財務管理個案研討

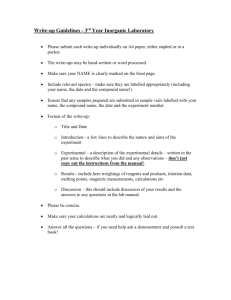

advertisement

財務管理個案研討 Instructor:Mia Twu Room:Business School 1017 Required text: Harvard Business School cases This is a course aimed to get students familiar with financial management by a participant-centered method. It will cover all the major topics of corporate finance, including working capital management, capital budgeting, capital structure, capital restructuring, external financing, risk management, corporate governance, etc. In the class, students are the key players in finding key questions and giving adequate answers. My role will be assisting students in going through the process. Students are required to separate into groups. In every week, a specific group is scheduled to do the presentation of the assigned case at the beginning of the class and hand in its complete write-up. The presentation time should be approximately 50 minutes. The other groups have to hand in a write-up which is no more than 2-page (plus appendices with spreadsheet printouts, etc ) for each case. For the remaining 100 minutes, I will lead students in discussing the case. Course requirements: 1. Students are supposed to attend every class unless for some burning reasons. Any student will receive a fail grade automatically if he/she skip classes equal to or more than four times. 2. Each student is required to pick up a fixed seat and turns in a picture for grading purpose. 3. Laptops are not suggested to be used unless showing some spread sheets. 4. At the end of each class, students will be graded according to his/her participation performance (such as how many times he/she presents his/her opinions and the quality of the opinion). 5. There are two term exams. Each will cover what we discussed in the classes or a brief case. Grading: Reports Participation Term exams 25% 25% 50% Tentative schedule: 9/17 Introduction 9/24 Butler Lumber Company Short-term sources of funds 10/1 BBC Working capital management 10/8 Marriott The cost of capital 10/15 Hansson Capital budgeting 10/22 Air Bus Capital budgeting 10/29 Calaveras vineyards Valuing business 11/5 Pinkerton (A) Valuing Business 11/12 Laura Martin Real options 11/19 Midterm 11/26 Du Pont Capital structure 12/3 Nantucket Nectars Sell or Go 12/10 Massey-Ferguson Ltd Costs of financial distress 12/17 Dividend policy at FPL Dividend policy 12/24 MCI (1983) Equity-linked loans 12/31 AIFS Risk management 1/7 Marriott (A) Financial Ethics 1/16 Final 祝各位本學期學習愉快!