Operating Expenses - Cost of Merchandise Sold

advertisement

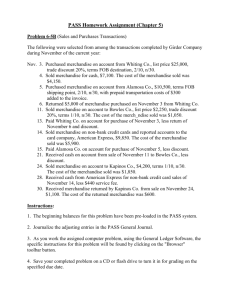

5 Day – Chapter 6 Survival Guide There are 23 Excercises that Each Student Must Master in this Note Packet Pg. 254 I. Students must know how the income statement is different for a Service Business and a Merchandising Business. Service Business Merchandising Business Fees Earned - Operating Expenses = Net Income(Loss) Sales - Cost of Merchandise Sold = Gross Profit - Operating Expenses = Net Income(Loss) *Note: with a Merchandising business, they must first purchase the material that they will ultimately sell to the final customer. The cost to buy the merchandise from the manufacturer or wholesaler is referred to as COMS (Cost of Merchandise Sold). **Important: What’s the difference between Gross Sales & Net Sales? Answer: Gross Sales represents the total sales of the merchandiser while Net Sales is the final sales that the company had. The two differ because Net Sales pulls out those sales that were returned to the store by the customer. Net Sales also pulls out any Sales Discounts that were given by the company. Practice: (4 Exercises) (Remember: All answers are on Edmodo) 1. PE 6-1A & PE 6-1B (Determining Gross Profit) 2. EX 6-1 (Determining Gross Profit) 3. EX 6-2 (Determing COMS) 4. EX 6-3 (Income Statement for Merchandiser) Pg. 255 I. The Operating Cycle a. Step 1 – Purchase the merchandise from the manufacturer b. Step 2 – Sell the merchandise to your customers (most customers buy on credit) c. Step 3 – Complete the collection activities once the customer pays for the merchandise. II. Operating Cycles are longer for products that have a high markup such as Jewelry (30%-50% Markup). In other words, the average time that a diamond rings sits at a jewelers is longer than the time that a bottle of Coke sits on the shelf at Publix. Products that fly off of the shelves have a shorter Operating Cycle and a smaller markup (1%-5% Markup). III. Multi-Step Income Statement A multi-step income statement is one that solves from Gross Profit first by subtracting COMS from Net Sales. Then, the Operating Expenses are subtracted to determine the company’s Operating Income. Finally, Other Revenues & Other Expenses are removed from Operating Income to arrive at the Net Income(Loss). Pg. 256 I. To determine Net Sales, you must: Start with Gross Sales then subtract the Contra Revue Accounts II. III. IV. Gross Sales -Sales Returns & Allowances -Sales Discounts Net Sales Sales Returns & Allowances = the products that were purchased by customers and then returned for whatever reason (i.e. – they decided that they didn’t want them, they were missing parts or broken, etc.) Sales Discounts = the discount that the store gave to the customer if they pay their bill before the expiration of the credit terms. Sales Discount Example: Johnny received the credit terms of 2/10 n30 on a $1000 purchase from Best Buy. This means that Johnny will receive a 2% discount ($20) if he pays within 10 days of the purchase. If he doesn’t pay his bill in the first 10 days, then the entire $1000 balance is due in 30 days. Companies offer Sales Discounts to encourage their customers to pay early because “A Dollar Today is Worth More Than A Dollar Tomorrow.” Pg. 257 I. Cost of Merchandise Sold (COMS) a. There are 2 ways to determine COMS i. The Periodic Inventory System (we will discuss this in a later chapter) – this system doesn’t calculate COMS until the end of the fiscal period when the company takes a physical hard count of their inventory and then compares it to their accounting records to determine how much was sold and what the COMS was. ii. The Perpetual Inventory System (the focal point of this chapter) – with computer systems today, most companies use the Perpetual System, whereby the amount of inventory and COMS is automatically updated by the computer every time a transaction takes place. II. Income from Operations – sometimes called Operating Income, is determined by subtracting Operating Expenses from Gross Profit. Gross Profit – Operating Expenses = Operating Income a. Operating Expenses can be broken down into 2 types: i. Selling Expenses – those expenses directly incurred in the process of selling the company’s products. Examples include Sales Salaries, Store Supplies Used, Depreciation of Store