Capital Budgeting and Appraisal Methods

advertisement

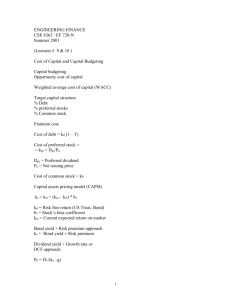

CAPITAL BUDGETING & INVESTMENT APPRAISAL METHODS PRESENTATION BY PROF. V.RAMACHANDRAN SIESCOMS, NERUL, NAVI MUMBAI 1 AGENDA Concept of Capital Budgeting Capital Expenditure Budget Importance of Capital Budgeting Rational of Capital Expenditure Kinds of Capital Investment Proposals Factors affecting Investment Decision Investment Appraisal Methods Capital Rationing 2 Concept of Capital Budgeting Finance Manager is concerned with Planning and Financing investment decisions. Financing Decisions relate to determination of amount of long term finance and decision on sources for financing the same. Investment decisions also termed as “Capital Budgeting Decisions” involve cost - benefit analysis. Investment decisions are based on careful consideration of factors like profitability, safety, liquidity, solvency etc. 3 Why Capital Budgeting Capital investment means investments in projects which by nature involve huge expenditure and results of the same are known only after a long time. Why Capital investment is necessary For investments in New Projects Replacement of worn out/ out dated assets. Expansion of existing capacity – To meet high demand or inadequate production capacity. Diversification – to reduce risk Research and Development – Ensuring updated technology. Miscellaneous – Installation of Pollution Control equipment, 4 other legal requirements. Capital Budgeting The term Capital Budgeting refers to long term planning for proposed capital outlays and their financing It involves raising of long term funds and their utilization. In other words, It is the formal process for acquisition and investment of capital. Capital Budgeting is a many-sided activity. It is a process of: searching for new and more profitable investment options by taking into account the consequences of accepting an investment proposal by making a detailed economic analysis of the profit making potential of each investment proposal. 5 Capital Budgeting Essential features based on which decisions are taken Profit potential Degree of risk Gestation period i.e time lag from the period of initial investment to anticipated returns. 6 Capital Expenditure Budget It is the formal plan of Capital expenditure on new projects/ purchase of fixed assets. Provides for the capital outlay available for procurement of capital assets during the Budget period. It is prepared by taking into consideration Future demand projections/growth of industry the available production capacities, allocation of existing resources and likely improvement in production techniques. 7 Capital Expenditure Budget-objectives Determines the When the work on capital projects can be commenced Estimates the expenditure that would be incurred on the projects approved by the management and the sources from which finance will be obtained Restricts capital expenditure on projects within the authorized limits 8 Importance of Capital Budgeting One of most crucial and critical business decisions Involvement of heavy funds- Improper and ill-advised investment and incorrect decisions can jeopardize the survival of even Biggest firm Long – term implications- Impact of capital decisions are known after a long period. A wrong decision can prove disastrous for the long term survival of the firm Irreversible decisions Most difficult decisions to make – Capital Budgeting decisions require assessment of future events which are uncertain. Further assessing future costs and benefits accurately in quantitative terms is not easy. E.g KCC and Taloja In view of the above the capital expenditure decisions are best reserved for consideration of the highest 9 level of management Kinds of Capital Investment Proposals Independent proposals- Don’t compete with any other proposal. They are cases of “accept or reject” proposals on the minimum return on investment cut off criteria basis. Contingent or dependent Proposals :Proposals whose acceptance depends on the acceptance one or more proposals.-Substantial Expansion of plan, other capital requirement. Like township etc Mutually exclusive proposals;e.g Temperature control Systems, Agitator, Valves Etc 10 Factors affecting Capital investment decisions The amount of investment where no funds constraints are there proposals giving higher rate of return than the minimum cut off rate may be accepted However where fund constraints are there, then Capital Rationing has to be resorted to. Projects should be arranged in ascending order of capital investment and giving due consideration of priority 11 Investment Appraisal Methods In view of the importance of Capital Budgeting decisions, it is essential that the Capital Investment appraisal method adopted must be sound. A good appraisal method should have the features. Clear Basis for distinguishing between acceptable and non acceptable projects Ranking the projects on the basis of desirability Choosing among several alternatives A criterion applicable to any conceivable project Recognizing bigger benefit projects are preferable to smaller ones and early benefit projects are preferable to later ones 12 Investment Appraisal Methods 1. 