PUB - Smart Woman Securities

advertisement

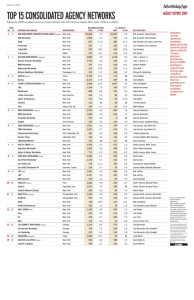

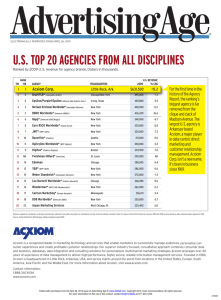

April 29, 2007 Christina Grassi Publicis Groupe (PUB) Company Highlights: Market Cap: 9.57 Billion P/E: 17.90 EPS: 2.69 52-week range: $34.28-49.40 Current Price (as of 4/27/07): $48.15 Company Overview: Publicis Groupe, founded in 1926 in Paris, France, and listed on the New York Stock Exchange in September 2000, is an advertising and marketing agency that operates in over 104 countries and across five continents. It is the fourth largest communications company and the second largest media buying company with a market cap of 9.57 billion dollars. Its three larger competitors are Omnicom, Inc. (market cap 17.65 billion dollars ), WPP Group plc (market cap 18.54 billion dollars ), and the Interpublic group ( market cap 6 billion dollars). Its services can be divided into the following three categories: 1) Traditional Advertising (44% of annual revenues, 2006) 2) Specialized Communications Services (SAMS) (30% of annual revenues, 2006) 3) Media Consulting and Purchase Services (26% of annual revenues, 2006) Publicis will design a customized package of services, often a combination of the three mentioned above, to its clients. Through its Publicis, Saatchi &Saatchi and Leo Burnett networks, Publicis performs traditional advertising services. These include creating advertising materials in various medias, such as newspapers, internet, interactive media, cell phones and other electronic materials. Through its SAMS, Publicis provides public relations services, financial communications, healthcare communications, direct marketing, sales promotion, and event communications and design. Through its media consulting and purchase services, the company advises the client as to what is the most effective form of media to publicize its product. Through this division, the company will also purchase advertising space for its clients (be it outdoor media, print, internet, or advertising on cell-phones). Publicis’ clients include the Coca Cola Company, Cadbury-Schweppes, Hewlett Packard, L’Oreal, Nestle, Proctor and Gamble, Whirlpool, Telefonica, and Zurich Financial. During 2006, the Company launched a new program known as OnSpot Digital Network, which is a high definition digital cable advertising channel focused on the interests of the Simon Mall clientele. Recent acquisitions (April 2007) include the McGinn Group, an American communications firm, Pharmagistics, an American healthcare and pharmaceutical company concentrating in sales and marketing. Other acquisitions include Digitas Inc. and Yong Yang, a Chinese promotional marketing company. Publicis Group has two boards, a Supervisory Board and a Management Board. The chairman and Chief Executive Officer is Maurice Levy. He has been with the company since 1971. In June 2005, Levy was interviewed by CNN financial editor Todd Benjamin in a feature article about what it takes to be a “great leader”. Industry Overview: The Media Industry is a unique one in that the strength of a media company relies on creativity. The services of a media company must be continually progressive and innovative. There also must be a significant amount of ingenuity on the part of company management in order for the corporation to truly succeed and grow long term. The second challenge of companies within the media industry is to use the potential of the Internet and “new media”. As traditional means of disseminating information (such as newspapers, radio, etc), becomes obsolete, media companies must be prepared to reach their audiences through more technologically progressive mediums, such as through digital technology, cellular phones, and online content. Because of the inherent competition in the media industry, and the threat of substitutes for various media company services, attracting the largest number of clients becomes paramount. Competition: Omnicom Group is the world’s largest media services company, with advertising, marketing, public relations, and global advertising divisions. It serves over 5,000 clients throughout approximately 100 countries. Despite Omnicom’s title as the “world’s leader in marketing communications”, there seem to be no near term catalysts for the stock. In contrast to Publicis, Omnicom has not seemed to be pursuing an innovative business strategy, including expansion into emerging markets, or continued acquisitions. WPP Group is based in the United Kingdom and incorporated in 1971. Its market cap is larger than that of Publicis Groupe, (18.54 billion dollars) as opposed to PUB’s 9.57 billion dollar market cap. It holds a P/E ratio higher than that of Publicis Groupe. Recently, WPP released first quarter results that showed a 0.7% slip in revenue, most likely due to the fact that the U.S. dollar value dropped relative to the British pound. Again, this company when directly compared to Publicis quantitatively, shows no near term catalysts for the stock. Interpublic Group is an American advertising agency based in New York City. It