Document

advertisement

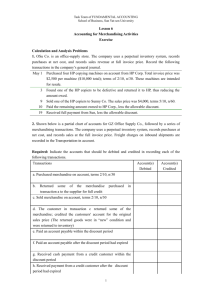

PASS Homework Assignment (Chapter 5) Problem 6-5B (Sales and Purchases Transactions) The following were selected from among the transactions completed by Girder Company during November of the current year: Nov. 3. Purchased merchandise on account from Whiting Co., list price $25,000, trade discount 20%, terms FOB destination, 2/10, n/30. 4. Sold merchandise for cash, $7,100. The cost of the merchandise sold was $4,150. 5. Purchased merchandise on account from Alamosa Co., $10,500, terms FOB shipping point, 2/10, n/30, with prepaid transportation costs of $300 added to the invoice. 6. Returned $5,000 of merchandise purchased on November 3 from Whiting Co. 11. Sold merchandise on account to Bowles Co., list price $2,250, trade discount 20%, terms 1/10, n/30. The cost of the merch_ndise sold was $1,050. 13. Paid Whiting Co. on account for purchase of November 3, less return of November 6 and discount. 14. Sold merchandise on non-bank credit cards and reported accounts to the card company, American Express, $9,850. The cost of the merchandise sold was $5,900. 15. Paid Alamosa Co. on account for purchase of November 5, less discount. 21. Received cash on account from sale of November 11 to Bowles Co., less discount. 24. Sold merchandise on account to Kapinos Co., $4,200, terms 1/10, n/30. The cost of the merchandise sold was $1,850. 28. Received cash from American Express for non-bank credit card sales of November 14, less $440 service fee. 30. Received merchandise returned by Kapinos Co. from sale on November 24, $1,100. The cost of the returned merchandise was $600. Instructions: 1. The beginning balances for this problem have been pre-loaded in the PASS system. 2. Journalize the adjusting entries in the PASS General Journal. 3. As you work the assigned computer problem, using the General Ledger Software, the specific instructions for this problem will be found by clicking on the "Browser" toolbar button. 4. Save your completed problem on a CD or flash drive to turn it in for grading on the specified due date.