Chapter4 - CLSU Open University

advertisement

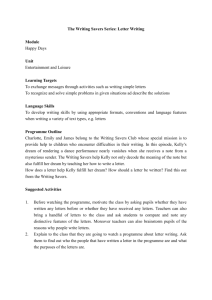

14 Chapter IV Project Feasibility Studies Organization and Management Aspect Marketing Aspect Technical Aspect Production Aspect Financing Aspect Socio-Economic Aspect Objectives: The student should be able: 1. To structure the organization of an educational project. 2. To staff the organizational structure of the project. 3. To conduct market research relevant to the project. 4. To conduct technical requirements of the project. 5. To describe the process of productions 6. To identify sources of funds for the project. 7. To prepare the financial statements of the project and analyses thereof. 8. To define the role of the project socially and economically. 15 Organization and Management The aspect of organization and management involves four parts: 1. External Linkages – The external environment consists of different components and one of these is the linkage among the different public and private agencies. These agencies will complement or fill the gap to satisfy the needs of the project. 2. Internal Organization – the internal environment is as important as the external environment. Proper organization of this will spell success for the project. 3. Management Plan – The importance of this part cannot be over emphasized. Supervision of all activities, control techniques, coordination and integration of schedules etc. are the highlights of activities in this part. 4. Personnel – an organizational structure without personnel is futile. Any project should not be devoid of human aspect. A motivated personnel will produce optimum outputs for the project. 5. Planning – this shows the various stages of management. 5.1 Management prior to full project orientation. 5.2 Management at full project operation 5.3 In-between full operational states. 16 Marketing Aspect In this aspect, the determination of the demand and supply will necessitate the preparation of different instruments to gather data relative to the project proposal. Some of the more important areas to be considered are: a. b. c. d. e. f. Market share Target clientele Existing competitors Prevailing Prices Location of Suppliers and Consumers Break-even Point g. Present demand and supply An illustration below will show you how break-even point analysis will make use of market share, prevailing tuition fees, target clientele, etc. Tuition fees for 2 semesters and 1 summer 1st semester 80 students x Php 6,000 / semester=Php 480,000 2nd semester 80 students x Php 6,000 / semester= 480,000 Summer 50 students x Php 6,000 / summer= 300,000 Total Tuition Fees Php1, 260,000 Professors’ Fees 1st semester 10 professors x Php 16,200/semester=Php 162,000 2nd semester 10 professors x Php 16,200/semester= 162,000 3rd semester 10 professors x Php 16,200/semester= 162,000 Total Professor’s Fees Php 486,000 Fixed Costs Depreciation Telephone, Light, Power Dean & staff’s salaries Total Php 100,000 194,000 480,000 Php 774,000 Break-Even Point Analysis: Revenues Less-Variable Costs Contribution Margin Less-Fixed Costs Profit (Loss) Php 1,260,000 486,000 Php 774,000 774,000 Php xxx____ 17 If the graduate school’s market share is 20% or 210 students then it will break-even. However, if through market research and the graduate school’s market share is only 10% then it will lose. Any market share lower than 20% is a losing proposition. The catchment area or the location of target clientele is very essential in the demand and supply analysis. If we can identify the total number of prospective graduate students and can enumerate the number of graduate schools with similar graduate offerings, with different modes of delivery, then we can determine in advance if we will lose or gain in our proposed project. FINANCE ASPECT Individuals, groups of individuals, partnerships and corporations often seek sources of funds to capitalize on their prospective projects. These various entities are brought together with those having surplus funds in the financial markets. Each financial market has different instruments in terms of maturity and assets backing it. Weston and Brigham, 1990, classified financial markets into 11 major types: 1. Physical Asset Markets- these are for tangible goods like books, school supplies, computers, desks, blackboards, chalks, tables, magazines, slides, projectors, microscopes, globes, basketballs, uniforms, shoes, school bus, educational films, etc. 2. Financial Markets- deal with stocks, bonds, notes, mortgages, and other claims or real assets. 3. Spot Markets- these indulge in cash on delivery. 4. Future Markets- engage in delivery at some future date e.g. 30 days, 6 months or a year. 5. Money Markets- a financial market for debt securities with maturities of less than one year. 6. Capital Markets- also a financial market for long-term debt and corporate stocks. 7. Mortgage Markets- deal with loans on residential, commercial, and industrial, educational real estate and farmlands. 