Chapter 5 - Accounting

advertisement

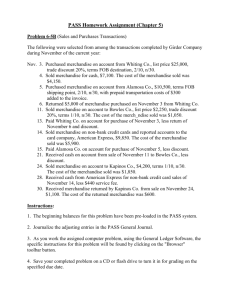

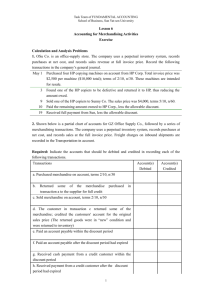

Chapter 5 Exercises Accounting for Merchandising Operations Merchandising Transactions • In-Class Exercises: Exercise No. 5-1 Page 211 Merchandise purchases Merchandise Purchases Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Blue Company under the following terms: $3,600 price, invoice dated April 2, credit terms of 2/15,n/60, and FOB shipping point. 3 Paid $200 for shipping charges on the April 2 purchase. 4 Returned to Blue Company unacceptable merchandise that had an invoice price of $600. 17 Sent a check to Blue Company for the April 2 purchase, net of the discount and the returned merchandise. 18 Purchased merchandise from Fox Corp. under the following terms: $7,500 price, invoice dated April 18, credit terms of 2/10,n/30, and FOB destination. 21 After negotiations, received from Fox a $2,100 allowance on the April 18 purchase. 28 Sent check to Fox paying for the April 18 purchase, net of the discount and allowance. Merchandise Purchases Merchandise Purchases Discount ($3,000 x 2% = $60) Merchandise Purchases End of Exercise Seller Transactions Exercise No. 5-2 Page 211 Seller transactions only Seller Transactions Taos Company purchased merchandise for resale from Tuscon Company with an invoice price of $22,000 and credit terms of 3/10, n/60. The merchandise had cost Tuscon $15,000. Taos paid within the discount period. Assume that Tuscon uses a perpetual inventory System. Prepare entries that the seller (Tuscon) should record for: a. The sale. b. The cash collection. Seller Transactions Discount ($22,000 x 3% = $660) Seller Transactions Seller Transactions End of Exercise