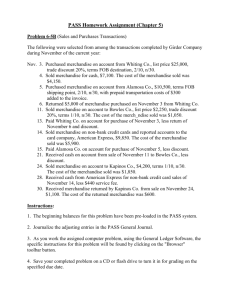

Chapter 5 - SimpleEdu.org

advertisement

Accounting I Homework Chapter 5 Name:_______________________ Date:________________________ Exercise 5.1 During the current year, merchandise is sold for $850,000. The cost of the goods sold is $650,000. Required: 1. 2. 3. What is the amount of the gross profit? Compute the gross profit percentage (gross profit divided by sales). Will the income statement necessarily report a net income? Explain. Exercise 5.2 The following transactions are from a Merchandising Company: a. Sold merchandise for cash, $12,000. The Cost of Goods Sold (COGS) was $9,100. b. Sold merchandise on account, $5,000. The Cost of Goods Sold (COGS) was $4,000. c. Sold merchandise to customers who used a credit card, $30,750. The Cost of Goods Sold (COGS) was $20,000. d. Sold merchandise to customers who used a credit card, $17,000. The Cost of Goods Sold (COGS) was $10,500. e. Received an invoice from National Credit Co. for $2,900, representing a service fee paid for processing MasterCard, VISA, and American Express sales. Required: 1. 2. In General Journal form record the above transactions. Just based on the above transactions, what is the companies Gross Profit? Exercise 5.3 A sale of merchandise on account for $12,000 is subject to a 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received? (b) What is the amount of the sale? (c) What is the amount debited to Accounts Receivable? (d) What is the title of the account for Sales Tax? Required: 1. Answer the above questions (a) through (d). Exercise 5.4 The Biddle Company has the following transaction: a. Purchased $18,500 of merchandise from Harbin Co. on account, terms 2/10, n/30. b. Paid the amount owed on the invoice within the discount period. c. Discovered that $4,000 of the merchandise was defective and returned items, receiving credit. d. Purchased $6,000 of merchandise from Harbin Co. on account, terms n/30. e. Harbin received a check for the balance owed from the return in (c), after deducting for the purchase in (d). Required: 1. Record transactions (a) through (e) in General Journal form. Exercise 5.5 Poshy Company a furniture wholesaler sells merchandise to Pushy Co. on account, $14,000, terms 2/10, n/30. The Cost of Goods Sold is $8,000. Poshy Company issues a credit memorandum for $3,050 for merchandise returned and subsequently receives the amount due within the discount period. The Cost of Goods Sold on the returned items is $2,000. Journalize Sellers Co.’s entries for (a) the sale, including the Cost Goods Sold, (b) the credit memorandum, including the cost of the returned merchandise, and (c) the receipt of the check for the amount due from Pushy Co. Required: 1. Record the following transaction between Poshy and Pushy in General Journal form. 2. Record both for the buyer and seller. Problem 5.1 The following selected transactions are for Semester Company, which sells school supplies primarily to wholesalers and sometimes to retail customers. December – 2. Sold merchandise on account to Brown Co., $10,000, terms FOB destination, 1/10, n/30. The Cost of Goods Sold was $5,500. 3. Sold merchandise for $12,000 plus 10% sales tax to cash customers. The Cost of Goods Sold was $8,000. 4. Sold merchandise on account to Green Co., $5,500, terms FOB shipping point, n/eom. The Cost of Goods Sold was $4,100. 5. Sold merchandise for $8,000 plus 10% sales tax to customers who used a credit card. The Cost of Goods Sold was $6,000. 12. Received check for amount due from Brown Co. for sale on December 2. 14. Sold merchandise to customers who used American Express cards, $11,000. The Cost of Goods Sold was $5,200. 16. Sold merchandise on account to Pink Co., $12,000, terms FOB shipping point, 1/10, n/30. The Cost of Goods Sold was $7,200. Dec. 18. Issued credit memorandum for $3,000 to Pink Co. for merchandise returned from sale on December 16. The cost of the goods returned was $1,500. 19. Sold merchandise on account to Orange Co., $14,950, terms FOB shipping point, 2/10, n/30. Added $600 to the invoice for transportation costs prepaid. The Cost of Goods Sold was $9,500. 26. Received check for amount due from Pink Co. for sale on December 16 less credit memorandum of December 18 and discount. 28. Received check for amount due from Orange Co. for sale of December 19. 31. Received check for amount due from Green Co. for sale of December 4. 31. Paid Delivery Service $2,100 for merchandise delivered during December to customers under shipping terms of FOB destination. January – 3. Paid My Bank $1,130 for service fees for handling MasterCard and American Express sales during December. 15. Paid $1,600 to state sales tax division for taxes owed on sales. Required: 1. On an 8 ½ x 11 piece of paper draw a line down the middle of the page. 2. On the left side put the buyer and the right side put the seller. 3. Record transactions for both the buyer and seller; use the date of each transaction to ensure you have recorded both simultaneously. Accounting I Written Assignment The following transactions are from Alpha Company for the month of March 2015. March -3. Purchased merchandise on account from Baskin Co., $3,980, terms FOB shipping point, 2/10, n/30, with prepaid transportation costs of $250 added to the invoice. 5. Purchased merchandise on account from SingSing Co., $6,500, terms FOB destination, 1/10, n/30. 6. Sold merchandise on account to ButterField Co., $5,000, terms 2/10, n/30. The Cost of Goods Sold was $2,500. 8. Purchased office supplies for cash, $1500. 10. Returned merchandise purchased on March 5 from SingSing Co., $3,300. 13. Paid Baskin Co. on account for purchase of March 3, less discount. 14. Purchased merchandise for cash, $3,500. 15. Paid SingSing Co. on account for purchase of March 5, less return of March 10 and discount. 16. Received cash on account from sale of March 6 to ButterField Co., less discount. 19. Sold merchandise-accepting credit cards, $4,450. The Cost of Goods Sold was $1,980. 22. Sold merchandise on account to Sick Co., $3,400, terms 2/10, n/30. The Cost of Goods Sold was $1,700. 24. Sold merchandise for cash, $4,350. The Cost of Goods Sold was $1,750. 25. Received merchandise returned by Sick Co. from sale on March 22, $1,480. The Cost of Goods Sold was $600. 31. Paid a bank fee of $440 for MasterCard sales. Required: 1. Record the above transactions using General Journal form for Alpha Company. 2. Prepare an Income Statement for the month of March 2015. 3. Use 30% of Gross Sales as the estimate for expenses.