18 8. Consumer Credit Markets- involve loans or tangible assets, education, vacation, etc. 9. World, National, Regional, and Local Markets- depending on the individual, group or organizations’ size, nature and scope of operation, it may borrow all around world, or it may be confined to a strictly local, even neighborhood market. 10. Primary Markets- are markets in which newly issued securities are involved. The corporation selling the stock receives the proceeds from the sale in a primary market transaction. 11. Secondary Markets- markets in which existing outstanding securities are traded among investors. Secondary markets also exist for mortgages, various types of loans and other financial assets. The corporation whose securities are being traded is not being involved in a secondary market and, thus, does not receive any funds from such a sale. The efficient transfer of funds from people who are net savers to individuals and firms who need capital is vital to any economy. Any economy for that matter needs efficient financial markets. Transfer of capital between savers and those who need capital take place in three different ways: 1. Direct Transfer of Cash and Securities The business sells its stocks or bonds directly to savers, without going through any type of intermediary. The business delivers the securities to savers who pay in cash, 2. Investment Banking HouseThere is a middleman who facilitates the issuance of securities. The company sells its stocks or bonds to the investment bank, which in turn sells these some securities to ultimate savers. The business securities and the savers’ money merely “pass through” the investment banking house. The investment bank buy and hold the securities for a period of time, so it is taking a chance- it may not be able to resell them to savers for as much or more than it paid. 19 3. Financial Intermediary The intermediary obtains funds from savers issuing its own securities in exchange and uses cash to purchase business’ securities. These transfers of capital between the savers and those who use it may well be illustrated as shown in Figure 4.1 1. Direct Transfer Securities (Stocks or Bonds) Business Savers PESOS 2. Indirect Transfer though Investment Bankers Securities Investme nt Business Savers Banking PESOS PESOS House 3. Indirect Transfers though a Financial Intermediary Securities Businesses’ Securities Business Financial Intermediary Intermediary’s Securities Savers Figure 4.1- Diagram of the Capital Formation Process Intermediaries classifications: are generally categorized into seven major 1. Commercial Banks- are the traditional financial institutions which serve a wide variety of savers and those with needs for funds. Commercial banks lend money to those who need it and are capable of paying it back with interest. 2. Savings and Loan Association- traditionally, these served individual savers and residential and commercial mortgage borrowers, take the funds of many small savers and then lend this money to home buyers 20 and other types of borrowers. The most significant economic function of savings and loan association is to create liquidity. These intermediaries have more expertise in analyzing credit, setting up loans, and making collections than individual savers could possibly have, so they reduce the cost and increase the availability of real estate loans. Lastly, these intermediaries hold large, diversified portfolios of loans and other assets and thus spread risks in a manner that would be impossible if small savers were making mortgage loans directly. 3. Mutual Savings Banks- these are similar to savings and loan associations, these accept savings primarily from individuals, and lend mainly on a long-term basis to home buyers and consumers. 4. Credit Unions- are cooperative associations whose members have a common bond. Members savings are loaned only to other members. Credit unions are sometimes the cheapest source of funds available to the individual borrower. 5. Pension Funds- are retirement plans funded by corporations or government agencies for their workers and administered primarily by the trust departments of commercial banks or by insurance companies. Pension funds invest primarily on bonds, stocks, mortgages, and real estate. 6. Life Insurance Companies- take savings in the form of annual premiums, then invest these funds in stocks, bonds, real estate and mortgages, and finally make payments to the beneficiaries of the insured parties. 7. Mutual Funds- are corporations which accept cash from savers and then use these to buy stocks, long-term bonds, or short-term debt instruments issued by business or government units. These organizations pool funds thus reduce risks by diversification. They also gain economies of scales, which lower the costs, or analyzing securities, managing portfolios, and buying and selling securities. Different funds are designed to meet the objectives of different types of savers. The Cost of Money The factors which affect the supply of and demand for investment capital, or the cost of capital are described below: 1. Production Opportunities- returns available within an economy from investment in productive or cash-generation assets. 