12

Contributed Capital

Management Issues Related to

Contributed Capital

OBJECTIVE 1: Identify and explain the

management issues related to contributed

capital.

Key Ratios

• Dividends yield

• Return on equity

• Price/earnings (P/E) ratio

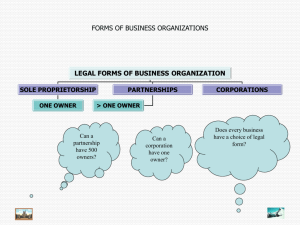

Figure 1: The Corporate Organization

Figure 2: Dividend Dates

Management Issues Related to

Contributed Capital

• A corporation is a business organization

authorized by the state and considered a

separate legal entity from its owners.

– Articles of incorporation form the company

charter.

– Share of stock is unit of ownership.

– Board of directors decide major business

policies.

Management Issues Related to

Contributed Capital

• A corporation is a business organization

authorized by the state and considered a

separate legal entity from its owners.

(cont.)

– Dividends are distributions of resources to

stockholders.

– Corporate officers are appointed by the board

of directors.

Management Issues Related to

Contributed Capital

• Advantages and disadvantages of corporate

form of business

– Advantages to the corporate form of business.

•

•

•

•

•

•

•

•

Separate legal entity

Limited liability of owners

Ease of capital generation

Ease of transfer of ownership

Lack of mutual agency

Continuous existence

Centralized authority and responsibility

Professional management

Management Issues Related to

Contributed Capital

• Advantages and disadvantages of corporate

form of business(cont.)

– Disadvantages to the corporate form of

business.

•

•

•

•

Government regulation

Double taxation

Limited liability of owners

Separation of ownership and control

Management Issues Related to

Contributed Capital

• Equity Financing

– Par value is an arbitrary amount assigned to

each share of stock; legal capital equals the

number of shares issued times the par value.

– In IPOs, stock is generally issued through an

underwriter.

Management Issues Related to

Contributed Capital

• Equity Financing(cont.)

– Start-up and organization costs consist of all

costs of forming a corporation.

– Start-up and organization costs usually are

expensed when incurred.

Management Issues Related to

Contributed Capital

• Dividend policies

– Stockholders can earn a return on their

investment in one of two ways.

• Through dividends paid by the corporation

• By selling their shares of stock for more than they

paid for them

Management Issues Related to

Contributed Capital

• Dividend policies (cont.)

– The board of directors has sole authority to

declare dividends.

• Dividend policies are usually influenced by top

management.

• Dividends are usually paid when a company has

experienced profitable operations; however, two

other considerations will affect the decision to make

dividend payments.

– The expected volatility of earnings

– The level of cash flows

Management Issues Related to

Contributed Capital

• Dividend policies (cont.)

– The board of directors has sole authority to

declare dividends. (cont.)

• Dividends can be paid quarterly, semiannually,

annually, or as decided by the board of directors.

• A liquidating dividend is the return of contributed

capital to the stockholders and is normally paid

when a company is going out of business or

reducing operations.

Management Issues Related to

Contributed Capital

• Dividend policies (cont.)

– There are three dates associated with a cash

dividend.

• Declaration date

• Record date

• Date of payment

Management Issues Related to

Contributed Capital

• Dividend policies (cont.)

– Stock sold after the date of record is sold exdividend.

Management Issues Related to

Contributed Capital

• Dividend policies (cont.)

– Common ratios

• Dividends yield

• Return on equity

• Price/earnings ratio

Management Issues Related to

Contributed Capital

• The return on equity ratio is the most

important ratio associated with

stockholders’ equity.

– The return on equity ratio is affected by the

following:

• The amount of net income the company earns

• The company’s level of average stockholders’

equity

Management Issues Related to

Contributed Capital

• The return on equity ratio is the most

important ratio associated with

stockholders’ equity. (cont.)

– Stockholders’ equity is affected by

management decisions.

• How much stock a company sells to the public

• How many shares the company buys back on the

open market (reducing the number of shares held by

the public), known as treasury stock

Management Issues Related to

Contributed Capital

• A stock option plan gives corporate

employees the right to purchase stock in a

certain quantity and at a certain price.

– Most plans are intended to compensate

employees (usually management).

– The amount of compensation equals the market

price on the date the option is granted minus

the option price.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

Components of Stockholders’ Equity

OBJECTIVE 2: Identify the components of

stockholders’ equity.

