Capital Asset Pricing Model

advertisement

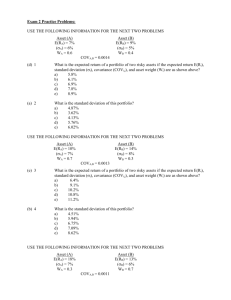

Capital Asset Pricing Model Applied covariance: Project Part 1 Review variance, covariance Variance: square the deviations and take expectation. Covariance: multiply the deviations and take expectation. Application Asset B is the market portfolio Call it asset M. Everyone prefers to hold M, in theory Asset A is any asset. Think of adding a little A to the market portfolio. Question does adding a little of asset A to the market portfolio increase the risk? Yes if 2 AM M No if AM M 2 Derivation P X A A (1 X A ) M 2 X A (1 X A ) AM 2 2 2 2 2 d 2 2 2 P 2 X A A 2(1 X A ) M dX A 2(1 X A ) AM 2 X A AM at X A 0, d 2 2 P 2 M 2 AM dX A Beta measures risk How much risk is added depends on the relation of sigma AM and sigma squared M Define beta AM A 2 M Sum of squared errors t T F (b) ( Dev A,t bDev M ,t ) 2 t 1 Minimize it F ' (b) 0 t T F ' (b) 2( Dev A,t bDevM ,t ) DevM ,t 0 t 1 t T Dev t 1 t T A,t DevM ,t bDev t 1 2 M ,t 0 Divide by T-1 t T 1 Dev A,t DevM ,t T 1 t 1 b t T 1 2 DevM ,t T 1 t 1 The estimate of Is the ratio of sample covariance over variance of the market. It’s beta, except for using sample statistics instead of population values. The story of CAPM Investors prefer higher expected return and dislike risk. All have the same information. Two (mutual) funds are sufficient to satisfy all such investors: The two funds: 1) The "risk-free" asset, i.e., Treasury Bills 2) The market portfolio consisting of all risky assets held in proportion to their market value. The market portfolio Its expected return is 8.5% over the TBill rate It bears the market risk Its beta is unity by definition. Capital asset pricing model E ( R j ) R f E[ RM R f ] j T-bill rate is known. Market premium is known, approximately 8.5%. Estimate beta as in the project Security market line It’s straight. Risk-return relation is a straight line. Why is it a straight line? Beta is the measure of risk that matters. Given beta construct a portfolio with the same beta by a mix of T-Bills (beta = 0) and the market portfolio (beta = 1) Expected return on the portfolio is on the SML. So any asset with the same beta must also be on the SML. Rate of return expected by the market E[RM] Rf beta 1 Review item Return on asset A has a std dev of .05 Return on asset B has a std dev of .07 Correlation of return on asset A with return on asset B is 1. What is the covariance of the returns? Answer: Covar = corr*stdevA*stdevB=.0035