offers very similar services to that of WPP Group, Omnicom, and Publicis. The aims and goals of Interpublic in terms of continued growth are very similar to that of Publicis: Interpublic is aiming to expand into foreign markets, declare additional dividends for investors, expand into China, and work on effectively integrating its various subsidiaries. PUB OMC WPPGY IPG Market Cap 9.57B 17.65B 18.54B 5.99B Current 17.90 21.16 21.23 N/A 17.33 18.40 N/A N/A P/E Estimated P/E 2007 Financials and Valuation: Publicis’ recently released annual report confirms its strong financials. Although the company has made numerous acquisitions in the past year, it has not remained stagnant in its organic growth. In the company’s 2006 annual report, it reported 6.3% in the first quarter, 7.3% in the second quarter, 2.6% in the third quarter, and 6.3% in the fourth quarter. Distribution of Publicis’ revenue is evenly dispersed; in 2006, 44% of revenue came from traditional advertising, 30% SAMS, and 26% Media. Revenue increased in 2006 in all regions of the world in which Publicis operates. In 2006, emerging markets (Africa, the Middle East, Latin America) represented 21% of revenues. Free cash flow, 541 million euros, increased 14%, in 2006, in spite of the company’s aggressive acquisitions. This is one of the indicators that shows that the company can financially back up its investments in these new acquisitions. Through an analysis of the table at the left, it appears that Publicis Groupe is a cheaper stock than that of its peers (if considering the P/E ratio). Consensus estimates by analysts for 2007 project that the stock will maintain this relatively low P/E value, suggesting that this time may be a favorable point to invest in the company. P/E Earnings per Share Publicis Groupe Industry 17.90 2.69 21.30 0.62 Summary of Financials (in millions of Euros, except for per share items) Total Revenue Total Operating 6 months ending 31- 6 months ending 30- 3 months ending 31- Dec-2006 June-2006 3-3006 2,264.00 1,887.00 2,122.00 1,810.00 994.00 --- Expense Net Income Total Current Assets Total Assets Total Current 248.00 195.00 994.00 7,235.00 11,627.00 6,884.00 6,958.00 11,436.00 6,813.00 7,151.00 11,758.00 6,967.00 1,911.00 11,627.00 1,949.00 11,436.00 1,913.00 11,758.00 589.00 --- 620.00 (12 months ending 12-31 2005) -41.00 (12 months Liabilities Total Long Term Debt Total Stockholder Equity and Total Liabilities Cash from Operating Activities Cash from Investing -28.00 Activities Cash from Financing -82.00 ---- 373.00 --- Activities Net Change in Cash ending 12-31-2005). 220.00 (12 months ending 12-31-2005). 871.00 (12 months ending 12-31-2005). While cash flow from financing activities is negative for 2006, this could account for the fact that Publicis is planning on raising dividends for its shareholders (according to the annual report, a 39% expected increase) which would account for the negative value. Cash flow from investing activities is also negative, and this is most likely due to investment expenditures incurred as a result of the company’s acquisitions. However, the fact that overall net change in cash is positive, and cash from operating activities is positive, indicates that the company is still able to maintain strong financial performance despite investment expenditures. Additional Valuation Estimates for Publicis Groupe: EPS EBITDA Sales 2007Estimates 2.77 1128 5783 2008Estimates 3.11 1216 6414 Shares out Net Debt Enterprise Value 238 194 238 194 $11,618 $11,618 PE EV/EBITDA EV/Sales 17.33 x 10.30 x 2.01 x 15.43 x 9.56 x 1.81 x Opportunities: BUSINESS STRATEGY OF GLOBAL EXPANSION Since 2002, management at Publicis has adopted a strategy of global expansion. To this end, the management team decided to first concentrate on the acquisition of small specialized agencies, or agencies based in emerging markets. Then, in phase two of the company’s business strategy (2004), the company made smaller acquisitions so as to concentrate on integrating its previous acquisitions and to maintain strong financial ratios. Then, in phase three of the plan (2005), management continued a process of selective expansion, targeting companies that would increase its range of services (such as healthcare communications, marketing agencies in the United Kingdom, and only the top marketing agencies in Germany and Austria). Recently, in 2006, Publicis decided to pursue the technology sector, such as the mobile digital communications sector (with the acquisition of Digitas). Future goals include continuing to penetrate emerging markets, working on integrating Digitas into the company’s current operations, and working to further reduce financial ratios such as average net debt to operating margin. USING ADVERTISING MEDIUMS OF THE FUTURE AND DIVERSIFIED SERVICES Although risky, Publicis’ business strategy of aggressive acquisition is an excellent way to expand the company’s services, particularly in media ventures of the future. Publicis’ acquisition of Digitas, Inc. (completed in April 2007), was an example of this business strategy. Digitas