2. In all the appraisal methods emphasis is on the return. The basic approach to compare the investment in the project with benefits derived there from. Following are the main methods generally used;Pay –back period method Discounted Cash flow method a) b) c) 3. The Net present value method Present value index method IRR Method Accounting Rate of return Method 13 Pay –back period method The term Pay –back Period refers to the period in which the project will generate the necessary cash to recoup the initial investment For e.g- if a project requires Rs.20000 as initial investment and it will generate an annual cash flow of Rs.5000 for ten years, the pay-back period will be 4 years, calculated as follows Pay –back period = Initial investment Annual cash Flow The Annual cash flow is calculated on the basis of Net income before depreciation but after considering the tax. (PAT+Depreciation) 14 Pay –back period method The income expressed as %of initial investment is termed as Unadjusted rate of return Unadjusted Return = = Annual return x100 Initial Investment 5000 x100 =25% 20000 Uneven cash flow:- If a project requires an initial investment of Rs.20000 and annual cash inflows for 5 years are Rs.6000,Rs.8000,Rs.5000,Rs.4000 and Rs.4000 respectively ,the pay –back period will be calculated as follows 15 Pay –back period method Year 1 2 Cash Cumulative Inflows cash inflows 6000 6000 8000 14000 3 4 5000 4000 19000 23000 5 4000 27000 Rs.19000 is recovered in 3years and Rs.1000 is left out of initial investment. The cash inflow in 4th year is Rs.4000 which indicates that pay-back period is in between 3rd and 4th year.i.e.3+(1000/4000) = 3.25 years 16 Pay –back period method Criterion of accept or reject: Reciprocal of cost of capital (COC). for e.g If COC is 20% the maximum acceptable Pay-back period would be 5 years (i.e.100/20)which can also be termed as cut off point. May be a predetermined Criteria by management i.e.say Reciprocal of COC -Safety Margin. 5 years -1= 4 Refer to illustration 5.4 and 5.5 17 Pay –back period method Merits Useful for evaluation of projects with high uncertainty, political instability, obsolescence of Technology etc Method based on the assumption that no profit arises till initial capital is recovered. Suitable of new companies Simple to understand and to workout Reduces the possibility of loss due to obsolescence as the investment is made only on short term projects 18 Pay –back period method Demerits Ignores the returns after its pay –back period Projects with long gestation period will never be taken up though they yield better returns The method ignores the time value of money 19 Pay –back period method Suitability Hazy long term outlookPolitical or other conditions are hazy this method is suitable Firms suffering from liquidity crises Firms dependent on short term performances 20 Discounted Cash Flow (DCF) DCF Technique is an improvement on payback period method. It takes into account Time Value of money i.e interest factor as well as the returns after the payback period. The method involves 3 stages Calculation of cash flows (both inflow and outflow preferably after tax for full life of the project). Discounting cash flows by applying a discount factor. Aggregation of discounted cash flows and ascertainment of net cash flow. 21 NPV Method The cash inflows and cash outflows associated with the project are worked out. The present value of these cash flows is calculated at a rate of return acceptable to the management ( Cost of capital suitably adjusted for risk element) The net present value (NPV) i.e. difference between total present value of cash inflow and total present value of cash outflow is ascertained. 22 NPV Method Accept or reject criterion Where NPV > Zero Accept the proposal. Where NPV < Zero Reject the proposal. Refer illustration 5.6 , 5.7 and 5.8. 23 Excess present value index This is a refinement of NPV method. Instead of working out the NPV a present value index is worked out by comparing total present value of future cash inflows and total present value of future cash outflows. Refer illustration 5.10. 24 Internal rate of return (IRR) IRR is that rate of return at which the sum of discounted cash inflows equals the sum of cash outflows. In other words it is the rate which discounts the cash flows to zero. It can be stated in the form of formula as under. Cash inflows =1 Cash outflows 25 Internal rate of return (IRR) Accept / Reject Criterion: IRR is the maximum rate of interest which an organization can afford to pay on capital invested in a project. A Project would qualify only if IRR exceeds the cut-off rate. A project giving higher IRR than cut-off rate would be preferred. Refer e.g. 5.12 & 5.13. 26 Accounting Rate of return (ARR) Under this method proposals are judged on the basis of relative profitability. It is calculated on the following basis. (Annual Average net earnings / original investments)*100 Annual Average net earnings is the average net earnings after depreciations and tax for the entire life of the project. Refer illustration 5.16. 27 CAPITAL BUDGETING & INVESTMENT APPRAISAL METHODS 28