Lesson 6 - Sun Yat

advertisement

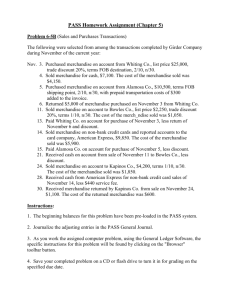

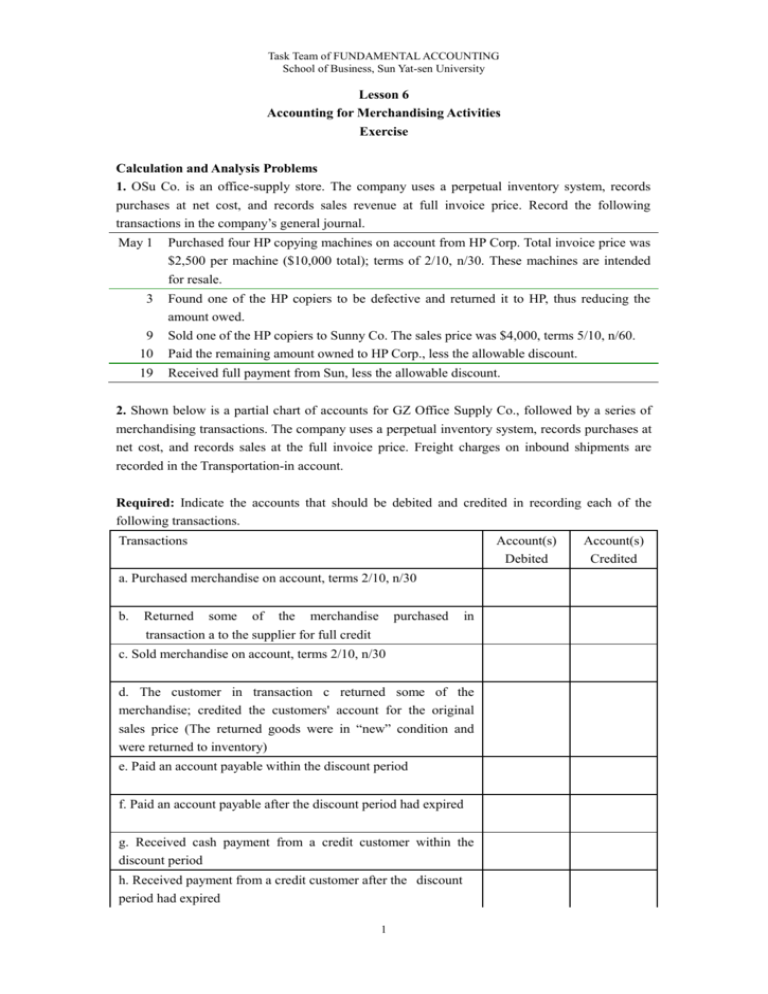

Task Team of FUNDAMENTAL ACCOUNTING School of Business, Sun Yat-sen University Lesson 6 Accounting for Merchandising Activities Exercise Calculation and Analysis Problems 1. OSu Co. is an office-supply store. The company uses a perpetual inventory system, records purchases at net cost, and records sales revenue at full invoice price. Record the following transactions in the company’s general journal. May 1 Purchased four HP copying machines on account from HP Corp. Total invoice price was $2,500 per machine ($10,000 total); terms of 2/10, n/30. These machines are intended for resale. 3 9 10 Found one of the HP copiers to be defective and returned it to HP, thus reducing the amount owed. Sold one of the HP copiers to Sunny Co. The sales price was $4,000, terms 5/10, n/60. Paid the remaining amount owned to HP Corp., less the allowable discount. 19 Received full payment from Sun, less the allowable discount. 2. Shown below is a partial chart of accounts for GZ Office Supply Co., followed by a series of merchandising transactions. The company uses a perpetual inventory system, records purchases at net cost, and records sales at the full invoice price. Freight charges on inbound shipments are recorded in the Transportation-in account. Required: Indicate the accounts that should be debited and credited in recording each of the following transactions. Transactions Account(s) Debited a. Purchased merchandise on account, terms 2/10, n/30 b. Returned some of the merchandise transaction a to the supplier for full credit purchased in c. Sold merchandise on account, terms 2/10, n/30 d. The customer in transaction c returned some of the merchandise; credited the customers' account for the original sales price (The returned goods were in “new” condition and were returned to inventory) e. Paid an account payable within the discount period f. Paid an account payable after the discount period had expired g. Received cash payment from a credit customer within the discount period h. Received payment from a credit customer after the discount period had expired 1 Account(s) Credited Task Team of FUNDAMENTAL ACCOUNTING School of Business, Sun Yat-sen University i. Paid transportation charges on an inbound shipment of merchandise from a supplier j. Paid delivery charges on a shipment of merchandise being sent to a customer k. The physical inventory taken at year-end disclosed a normal amount of inventory shrinkage l. Made an adjusting entry to record corporate Income taxes for the period. 3. Prepare journal entries to record the following perpetual system merchandising transactions of Benny Company. (Use a separate account for each receivable and payable; for example, record the purchase on August 1 in Accounts Payable—Mart Co.) May 1 Purchased merchandise from Mart Company for $30,000 under credit terms of 1/10, n/45, FOB shipping point. 