JOURNAL ENTRY “CHEAT SHEET”

advertisement

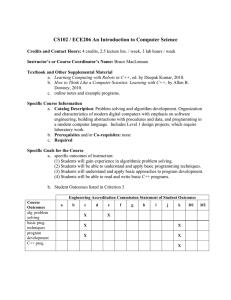

JOURNAL ENTRY HELPFUL HINTS 1. If an Account number begins with a 1, 2, or 3 (a balance sheet account) the Tcode is either B410 (for a credit “-“) or B411 (for a debit “+”). 2. If an Account number begins with a 4 or 5 (a revenue account) the Tcode is either 410 (for a credit “-“) or 411 (for a debit “+”). Also, revenue accounts MUST have a Prog FIN of “000”, and MUST have a SOF (usually “3000” unless another value has been approved by Bob Preston). 3. If an Account number begins with a 6, 7, or 8 (an expense account) the Tcode is either 412 (for a credit “-“) or 413 (for a debit “+”) Also, expense accounts CANNOT have a Prog FIN of “000” and DO NOT have a SOF. 4. While any fund can have a project, if the fund is either 1113 or 1253, then there MUST be Project information included (Proj Business Unit, Project, Activity ID, Resource Type, and Analysis Type). For General Ledger accounts, Analysis Types are “GLE” for EXPENSE accounts and “GLR” for REVENUE and BALANCE SHEET accounts. Cost share accounts will use CGE or CGR as directed by Grant Accounting. 5. If the fund on an EXPENSE account is 1112 the Prog FIN MUST be “081”. NOTE: for a REVENUE account, refer to #2 above. Any JE received that has misapplied any of these “rules” or that has any other incorrect or missing information will be returned to the requester. If you have additional questions, contact your Division Coordinator or Financial Accounting and Reporting for support.