Equipment, Delivery Expense, and Advertising Expense. ii. Administrative Expenses – aka General Expenses, are incurred in the administration or general operations of the business. Examples include: Office Salaries, Depreciation of Equipment, and Office Supplies used. iii. Pg. 258-259 I. Other Income (Gains) and Expenses (Losses) – Companies often receive additional income that is not directly related to their main core business. For example, Duncan Donuts’ main revenue comes from selling donuts, coffee, bagels, etc. However, if the owner of a Duncan Donuts restaurant owns the shopping center that his store is located in, he is receiving rental income from the other tenants that are leasing space in the shopping center. This Other Income would be added at the bottom of Duncan Donuts’ Income Statement. Furthermore, if the company sold a fixed asset for a gain (its sales price was greater than its book value), this would be a gain reported at the bottom of the Income Statement. When it comes to Other Expenses, these are expenses that cannot be directly traced to the normal operations of the donut company. Such expenses might include the loss received from selling an oven (a fixed asset). II. Single Step Income Statement Differs from the Multi-Step Income Statement in that Gross Profit and Operating Income are not calculated. Instead, ALL revenues are listed at the top of the Income Statement and totaled. Then, ALL expenses are listed immediately below and subtracted in order to determine the company’s Net Income(Loss). Practice: (4 Exercises) 1. EX 6-4 2. EX 6-5 3. EX 6-6 4. EX 6-8 *USE THE TEMPLATE PROVIDED ON EDMODO Pg. 260 MERCHANDING TRANSACTIONS I. Chart of Accounts a. Differs from the Chart of Accounts for a Service Company because there are now 3 digits for a Merchandising Company. i. 1st Digit – indicates the major classification of the account (1 – Assets, 2- Liabilities, 3-Equity, 4-Revenues, 5-Expenses) ii. 2nd Digit – indicates the sub-classication of the account (1- Current Asset, 2- Long-term Asset). iii. 3rd Digit – indicates the specific account (110 – Cash, 111 – Accounts Receivable, 121 Equipment). Pg. 261-265 Sales Transactions Example A: Cash Sale NetSolutions sells merchandise for $1800 for cash. The merchandise originally cost NetSolutions $1200. This transaction involves 2 entries into the General Journal. Entry 1 – NetSolutions records the sale by: Cash Sales Sold Merchandise for Cash 1800 1800 *Note: Sales is credited by a Merchandising Company instead of Fees Earned. Fees Earned is only used by a Service Company. Entry 2 – NetSolutions now must remove the merchandise from its Merchandise Inventory account and record this amount as an expense to Cost of Merchandise Sold. Cost of Merchandise Sold 1200 Merchandise Inventory 1200 To Record the COMS Example B: Credit Sale using a Bank Card (i.e. – Visa & Master Card) *When a customer uses a Bank Card, the company treats the transaction just as if it were a cash transaction because the company will be paid with a few days by the clearing-house that processes the transaction for both the company and the bank that the credit card was issued on. Even though American Express is not a bank card, the process works the same, with the clearing-house processing the transaction for the both the company & AMEX. Entry 1 Cash Sales 1800 1800 Sold Merchandise for Cash Entry 2 Cost of Merchandise Sold Merchandise Inventory To Record the COMS 1200 1200 The only difference is that Visa, Mastercard & AMEX all charge a very small convenience fee to the company. The company does not receive the full amount of the sale due to this fee. The fees are based on a per transaction basis and are paid periodically during each month. For example, suppose NetSolutions Credit Card fees for the month are $48. At the the month, NetSolutions would record the following journal entry. Entry 3 Credit Card Expense 48 Cash Service charges on Credit Card Sales 48 Example C: Credit Sale using a Store Charge Card NetSolutions sells merchandise for $1800 on account to Bill Daniel. The merchandise originally cost NetSolutions $1200. This transaction involves 2 entries into the General Journal. Entry 1 – NetSolutions records the sale by: Accounts Receivable/Bill Daniel Sales Sold Merchandise on Account 1800 1800 *The only difference is now the Accounts Receivable