21 2. Time Preferences for Consumption- the preferences of consumers for current consumption as opposed to saving for future consumption. 3. Risk- the chance that a loan will not be repaid as promised. 4. Inflation- the tendency of prices to increase over time. Production and Technical Aspect Production/Operations Management or simply Operations Management is management of resources to produce goods or survives. The scope of production/operations management which includes the technical aspect are: 1. Quality management 2. Strategic business planning 3. Performance measurement 4. Human resource management 5. Designing and developing products and services 6. Forecasting and capacity planning 7. Location and distribution 8. Technology and automation 9. Process design and facility layout 10. Inventory and materials management 11. Production planning and scheduling 12. Operations scheduling 13. Project management The Environment of a Production System The production system is greatly affected by both the extreme and internal environment. The external environment influences the overall policies and objectives of the company, so indirectly it influences the production system. The following external factors influence the production system. 1. 2. 3. 4. Economic conditions Government regulations Competing organizations Evolving technology 22 On the other hand according to James R. Evans, 1997, the internal environment or other functional areas within the firm have a more direct impact on production. 1. Financial decisions affect the choice of manufacturing equipment, use of overtime, cost-control policies, and price-volume decisions. 2. Accounting provides data on costs, and prices that help managers evaluate performance. 3. Marketing is responsible for understanding customer needs, generating and maintaining demand for the firm’s products, ensuring customer satisfaction, and developing new markets and product potential. 4. Product design and engineering determine product specifications to meet customer needs and the production methods necessary to make the products or services. 5. Human resources- recruits and trains employees and is responsible for employee development, motivation, and union relationships. 6. Research and development-investigates new ideas and their potential uses as consumer products. 7. Purchasing- is responsible for acquiring the materials and supplies necessary for production. 8. Traffic- is responsible for distributing the finished goods to customer. 9. Legal services ensure that laws and regulations for product labeling, performance, safety, packaging, transportation, and other contractual requirements are met. 10. Information systems provide the means for capturing, analyzing, and coordinating the information needs of each of the proceeding area. 23 The figure below shows the positions of the internal and external environments. ECONOMIC CONDITIONS FINANCE PURCHASING GOVERNMENT REGULATIONS MARKETING COMPETITION TRAFFIC Production TECHNOLOGY PRODUCT DESIGN AND ENGINEERING HUMAN RESOURCE System ACCOUNTING LEGAL INFORMATION SYSTEMS RESEARCH AND DEVELOPMENT Figure 4.2- The Production System and Its Environment Financial Aspect This aspect shows the statement of income and balance sheet of the proposed project for at least 3 years to see its profitability, thus its feasibility and viability. After one year of operation the financial statements are prepared. The income statement summarizes the firm’s revenues and expenses over an accounting period, while the balance sheet shows the financial position at a specific point in time. The income statement is composed of the following captions: Revenues- gross receipts or receivables from sales or services rendered. 24 Cost of Sales or Services- the total inputs’ amount to finish a product or render a service. Operating expenses- incurred in the distribution of products or services. Other income- receipts or collectibles which are not normally earned by the business. Other expenses- incurred incidentally aside from operating expenses. Assets Current Assets Permanent Investments Plant, Property and Equipment Intangibles Other Assets Liabilities Current Liabilities Long-Term Liabilities Capital 1.) If the business is a sole proprietorship Owner’s, Capital 2.) If the business is a partnership Partner’s, Capital Partner’s, Capital 3.) If the business is a corporation Stockholder’s Equity Paid-up Capital Additional Pain-in Capital Retained Earnings FINANCIAL RATIOS To asses the economy’s standing based on the statements prepared different ratios are computed. 