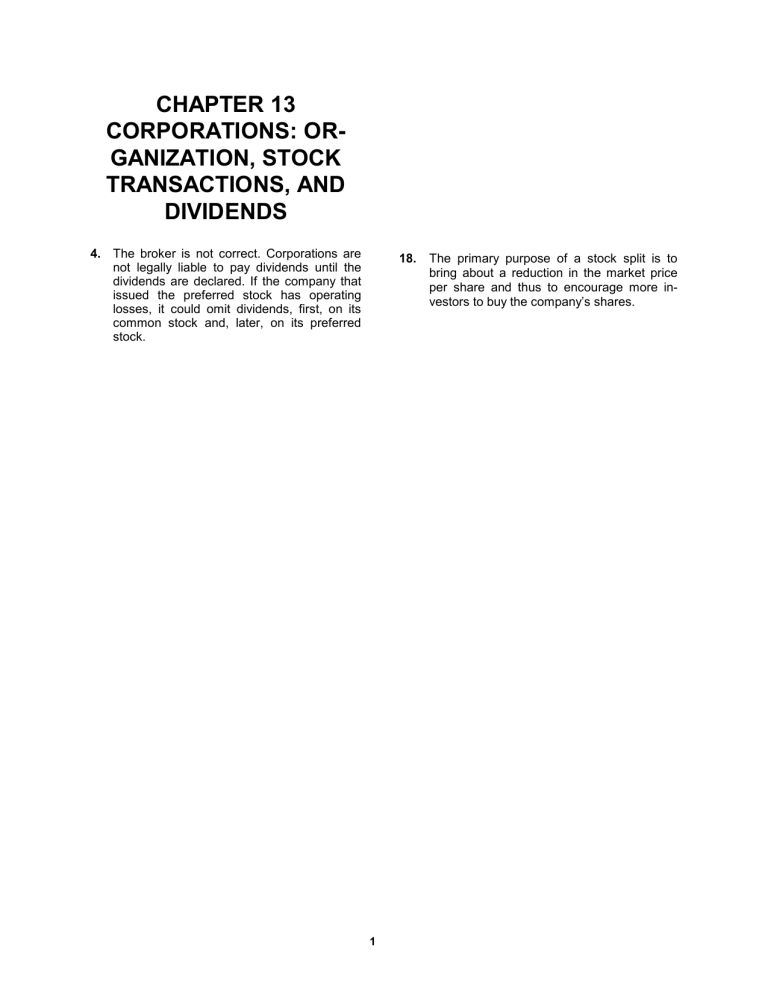

CHAPTER 13

CORPORATIONS: OR-

GANIZATION, STOCK

TRANSACTIONS, AND

DIVIDENDS

4. The broker is not correct. Corporations are not legally liable to pay dividends until the dividends are declared. If the company that issued the preferred stock has operating losses, it could omit dividends, first, on its common stock and, later, on its preferred stock.

18.

The primary purpose of a stock split is to bring about a reduction in the market price per share and thus to encourage more investors to buy the company ’s shares.

1

PRACTICE EXERCISES

PE 13 –1A

Amount distributed ..............................

Preferred dividend (5,000 shares) .......

Common dividend (10,000 shares) .....

*(3,000 + 8,000)

Year 1

$

$

15,000 $

8,000

7,000 $

Dividends per share:

Preferred stock ............................. $1.60

Common stock ............................. $0.70

Year 2

$1.00

None

5,000 $ 62,000

5,000 11,000*

0 $ 51,000

Year 3

$2.20

$5.10

PE 13 –2A

July 3 Cash .....................................................................

Common Stock ..............................................

(450,000 shares × $2.50).

Sept. 1 Cash .....................................................................

Preferred Stock ..............................................

(10,000 shares

× $25).

Oct. 30 Cash .....................................................................

Preferred Stock ..............................................

Paid-In Capital in Excess of Par ...................

*(7,500 shares

× $5)

1,125,000

1,125,000

250,000

250,000

225,000

187,500

37,500*

2

PE 13 –3A

Oct. 6 Cash Dividends ...................................................

Cash Dividends Payable ...............................

Nov. 5 No entry required.

Dec. 5 Cash Dividends Payable ....................................

Cash ................................................................

PE 13 –4A

May 10 Stock Dividends (100,000

× 2% × $48) ..............

Stock Dividends Distributable (2,000 × $40)

Paid-In Capital in Excess of Par —

Common Stock ($96,000 – $80,000) .............

June 9 No entry required.

Aug. 1 Stock Dividends Distributable ...........................

Common Stock ..............................................

PE 13 –5A

Oct. 3 Treasury Stock (10,000 × $9) .............................

Cash ................................................................

Nov. 15 Cash (6,800 × $12) ..............................................

Treasury Stock (6,800 × $9) ..........................

Paid-In Capital from Sale of

Treasury Stock [6,800

× ($12 – $9)] ..............

Dec. 22 Cash (3,200

× $7) ................................................

Paid-In Capital from Sale of

Treasury Stock [3,200 × ($9 – $7)] .....................

Treasury Stock (3,200 × $9) ..........................

112,750

112,750

112,750

112,750

96,000

80,000

16,000

80,000

80,000

90,000

81,600

90,000

61,200

22,400

20,400

6,400

28,800

3

PE 13 –6A

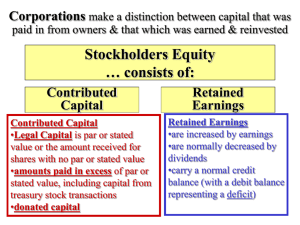

Stockholders ’ Equity

Paid-in capital:

Common stock, $75 par (70,000 shares authorized, 63,000 shares issued) .................

Excess of issue price over par ............................

5,404,000

From sale of treasury stock .................................

Total paid-in capital .........................................

Retained earnings ......................................................

Total .......................................................................

Deduct treasury stock (7,500 shares at cost) ..........

Total stockholders ’ equity .........................................

$ 4,725,000

679,000 $

25,200

$ 5,429,200

2,032,800

$ 7,462,000

588,000

$ 6,874,000

PE 13 –7A

HORNBLOWER CRUISES INC.

Retained Earnings Statement

For the Year Ended October 31, 2010

Retained earnings, November 1, 2009 ..............................

Net income ..........................................................................

Less dividends declared....................................................

Increase in retained earnings ...........................................

Retained earnings, October 31, 2010 ...............................

$ 1,500,000

$475,000

350,000

125,000

$ 1,625,000

4