Fundamentals of Pension Fund Investing

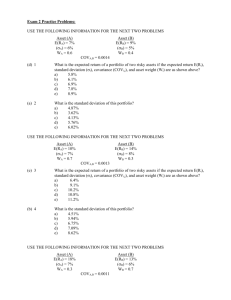

Certified Trustee Program

Bob Thompson

Senior Managing Director

Institutional Trust Services

rthompson@mbfinancial.com

847-653-2390

Paul Snyder

Senior Portfolio Manager

Institutional Investments

psnyder@mbfinancial.com

847-653-2143

Agenda

•

•

•

•

•

Terminology Outline

Plan Administration

• Prudent Investor Rule

Investment Policy Outline - (Order is important)

Asset Allocation

• Risk & Return and related measures

• Parameters & Constraints

• Portfolio Construction

Conclusion

2

Post Retirement Benefits - Two Types

Defined Contribution Plan

Employer promises to provide

participants with certain

contributions or “matching”

contributions each period.

Defined Benefit Plan

Economic Risk

falls on Employee

Employer promises to provide

participants with a certain

pension amount at retirement.

Economic Risk

falls on Employer

401k, 403b

3

Plan Administration Terminology

Source: Investopedia.com

4

Plan Investment Terminology

Term

Definition

Source: Investopedia.com

5

Prudent Investor Rule

Uniform Prudent Investor Act (UPIA) An updated trust investment law that reflects the changes that have

occurred in investment practice since the late 1960s, specifically with regard to modern portfolio theory.

The Uniform Prudent Investor Act (UPIA) made five fundamental changes to the previous Prudent Investor Act

standard. The most important change was that the standard of prudence would henceforth be applied to any

investment in the context of the total portfolio, rather than to individual investments. Another key change was the

extension of permission to the trustee to delegate investment management functions, subject to appropriate

safeguards; such delegation was expressly forbidden by the former trust law.

By taking the total portfolio approach and eliminating category restrictions on different types of investments, the

UPIA fostered a greater degree of diversification in investment portfolios. It also made it possible for trustees to

include in their investments more non-traditional asset classes such as derivatives, commodities and futures.

While these investments individually have a relatively higher degree of risk, they could potentially reduce overall

portfolio risk and boost returns when considered in a total portfolio context.

Per Illinois Statute, there are restrictions on non-traditional asset class investing.

Diversification

Asset Allocation

Lower Volatility

Source: Investopedia.com

6

Higher Return Potential

Investment Policy Statement (IPS)

•

•

What is it?

A formal document that governs the investment decision

making, taking into account objectives and constraints of

the plan.

• Must be readily implemented by current or

future investment manager.

• Must promote long term discipline for

portfolio related decisions.

• Must help protect against short term shifts in

strategy when either market environments or

portfolio performance cause panic or

overconfidence.

7

IPS – Statement of Purpose (1)

What is it?

• Brief but concise description of the plan, plan

participants, plan beneficiaries and administrative

personnel.

• Should provide enough background information so that

any competent investment manager can gain a common

understanding of the overall state of affairs.

• Should include key factual data and identify any unique

parameters and constraints.

• No one size fits all

• No formal template or boiler plate

•

8

IPS – Statement of Responsibility (2)

What is it?

• Identify all related parties with their respective duties

and responsibilities. (investment manager, custodian,

trustees)

• Identify any regulatory or statutory mandates that must

be followed.

• Determine the means by which all parties are to be

measured/monitored.

•

9

IPS – Investment Objectives & Goals (3)

What is it?

• Objectives should focus on risk and return

considerations.

• Risk objectives are associated with the plan beneficiaries’

ability and willingness to take on certain risks.

• Examples:

• Required near term funding needs (liquidity)

• Existing financial strength (under funded??)

• Time Horizon

• Stated risk tolerances (volatility of no more

than 25% in any given year)

•

10

IPS – Investment Objectives & Goals contd (3)

•

Return objectives should be realistic, flexible and

commensurate with normal market conditions.

•

Should be consistent with Risk Objectives.

•

Differentiating between nominal and “real” returns

•

Should be viewed from a “Total Return” perspective

11

IPS – Investment Objectives & Goals contd (3)

•

What is it?

•

Goals should be used to achieve a balance that satisfies

both nearer term and longer term beneficiaries.

•

Benchmark indices should be identified

•

Quantifiable measures against such indices should be

identified. (compare apples to apples)

12

IPS – Investment Guidelines (4)

•

What is it?

•

Identification of asset classes that are to be used or

forbidden in constructing a portfolio:

• Fixed Income: US Government Bills, Notes, Bonds, Agencies, Municipals,

Corporates, TIPS, CD’s ……..what is the lowest acceptable credit quality???

Equities: Domestic and International Large Caps, Mid Caps, Small Caps

• Alternatives: Real Estate, Commodities

Benchmark indices should be identified for above

Quantifiable measures against such indices should be

identified. (compare apples to apples)

•

•

•

13

IPS – Investment Performance Review & Evaluation (5)

•

What is it?

•

Goal is to obtain information from investment

manager(s) to identify actual performance (Gross & Net

of Fees)

Determine if performance was derived within the

boundaries of the Investment Guidelines

Ascertain capital market expectations

Rebalance (if necessary) to targets given market

fluctuations.

Discussion of any proposed changes in the future.

•

•

•

•

14

The Importance of Asset Allocation

•

•

Goal is to develop an investment strategy that attempts to balance risk versus reward

by adjusting the percentage of each asset class according to the unique needs of the

pension fund.

In general, adding asset classes that offer returns that are NOT perfectly correlated

can reduce the overall risk in terms of the variability of returns.

