1–1 How does managerial accounting differ from

advertisement

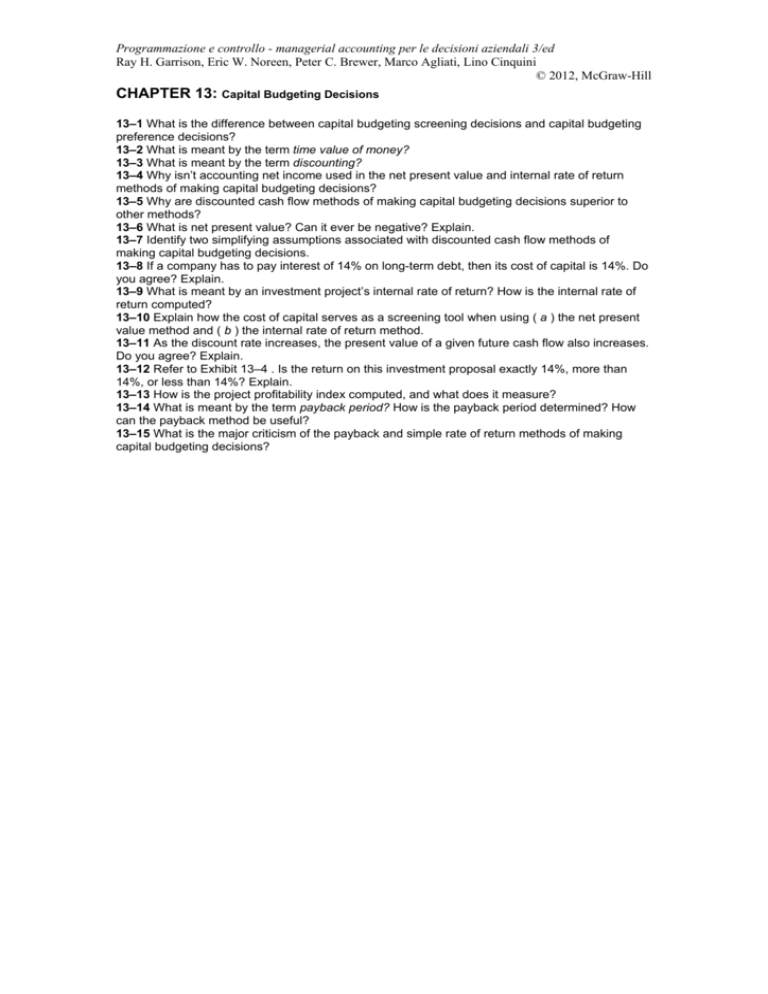

Programmazione e controllo - managerial accounting per le decisioni aziendali 3/ed Ray H. Garrison, Eric W. Noreen, Peter C. Brewer, Marco Agliati, Lino Cinquini © 2012, McGraw-Hill CHAPTER 13: Capital Budgeting Decisions 13–1 What is the difference between capital budgeting screening decisions and capital budgeting preference decisions? 13–2 What is meant by the term time value of money? 13–3 What is meant by the term discounting? 13–4 Why isn’t accounting net income used in the net present value and internal rate of return methods of making capital budgeting decisions? 13–5 Why are discounted cash flow methods of making capital budgeting decisions superior to other methods? 13–6 What is net present value? Can it ever be negative? Explain. 13–7 Identify two simplifying assumptions associated with discounted cash flow methods of making capital budgeting decisions. 13–8 If a company has to pay interest of 14% on long-term debt, then its cost of capital is 14%. Do you agree? Explain. 13–9 What is meant by an investment project’s internal rate of return? How is the internal rate of return computed? 13–10 Explain how the cost of capital serves as a screening tool when using ( a ) the net present value method and ( b ) the internal rate of return method. 13–11 As the discount rate increases, the present value of a given future cash flow also increases. Do you agree? Explain. 13–12 Refer to Exhibit 13–4 . Is the return on this investment proposal exactly 14%, more than 14%, or less than 14%? Explain. 13–13 How is the project profitability index computed, and what does it measure? 13–14 What is meant by the term payback period? How is the payback period determined? How can the payback method be useful? 13–15 What is the major criticism of the payback and simple rate of return methods of making capital budgeting decisions?