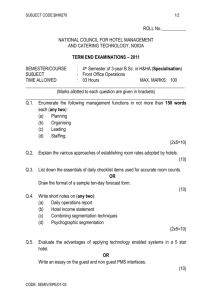

Hotel Occupancy Rates Hit 4-Year Low

advertisement

Hotel Occupancy Rates Hit 4-Year Low --Overbuilding Produces Glut, Despite Boom in Bookings By Thomas Goetz 05/14/1998 The Wall Street Journal Page A2 (Copyright (c) 1998, Dow Jones & Company, Inc.) Hotel occupancy rates have fallen to their lowest point in four years, the strongest proof yet that the nation's $88 billion-a-year lodging industry has a bad case of the overbuilding blues. In the midst of a travel boom -- and an otherwise robust hotel market -- the nation's major hotel companies and independents are reporting a surplus of rooms. Occupancy rates in the first quarter fell slightly below 60% for the first time s ince 1994 and are expected to be down from a year earlier during the important summer season. And the reasons couldn't be more obvious: Hotels are building at a stunning pace, adding more than 25 hotels -- or about 2,600 new rooms -- a week. The problem looms largest among midscale and economy hotels. "Everybody's rushing in and building," says Brent Andrus, a Marriott International Inc. franchisee who has watched nine hotel properties sprout up within 1,000 yards of his Fairfield Inn outside Irving, Texas, in the past 18 months. His fear: an inevitable decline in room rates and profits. "You kind of kill the golden goose," he says. "There's going to be a shakeout." Indeed, hoteliers have been here before. In the 1980s, favorable tax laws and surging occupancy rates spurred a building boom of unprecedented proportions. But demand didn't keep up and, after the tax laws were tightened, the hotel business posted losses of more than $10.6 billion from 1989 through 1992. It was the industry's worst slump since the Great Depression. Now, buoyed by the travel boom, the industry has resumed its coast-to-coast construction. It added 143,000 rooms last year and has plans right now to add 138,000 more this year. These are about 70% above the annual rate of hotel building in the past 25 years, according to Bjorn Hanson, chairman of the lodging group at Coopers & Lybrand. The upshot: occupancy rates in Atlanta have fallen 13% in the past two years, following a series of new hotels for the 1996 Olympics. While some regions such as New England continue to do well, markets such as Phoenix, Denver, and Raleigh-Durham, N.C., are showing "ominous" signs of oversupply, notes Jason Ader, lodging analyst at Bear Stearns & Co. And 8,000 new rooms opened in Dallas last year, an 18% increase from the 44,000 at the end of 1996, according to Sandi Bailey, executive director of the Hotel-Motel Association of Greater Dallas. "There's horrible concern" among hotel owners about overbuilding, says Ms. Bailey. "Unfortunately, development is always two years behind the curve." Even overbooked New York City is showing signs of overeagerness, says Robert Deiner, president of Hotel Reservations Network, which books last-minute hotel rooms for travelers. With Manhattan sold out most nights, "a new hotel sounds like a great investment in New York. But they don't factor in the 15 other projects going on at the same time," says Mr. Deiner. "Every new project is really marginal at this point." The industry says it is building because demand for rooms continues to rise. According to travel-industry projections, demand will grow 3% to 5% a year for the next several years. But many analysts say hoteliers are being urged on by developers and financiers, who are eager to act on current confidence in the industry. What's more, the industry is dominated by hotel franchisers, who profit from licensing new properties. "These guys are highly motivated to build their franchises and get their brand out there," says John Arabia of Green Street Advisors, an investment-research company based in Newport Beach, Calif. "But they often have little incentive" to mind whether the properties actually make money. Such concerns help to explain why Wall Street has been retreating from hotel stocks, which have been flat or down this year in a strong bull market. Choice Hotels International Inc. closed yesterday in New York Stock Exchange composite trading at $16.1875, down from its high for the year of $18.375 in late March. Marriott International is down 14% from its high for the year, after closing at $33.125 yesterday, also in composite trading. Shares of Hilton Hotel Corp. closed at $32.625, down from a high of $34.8125 in mid-March. "Caution is the word," said Bear Stearns's Mr. Ader. "You can see that the cycle needs to end." Shares of Starwood Hotels & Resorts Worldwide Inc., now the largest hotelier in the country, are falling too, closing yesterday in composite trading at $50.25 from a 1998 high of $57.75. Besides overbuilding in the industry, the company has another woe in common with other so-called paired-share realestate investment trusts: the Clinton administration recently proposed curbing the favorable tax status of such REITs. To be sure, the industry, including Marriott International and Hilton, is still posting double-digit increases in profits, because room rates are way up and travel demand is still strong. Some analysts also say the hotel industry is smarter than before about development; it has, for example, built luxury and upscale hotels on a pace with continued strong demand. "There's a financial discipline in place today that wasn't there before," says Thomas Corcoran Jr., chief executive officer at FelCor Suite Hotels Inc., the hotel real-estate investment trust based in Irving, Texas. "We don't see any gloom and doom," says William Floyd, chief executive officer at Choice, one of the nation's largest hotel franchisers, which controls Comfort Inn, Econo Lodge and five other lodging brands. The Silver Springs, Md., company is planning to add 870 more properties in the next few years, a 25% increase from its current stock. Its first-quarter occupancy rates averaged only 50.1%, and were only 50.5% a year ago. Much of the industry's building boom has focused on so-called limited-service hotels, which have no restaurants or room service, and extended-stay hotels, which cater to business travelers and families staying several weeks. Among chains, these kinds of hotels account for 71% of new construction, even though guest demand in these markets has grown no faster than average.