is one of the world’s leaders in digital and interactive communications, creating both digital and interactive media. One of the key trends in the media industry is the emergence of “new media”. Publicis is aware of this growing trend. With the acquisition of Digitas, the company is preparing for the future and is moving itself toward becoming a world leader in digital communication and marketing services. Publicis is also looking to expand to emerging markets, and on April 2, 2007, announced the acquisition of Yong Yang, a promotional marketing company in China. Publicis is also looking to become involved not only with clients in the consumer industry, but also in the healthcare industry. To this end, the company has been recently acquiring communication agencies in the healthcare sector, such as Pharmagistics, which provides direct marketing services to biotechnology and pharmaceutical companies. It appears that Publicis is diversifying its services and penetrating international markets so as to temper any risks associated with changes in economic conditions or client base. LONGSTANDING CLIENTS The company notes that although the length of contracts with clients can vary from year to year, longstanding clients account for a large amount of Publicis’ revenues. 45 years is the average retention rate of the ten biggest clients. NEW BUSINESS AND MANY NEAR TERM CATALYSTS FOR THE STOCK In 2006, Publicis acquired new clients, and continuing patrons extended their contracts with the company. New business included: Sanofi Aventis/Vaccins Pasteur (worldwide), Orange (for Europe), Marriott (for Asia), Kraft (marketing services for Europe), JC Penney (for America), Sony Ericson (worldwide), and Crowne Plaza Hotel and Resorts (America), among others. (Note that the main clients lost in 2006 included Cadillac, Heineken, and Sprint). This past January, Publicis received the following new clients in the short time span of one month: Wal-Mart, Fox Entertainment, Wendy’s, and Coca-Cola budgeted spending in China. Risks: COMPETITIVE INDUSTRY The Media and Communications Industry is an especially competitive one, given that Publicis’ services can be easily provided by other advertising companies. Publicis must not only compete with other larger communication services, but also with smaller agencies that target local and regional areas. Also, with the advent of the web, Publicis must compete with internet companies that also offer marketing solutions to prospective clients. ECONOMIC CONDITIONS Publicis Groupe is highly vulnerable to the economy’s current conditions. This is because given an economic downturn, companies will look to consolidate spending. In this situation, one of the first actions that a company will perform is to reduce its advertising and communication budgets. Publicis’ revenues will suffer as a result of its clients’ consolidated spending. CONTRACTS WITH CLIENTS Contracts with clients can be terminated at the client’s discretion, and sometimes at short notice (three to six months). Because there are many substitutes for Publicis’ services, clients will often put up their contracts for “competitive bidding” (Publicis, therefore, has low pricing power). Also, Publicis will consolidate its spending on a few leading companies, and this strategy, although economical, could be detrimental if the company loses these clients. ACQUISITION RISKS Recently, the company’s business strategy has been one of aggressive acquisition, so as to expand the company’s range of communication services. Although this is a progressive strategy, aggressive acquisitions are risky in their effects on the company’s investments. Also, if these companies are not well integrated into Publicis’ existing operations, then these acquisitions could have an unfavorable effect on company earnings (such as restructuring costs). Recommendation: The company has acquired over a hundred other corporations since 1996. Although this may at first sound like a very aggressive acquisition strategy, it is imperative for the company to do this in order to “stay alive”, given the aforementioned nature of the media industry. The ambition, behind these acquisitions, according to CEO Maurice levy, is to “attract the best client…to have the critical mass because we are in a market where bargain is important and economy of scale is important”. Through applying the average PE on its forward earnings (in 2007) 16.3 X 3.12= $51.00 (share price target). I propose that Smart Woman Securities buy at the current price, and sell at a price of $51.00 per share. The potential for near term catalysts for the stock, as well as a strong business strategy, low P/E ratio in relation to its competitors, and positive cash flow despite investment expenditures indicates that the company has the potential to continue an upward trend. For these reasons, I recommend Publicis Groupe a BUY, and propose that Smart Woman Securities invest in the company. Sources: CNN.com, Googlefinance.com, yahoofinance.com, Publicis groupe.com, Publicis Groupe SEC Annual Report, 2007, reuters.com