WORD document - Lyle School of Engineering

advertisement

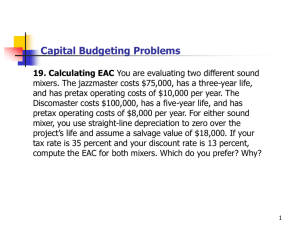

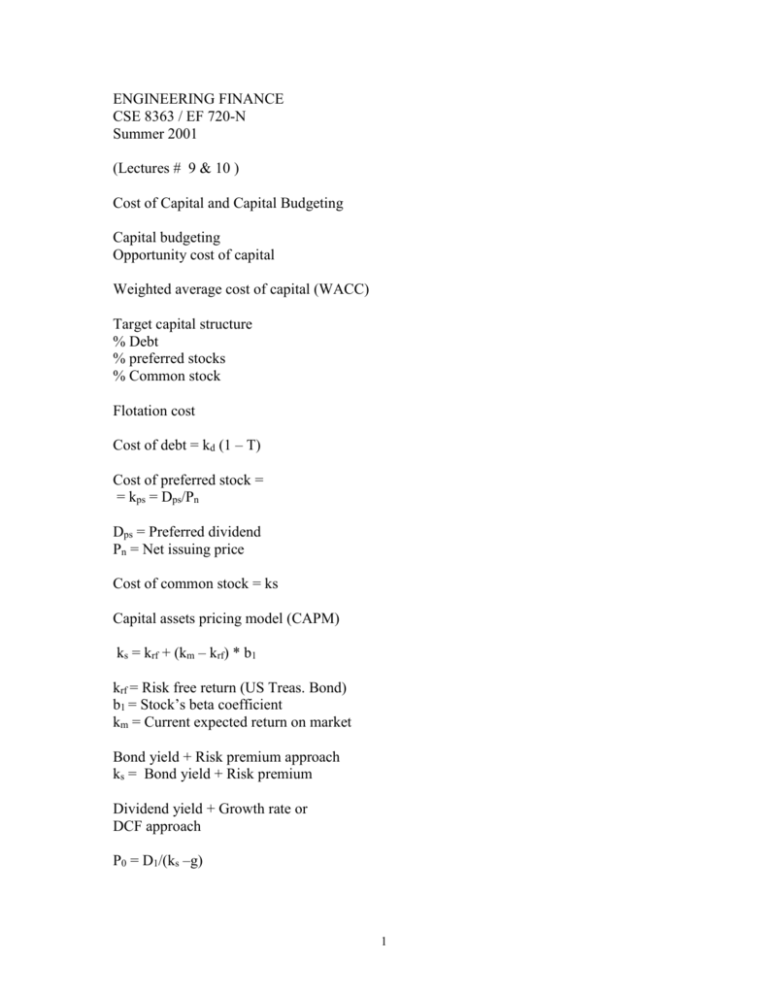

ENGINEERING FINANCE CSE 8363 / EF 720-N Summer 2001 (Lectures # 9 & 10 ) Cost of Capital and Capital Budgeting Capital budgeting Opportunity cost of capital Weighted average cost of capital (WACC) Target capital structure % Debt % preferred stocks % Common stock Flotation cost Cost of debt = kd (1 – T) Cost of preferred stock = = kps = Dps/Pn Dps = Preferred dividend Pn = Net issuing price Cost of common stock = ks Capital assets pricing model (CAPM) ks = krf + (km – krf) * b1 krf = Risk free return (US Treas. Bond) b1 = Stock’s beta coefficient km = Current expected return on market Bond yield + Risk premium approach ks = Bond yield + Risk premium Dividend yield + Growth rate or DCF approach P0 = D1/(ks –g) 1 ks = D1/P0 + g = D1/P0 + growth rate Finance is in large part a matter of judgement and we simply must face that fact WACC = Wd kd (1-T) + Wps * kps + Wcc*ks Factors affecting WCC Non-controllable – Interest rate & taxes Controllable Factors Capital structure policy Dividend policy Investment (capital budgeting) policy Project Risks Stand-alone risk Corporate, or within-firm risk Market or beta risk Risk Adjusted Cost of Capital Ks = krf + (km –krf) * b Cost of Internally Generated Funds (Depreciation etc.) Internal cash flow = net income – - Cash dividend + Depreciation = Retained Earnings + Depr. Problem Areas in Cost of Capital Privately owned firms Small businesses Measurement problems Projects of different riskiness Capital structure weights Capital Budgeting Capital budgeting is one the most important function financial managers and their staff perform. It is the whole process of analyzing projects and deciding which ones to include in the capital budget. 2 Forecast accuracy of asset requirements Timing Involves substantial expenditures Capital budgeting projects are created by the firm Strategic business plan Importance of capable and imaginative executives and employees Projects Types: Replacement: maintenance of business Replacement: cost reduction Expansion of existing products or markets Expansion into new products or markets Safety and/or environment projects Research and development Other The process of capital budgeting is very much similar to the security valuation process Capital Budgeting Decision Rules Payback period Discounted payback Net present value Internal rate of return (IRR) Modified IRR (NIRR) An NPV of zero signifies that the project’s cash flows are just sufficient to repay the invested capital and to provide the required rate of return on that capital The IRR is defined as that discount rate which equates the present value of the project’s expected cash flows to the present value of the project’s costs. NPV vs. IRR NPV Profiles NPV ranking depends on the cost of capital Independent projects Mutually exclusive projects Multiple IRRs 3 Multiple IRRs arise when the project has non-normal cash flows (negative net cash flows occur during some year after the project has been places in operation). Modified Internal Rate of Return (MIRR) MIRR is calculated by: PV costs = PV terminal value Profitability Index (PI) It is also called Benefit/Cost ratio B/C Ratio = PV Benefits/PV Costs In practice all four methods plus PI are used in most capital budgeting decisions Quantitative methods provide valuable information, but they should not be used as the sole criteria for accept/reject decisions. They should be considered as an aid to informed decisions but not as a substitute for sound management judgement Business practices The Post-Audit It is very important to compare actual results with those predicted by the project’s sponsors and understand why any differences occurred. It serves several purposes: Improve forecasts Improve operations Identify abandonment/ termination opportunities 4 5