1. Liquidity Ratios- show the relationship of a firm’s cash and other current assets to its current liabilities. 25 1.1 1.2 Current Ratio- this is computed by dividing current assets by its current liabilities. It indicates the extent to which the claims of short-term creditors are covered by assets expected to be converted to cash in the near future. Quick or Acid-test Ratio- this is computed by deducting inventories from current assets and dividing remainder by current liabilities. 2. Asset Management Ratios- a set of ratios which measures how effectively a firm is managing its assets. 2.1 Inventory Turnover- or the inventory utilization ratio is the ratio by inventories. 2.2 Day Sales Outstanding- or the ratio of the average sales per day into accounts receivable. It indicates the average length of time the firm must wait after making a sale before receiving payment. 2.3 Fixed Assets Turnover or the fixed assets utilization ratio, measures how effectively the firm uses its plant and equipment. 2.4 Total Assets Turnover is the ratio of sales by the total assets. 3. Debt Management Ratios- the extent to which a firm uses debt financing, or financial leverage. Some benefits are derived from this financial leverage: 1. By raising funds through debt, the owners can maintain control of the firm with a limited investment. 2. Creditors look to the equity, or owner supplied funds, to provide a margin of safety. If the owners have provided only small proportion of total financing, the risks of the enterprise are borne mainly by its creditors. 3. If the firm earns more on investments financed with borrowed funds that it pays in interest, the return on the owner’s capital is magnified or “leveraged”. 3.1 Debt Ratio- the ratio of total debt to total assets. This measures the percentage of total funds provided by creditors. Creditors prefer low debt ratios, because the lower the ratio, the greater the cushion against creditor’s losses in the event of liquidation. The owners on the other hand may seek high leverage, either to 26 magnify earnings or because selling new stock would mean giving up some degree of control. 3.2 Times Interest Earned- the ratio of earnings before interest and taxes (EBIT) to interest charges. It measures the ability of the firm to meet the annual interest payments. 3.3 Fixed Charge Coverage- this ratio expands upon the times interest earned ratio to include the firm’s annual long-term lease obligations. 3.4 Cash Flow Coverage- this ratio shows the margin by which the firm’s operating cash flow cover its financial requirements. 4. Profitability Ratios- a group of ratios showing the combined effects of liquidity, asset management, and debt management on operating results. 4.1 Profit Margin on Sales- this measures the income per peso of sales. This is the ratio of net profit after taxes over sales. 4.2 Basic Earning Power- indicates the ability of the firm’s assets to generate operating income. This is computed by dividing EBIT by total assets. 4.3 Return on Total Assets- the ratio of net income after taxes to total assets. 4.4 Return on Common Equity- the ratio of net income after taxes to common equity. It measures the rate of return on common stockholder’s investments. 5. Market Value Ratios- a set of ratios that relate the firm’s stock price to its earnings and book value per share. 5.1 Price/Earnings Ratio- the ratio of the price per share to earnings per share. It shows the peso amount investors will pay for Php 1 of current earnings. 5.2 Market/Book Ratio- the ratio of stock’s market price to its book value. 27 Trend Analysis- An analysis of a firm’s financial ratios over time. It is used to determine the improvement or deterioration of its financial situation. Comparative Ratio Analysis- An analysis based on a comparison of a firm’s ratios with those of other firms in the same industry. Uses of Ratio Analysis: 1. Managers- who employ ratios to help analyze, control, and thus improve the firm’s operation. 2. Credit Analysts- like bank loan officers or bond rating analysts who analyze ratios to help ascertain a company’s ability to pay its debts. 3. Security Analysts- including both stock analysts, who are interested is a company’s efficiency and growth prospects and bond analysts who are concerned with a company’s ability to pay interest on its bonds as well as with the liquidity value of the assets that would be available to bond holders in the event the company went bankrupt. Social Impact Business should set their goals and objectives congruent with the national, regional, and local goals and objectives. The firm must have social conscience. The policies and regulations formulated by the entity should not be devoid of human feeling for any business will only survive if its target clientele “human beings” will be highly considered. Evaluation Activities Following the different aspects of project feasibility study, prepare a hypothetical project feasibility study about putting up a school.