2 4 16 21 Paid $360 for freight charges on the purchase of May 1 Sold merchandise to Cindy Corp. for $4,560 under credit terms of 2/10, n/60, FOB shipping point. The merchandise had cost $2,040. Purchased merchandise from Judy Corporation for $7,200 under credit terms of 2/15, n/30. FOB destination. Received a $1,440 credit memorandum for the return of defective merchandise purchased on May 6. Sold merchandise that cost $600 for $1,080 cash. Paid the balance due to Mart Co. within the discount period. Sold merchandise that cost $1,200 to Carrol Co. for $3,720 under credit terms 2/10, n/30. FOB shipping point. Received the balance due from Cindy Co. for the May 4 sale within the discount period. Paid $300 shipping charges on the May 11 sale to Carrol Co. and added the amount to their bill. Issued a $240 credit memorandum to Carrol Co. for defective merchandise. Received Carrol Co’s cash payment for the amount due from the May 11 purchase. 22 Paid Judy Co. the amount due from the May 6 purchase. 6 7 8 9 11 14 15 4. Miller Company’s adjusted trial balance on Dec 31, 2002, its fiscal year-end, follows: Debit Merchandise inventory Other assets Liabilities Miller, Capital Miller, Withdrawals Sales Sales discounts Sales returns and allowances Credit $57,000 23,4000 $78,000 107,400 21,000 457,500 6,150 22,800 2 Task Team of FUNDAMENTAL ACCOUNTING School of Business, Sun Yat-sen University Cost of goods sold Sales salaries expense Store supplies expense Delivery expense Office salaries expense Office supplies expense 155,250 48,750 17,550 18,000 57,000 5,400 Totals $642,900 $642,900 On Dec. 31, 2002, merchandise inventory amounted to $33,000. Supplementary records of merchandising activities for the year ended Dec. 31, 2002, reveal the following itemized costs: Invoice cost of merchandise purchases $180,000 Purchase discounts received 2,550 Purchase returns and allowances 4,950 Costs of transportation-in 6,750 Required (1) Compute the company’s net sales for the year. (2) Compute the company’s total cost of merchandise purchased for the year. (3) Prepare a multiple-step income statement that lists the company’s net sales, cost of goods sold, and gross profit, as well as the components and amounts of selling expenses and general and administrative expenses. (4) Prepare a single-step income statement that lists these costs: cost of goods sold, selling expenses, and general and administrative expenses. (5) Accounts receivable decreased during the period by $27,000. Compute cash received from customers. (6) Prepare closing entries under the perpetual system as of Dec. 31, 2002. (7) The company makes all purchases on credit, and its suppliers uniformly offer a 2% sales discount. Does it appear that the company’s cash management system is accomplishing the goal of taking all available discounts? Explain. (8) In prior years, the company experienced a 6% return and allowance rate on its sales, which means approximately 6% of its gross sales were eventually returned outright or caused the company to grant allowances to customers. How do this year’s results compare to prior years’ results? 3