controlling account & corresponding A.R. Subsidiary Account are now debited. Entry 2 – NetSolutions now must remove the merchandise from its Merchandise Inventory account and record this amount as an expense to Cost of Merchandise Sold. Cost of Merchandise Sold 1200 Merchandise Inventory 1200 To Record the COMS Entry 3 – The customer pays his bill at a later time. Cash 1800 Accounts Receivable/Bill Daniel Received payment on account 1800 Example D: Credit Sale using a Store Charge Card & the Customer takes the Sales Discount NetSolutions sells merchandise for $1800 on account to Bill Daniel and offers him Credit Terms of 2/10 n30. The merchandise originally cost NetSolutions $1200. This transaction initially involves the same 2 entries into the General Journal as in Example C above. Entry 1 – NetSolutions records the sale by: Accounts Receivable/Bill Daniel Sales Sold Merchandise on Account 1800 1800 *The only difference is now the Accounts Receivable controlling account & corresponding A.R. Subsidiary Account are now debited. Entry 2 – NetSolutions now must remove the merchandise from its Merchandise Inventory account and record this amount as an expense to Cost of Merchandise Sold. Cost of Merchandise Sold 1200 Merchandise Inventory 1200 To Record the COMS However, if the customer (Bill Daniel) decides to take NetSolutions up on their Sales Discount when paying his liability, the journal entry will look very different from the one presented in that last transaction. To illustrate this, the Sales Discount of 2% must be calculated. 2% of $1800 = $36. This means that if Bill Daniel pays is liability before the end of 10 days, he’ll receive a $36 Sales Discount. The journal entry would then look like: Cash Sales Discount Accounts Receivable/Bill Daniel Received Payment on Account 1764 36 1800 Whenever a customer takes a Sales Discount, the Sales account is NEVER decreased with a debit. Instead, the Contra Revenue account Sales Discounts is debited. The same goes for when a customer buys something and then returns either all or a portion of what was purchased. Instead of reducing the Sales account with a debit, the Contra Revenue account Sales Returns & Allowances is debited. A CREDIT MEMO IS ISSUED BY THE STORE WHEN THERE IS A RETURN. THE CREDIT MEMO AUTHORIZES A CREDIT TO THE CUSTOMER’S ACCOUNTS RECEIVABLE. Example E: The customer buys $2000 on account using a store charge card. The merchandise originally cost NetSolutions $1000. The customer then returned $500 of the merchandise. The returned merchandise originally cost NetSolutions $250. Entry 1 – NetSolutions records the original sale. Accounts Receivable/John Thompson 2000 Sales Sold Merchandise on Account 2000 Entry 2 – NetSolutions now must remove the merchandise from its Merchandise Inventory account and record this amount as an expense to Cost of Merchandise Sold. Cost of Merchandise Sold 1000 Merchandise Inventory 1000 To record the COMS Entry 3 – NetSolutions must record a journal entry when the customer returns some of the merchandise. Sales Returns & Allowances 500 Accounts Receivable/John Thompson 500 Merchandise Returned Entry 4 – NetSolutions must increase their inventory and reduce their COMS since the merchandise was returned. Merchandise Inventory 250 Cost of Merchandise Sold 250 Merchandise Returned Practice: (4 Exercises) 1. PE 6-2A 2. PE 6-2B 3. EX 6-10 4. EX 6-11 Pg. 266-270 PURCHASE TRANSACTIONS Example A: Under a Perpetual Inventory System, cash purchases of merchandise are recorded as: Merchandise Inventory 2500 Cash 2500 Purchased Merchandise from Bowen Co. Example B: Under a Perpetual Inventory System, purchases of merchandise on account are recorded as: Merchandise Inventory 2500 Accounts Payable/Bowen Co. 2500 Purchased Merchandise on Account PURCHASE DISCOUNTS The buyer may receive a discount from the seller if they pay their bill off early. This transaction is the opposite of a Sales Discount. The seller records a Sales Discount when the customer pays his/her bill early. The buyer records a Purchase Discount in their General Journal. To analyze how both sides of the transaction would be recorded, please sell the example below. Scenario: General Store Incorporate buys $1400 of food items on account from Frito Lay. Frito Lay offers credit terms of 1/5 n/30. General Store Merchandise Inventory 1400 Accounts