Exhibit 1: Stockholders’ Equity Section of

a Balance Sheet

Figure 3: Relationship of Authorized Shares to

Unissued, Issued, Outstanding, and Treasury

Shares

Components of Stockholders’ Equity

• Stockholders’ equity is composed of

contributed capital and retained earnings.

• When only one type of stock is issued, it is

called common stock.

• The second kind of stock a company can

issue is preferred stock.

Components of Stockholders’ Equity

• Authorized shares are the maximum

number of shares the corporation is allowed

to issue according to its state charter.

• Issued shares represent the number of

shares sold or otherwise transferred to

stockholders.

• Outstanding shares are shares that have

been issued and are still held by

stockholders.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

Preferred Stock

OBJECTIVE 3: Identify the characteristics of

preferred stock.

Preferred Stock

• Holders of preferred stock are given

preference over common shareholders

when dividends (and liquidating dividends)

are declared; that is, the holders of

preferred shares must receive a certain

amount of dividends before the holders of

common shares can receive dividends.

– This dividend is a specific dollar amount or

percentage of par value.

Preferred Stock

• Holders of preferred stock... (cont.)

– Preferred stockholders receive their dividends

before common stockholders receive anything.

– Once preferred stockholders have received the

annual dividends to which they are entitled,

however, common stockholders generally

receive the remainder.

Preferred Stock

• Dividends in arrears are unpaid “back

dividends” on cumulative preferred stock.

• When a dividend is declared by the board

of directors, Cash Dividends Declared is

debited and Cash Dividends Payable is

credited.

Preferred Stock

• Convertible preferred stock can be

exchanged for common stock at a

predetermined ratio.

• Callable preferred stock can be redeemed

or retired at the option of the issuing

corporation.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

Issuance of Common Stock

OBJECTIVE 4: Account for the issuance of

stock for cash and other assets.

Issuance of Common Stock

• Common and preferred stock may or may

not have a par value.

– Par value is the legal value established for a

share of stock.

Issuance of Common Stock

• No-par stock may be issued with or without

a stated value.

– The total stated value is recorded in the Capital

Stock account. Any amount received in excess

of the stated value is recorded as Additional

Paid-in Capital.

– If no stated value is set, however, the entire

amount received constitutes legal capital and is

credited to Capital Stock.

Issuance of Common Stock

Issuance of Common Stock

• When stock is issued in exchange for assets

or for services rendered, the stock should

be recorded at the fair market value of the

assets or services, unless the fair market

value of the stock is more easily

determined.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.

Accounting for Treasury Stock

OBJECTIVE 5: Account for treasury stock.

Accounting for Treasury Stock

• Treasury stock is issued stock that the

issuing corporation has reacquired for any

of the following reasons:

– To use for stock option plans

– To maintain a favorable market for the

company’s stock

– To increase earnings per share

Accounting for Treasury Stock

• Treasury stock is issued stock that the

issuing corporation has reacquired for any

of the following reasons: (cont.)

– To use to purchase other companies

– To prevent a hostile takeover of the company

Accounting for Treasury Stock

• Treasury stock is the last item (a deduction)

in the stockholders’ equity section of the

balance sheet.

– Treasury stock appears on the balance sheet as

the last item in the stockholders’ equity section,

as a deduction.

Accounting for Treasury Stock

• Treasury stock is the last item (a deduction)

in the stockholders’ equity section of the

balance sheet. (cont.)

– Reissuance of treasury stock (at cost, above

cost, and below cost).

• When cash received from reissuance exceeds the

cost, the difference is credited to Paid-in Capital,

Treasury Stock.

• When cash received from reissuance is less than the

cost, Paid-in Capital, Treasury Stock (and Retained

Earnings, if needed) is debited for the difference.

• In no instance should a gain or loss account be

established.

Accounting for Treasury Stock

• Treasury stock is the last item (a deduction)

in the stockholders’ equity section of the

balance sheet. (cont.)

– Gains and losses are not recognized on treasury

stock transactions.

Accounting for Treasury Stock

• When stock is retired, all the contributed

capital associated with it must be removed

from the accounts.

– When less was paid on reacquisition than was

contributed originally, the difference is credited

to Paid-in Capital, Retirement of Stock.

– When more is paid, the difference is debited to

Retained Earnings.

Accounting for Treasury Stock

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicate, or posted to a publicly accessible website, in whole or in part.