15

Risk & Return: The Basics

•

Inherent trade off between return and risk.

16

Determining Asset Allocation Policy

Growth Oriented

Income Oriented

17

Identifying Acceptable Asset Classes

•

Expected Rate of Return

• Based on historical data

•

Risk Free Rate: The theoretical rate of return of an

investment with zero risk.

• Ex: Short term Treasury Bills

•

Risk Premium: The return in excess of the risk free rate

that an investment is “expected” to yield. This is a form

of compensation for investors who are willing to tolerate

extra risk.

• Think of this as “hazard” pay (Haz Mat, SWAT etc..)

18

Identifying Acceptable Asset Classes

•

Expected Rate of Return

If Treasury bill rate = 2%

If the Risk Premium = 5.5%

Then the expected rate of return is as follows:

ER = RF + RP

?? = .02 + .055

.075 or 7.5% “Expected” return

19

Identifying Acceptable Asset Classes

Risk or Volatility

• Measured in terms of Standard Deviation

• Defined as a measure of the dispersion of a set of data from its

average or mean. The more spread apart the data, the higher the

deviation. Standard deviation is calculated as the square root of

variance.

•

20

Identifying Acceptable Asset Classes

Which asset class has more risk in terms of volatility?

21

Identifying Acceptable Asset Classes

•

•

•

•

•

•

•

Risk or Volatility contd (Beta)

A quantifiable number describing the relation of an assets

returns with those of the respective benchmark.

Beta is a useful measure used to describe the “relationship” of

returns over time.

A Beta of 1 is typically used as the respective benchmark return.

If the benchmark index has market volatility of 10%, a fund with

a beta of 1 should have the same 10% volatility.

If the benchmark index has market volatility of 10%, and your

fund moved 15%, the Beta of this fund would be 1.5.

If the benchmark index has market volatility of 10%, and your

fund moved 8%, the Beta of this fund could would be 0.8.

22

Identifying Acceptable Asset Classes

•

•

•

•

Risk or Volatility contd (Beta)

Ex: The S&P 500 returned +12% in the past year. ABC fund has

historically had a Beta of 1.3.

Should the return of ABC fund be <12%, =12%, >12%?

If ABC fund had a Beta of 1.3 relative to the S&P 500 in the above

example what should you expect the return to be?

• S&P 500 return = 12%

Fund Beta = 1.3

•

ABC fund return @1.3 Beta = (12%*1.3) =15.6%

•

In dollar terms: $1000 invested in S&P 500 would return

$1120 in one year. $1000 invested in ABC fund would return

$1156.

23

Relationship of Investment Risk & Return (Correlation)

In a perfect world

24

Relationship of Investment Risk & Return (Correlation)

Trend is upward

sloping

• The real world

•

Trend is downward

sloping

• The real world

•

25

Determining Asset Allocation Policy (Weighting Constraints)

A brief (very brief) summary of Illinois Pension Code (40

ILCS 5/1-113)

• If pension fund assets <$2.5 million, then equity must

not exceed 10%. (separate/mutual funds)

• If pension fund assets >$2.5 million, then equity must

not exceed 45%. (separate/mutual funds)

• If pension fund assets >$5 million, then equity must not

exceed 45%. (separate/mutual funds individual equities

via investment manager)

• If pension fund assets >$10 million, then equity must not

exceed 50%. ***Changes in 2011 & 2012***

• What about Fixed Income (bonds)???

•

26

Determining Asset Allocation Policy (Time Constraints)

•

Plan participants are the ultimate beneficiaries of the

plan assets…..NO MATTER WHAT!!!

•

Time horizons are typically perpetual for pension funds

•

Working with the actuaries can provide some guidance

to your specific plan.

27

Determining Asset Allocation Policy (Investment Goals or Target Returns)

•

Realistic Expectations based on recent market history

and a similar interest rate environment.

28

Ibbotson® SBBI®

Stocks, Bonds, Bills, and Inflation 1926–2010

$16,055

$10,000

$2,982

Compound annual return

• Small stocks

• Large stocks

• Government bonds

• Treasury bills

• Inflation

1,000

12.1%

9.9

5.5

3.6

3.0

$93

100

$21

$12

10

1

0.10

1926

1936

1946

1956

1966

1976

1986

1996

Past performance is no guarantee of future results. Hypothetical value of $1 invested at the beginning of 1926. Assumes reinvestment of income

and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in

an index. © 2011 Morningstar. All Rights Reserved. 3/1/2011

2006

Ibbotson® SBBI®

Stocks, Bonds, Bills, and Inflation 1991–2010

$20

Compound annual return

• Small stocks

• Large stocks

• Government bonds

• Treasury bills

• Inflation

10

$12.57

13.5%

9.1

8.4

3.5

2.5

$5.75

$5.05

$1.97

$1.64

1

0.60

1991

1996

2001

2006

Past performance is no guarantee of future results. Hypothetical value of $1 invested at the beginning of 1991. Assumes reinvestment of income

and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in

an index. © 2011 Morningstar. All Rights Reserved. 3/1/2011

Stocks, Commodities, REITs, and Gold

1980–2010

$100

Compound annual return

• REITs

• U.S. stocks

• International stocks

• Commodities

• Gold

12.3%

11.4

10.1

7.5

3.2

$36.02

$28.08

$19.98

$9.35

10

$2.68

1

0.50

1980

1985

1990

1995

2000

2005

Past performance is no guarantee of future results. Hypothetical value of $1 invested at the beginning of 1980. Assumes reinvestment of income

and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in

an index. © 2011 Morningstar. All Rights Reserved. 3/1/2011

2010

Conclusion

•

Questions & Answers

•

Quiz

32