Pay/Frito Lay 1400 Bought Merch. On Account Frito Lay Accounts Rec./General Store Sales Sold Merch. On Account COMS Merchandise Inventory Sold Merch. On Account 1400 1400 600 600 When General Store pays their bill off early, here’s what it would look like for both companies. General Store Frito Lay Accounts Pay/Frito Lay 1400 Cash 1386 Cash 1386 Sales Discount 14 Merchandise Inventory 14 Accounts Rec./General Store 1400 Paid for Merch. On Account Customer Paid on Account PURCHASE RETURNS & ALLOWANCES Suppose that General Store decided that it was going to return $200 of the $1400 purchase made in previous example. A DEBIT MEMO WOULD BE ISSUED BY THE BUYER (GENERAL STORE) TO THE SELLER (FRIT0 LAY), INFORMING THE SELLER OF THE AMOUNT THE BUYER PROPOSES TO DEBIT TO THE LIABILITY DUE TO THE SELLER. The transaction would look like: General Store Accounts Pay/Frito Lay Merch. Inventory Returned Merch. 200 200 Frito Lay Sales Returns & Allowances 200 Accounts Rec./General Store Customer Returned Merch. 200 FREIGHT Freight charges (the cost of delivery of the merchandise) may either by the buyer (FOB SHIPPING POINT) or buy the seller (FOB DESTINATION). Example 1: Best Buy buys $90,000 of computers on account from Dell Computer Inc. Best Buy agrees to pay $300 for shipping (FOB Shipping Point) charges. The COMS for Dell was $40,000. Best Buy’s journal entry to record to the purchase of inventory would be: Merchandise Inventory 90000 Accounts Payable/Dell Computer Computers purchased on account 90000 Best Buy’s journal entry to record the shipping charges would be: Merchandise Inventory Cash Delivery charges 300 300 Dell Computer’s journal entry would be: Accounts Receivable/Best Buy Sales Merchandise sold on account 90000 Cost of Merchandise Sold 40000 Merchandise Inventory Merchandise sold on account 90000 40000 Example 2: Best Buy buys $90,000 of computers on account from Dell Computer Inc. Dell Computer Inc. agrees to pay the $300 shipping costs (FOB Destination). The COMS for Dell was $40,000. Best Buy’s journal entry to record to the purchase of inventory would be: Merchandise Inventory 90000 Accounts Payable/Dell Computer Computers purchased on account 90000 Dell Computer’s journal entry would be: Accounts Receivable/Best Buy Sales Merchandise sold on account 90000 90000 Cost of Merchandise Sold 40000 Merchandise Inventory Merchandise sold on account 40000 Dell Computer’s journal entry to record the shipping costs would be: Delivery Expense 300 Cash Paid shipping costs FOB Destination 300 Example 3: Best Buy buys $90,000 of computers on account from Dell Computer Inc. Best Buy agrees to pay $300 for shipping (FOB Shipping Point) charges. The COMS for Dell was $40,000. Dell agrees to pay the shipping costs up front and add it to Best Buy’s Accounts Receivable. Best Buy’s journal entry to record to the purchase of inventory would be: Merchandise Inventory 90000 Accounts Payable/Dell Computer Computers purchased on account 90000 Dell Computer’s journal entry would be: Accounts Receivable/Best Buy Sales Merchandise sold on account 90000 Cost of Merchandise Sold 40000 Merchandise Inventory Merchandise sold on account 90000 40000 Dell’s entry to show that Best Buy owes them for the shipping costs. Accounts Receivable/Best Buy 300 Cash Prepaid shipping costs on merchandise 300 271-272 SALES TAXES – All states levy a tax on the sale of merchandise. In Florida, the tax is 6% on each dollar sold. When a sale is made, the customer pays the tax and then the company is required to pay the tax on behalf of the customer to the state. Thus, when the company collects the tax from the customer, a liability to the state is created. Example: John Denver buys a $3,000 Bose system from the Bose Outlet on account. The sound system cost the Bose Outlet $1,200. The sales tax on this purchase is 6% or $180. The Bose Outlet would record the transaction as follows: Accounts Receivable/John Denver Sales Sales Tax Payable Sale on Account 3180 Cost of Merchandise Sold Merchandise Inventory Sale on Account 1200 3000 180 1200 To record the payment to the state of Florida, the Bose Outlet’s journal entry would be: Sales Tax Payable Cash Payment of State Sales Taxes Practice: (11 Exercises) 1. PE 6-3A 2. PE 6-4A 3. PE 6-5A 4. EX 6-14 5. EX 6-15 6. EX 6-18 7. EX 6-19 8. EX 6-21 9. EX 6-22 10.EX 6-23 11.EX 6-25 180 180