Econ 121 Midterm Exam – II

advertisement

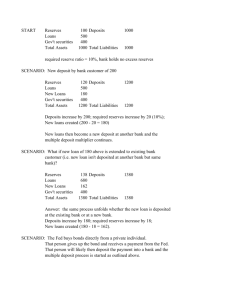

Econ 121 Midterm Exam – II Instructor: Chao Wei Provide a BRIEF AND CONCISE answer to each question. There are 50 points on this exam. 1. (12 points) Prepare the balance sheet of a bank that has $20 million in reserves, $40 million in securities, $140 million in loans, $150 million in deposits, and $50 million in equity capital. a. What are the bank’s excess reserves if the reserve requirement is 10% of deposits? (2 points) Excess reserves = $20-$150*10% = $5 million b. Suppose that checks drawn on the bank’s accounts withdraw $10 million. Show what the revised balance sheet looks like? (1 point) How much additional reserve does the bank need? (1 point) Assets side: $10 million in reserves, $40 million in securities, $140 million in loans; Liabilities side: $140 million in deposits, and $50 million in equity capital. Excess reserves = $10-$140*10% = -$4 million c. Suppose that the bank chooses one of the following transactions to make up its reserve deficiency: (1) sell securities; (2) call in loans; (3) borrow from other banks; (4) issue equity shares. For each of the above 4 options, first show what the balance sheet looks like after each transaction, then explain the advantages and drawbacks of using that particular transaction to make up the reserve deficiency (2 points for each transaction). After selling securities, the assets side of the balance sheet is: Reserves $14 million, Securities $36 million, Loans $140 million. Liabilities side is the same as that in b (1 point). Advantages: Securities market is highly liquid. Securities can be sold at small or little transaction cost (0.5 point). Disadvantages: The bank is forgoing interest earnings of securities. The transaction can involve capital loss and potential capital gain is also subject to taxes (0.5 point). After calling in loans, the assets side of the balance sheet is: Reserves $14 million, Securities $40 million, loans $136 million. Liabilities side is the same as that in b (1 point). Advantages: It is an opportunity to drop risky borrowers (0.5 point). Disadvantages: The bank risks offending customers, and potentially jeopardizes the repayment of entire loan made to the customer if some portion of the loan has been lent out to him (0.5 point). After borrowing from other banks, the assets side of the balance sheet is: Reserves $14 million, Securities $40 million, loans $140 million. Liabilities side is: Deposits $140 million, Borrowing from other banks $4 million, Equities $50 million (1 point). Advantages: (1) There is no need to reduce interestbearing assets. (2) Return on equity will be higher if return on assets is the same as before (0.5 point). Disadvantage: The bank now has smaller equity-Asset ratio, and subject to higher risk of insolvency if there are large loan losses (0.5 point). After issuing equity shares, the asset side of the balance sheet is: Reserves $14 million, Securities $40 million, loans $140 million. Liabilities side is: Deposits $140 million, Equities $54 million (1 point). Advantages: Higher bank capital is a cushion against bank failure (0.5 point). Disadvantages: The original shareholders’ control of the bank is diluted and the return on equity may decrease (0.5 point). 2. (8 points) If you were a banker who believed that interest rates were about to rise, use gap and duration analysis to explain what you would try to do with your bank’s balance sheet and why it makes sense to do so. (4 points each for gap/duration analysis, 2 points on “what” and 2 points on “why” respectively). If I were a banker, I would rearrange the balance sheet to: a. Increase rate-sensitive assets and decrease rate-sensitive liabilities to make the GAP positive, because when GAP is positive, if the interest rate increases, the bank profits will increase. b. Shorten the duration of assets and lengthen the duration of liabilities. When the interest rate increases, market values of both assets and liabilities decline. By shortening the duration of assets and lengthening the duration of liabilities, one can make the decline in the value of liabilities larger than the decline in the value of assets, thus contributing to an increase in the bank’s net worth. 3. (10 points) Suppose that the First National Bank has the following balance sheet (in million dollars): Assets: Reserves 5; Loans 40; Liabilities: Deposits 35; Bank capital 10. a. If net profit is $1 million dollars, then what are the return on asset (1 point) and the return on equity (1 point)? ROA = 1/45 = 2.2% ROE = 1/10 = 10%. b. Suppose that the bank raise deposits from $35 million to $60 million. If the required reserve ratio is 10%, and if the bank holds only required reserves and loans out all excess reserves, then how much in reserves will the bank have (1 point)? How much in loans will the bank have (2 points)? The bank will have $6 million in reserves, and $64 million in loans. c. If the return on asset is unchanged, what is the net profit that the bank earns (2 points)? What is the new return on equity (3 points)? Net profit = 70*2.2% = $1.54 million ROE = 1.54/10 = 15.4%. 4. (9 points) The following questions address the internet’s impact on asymmetric information problems: a. How can the Internet help to solve information problems? The internet helps to reduce adverse selection problem by making it much cheaper and faster to access information on previously unknown firms. It reduces moral hazard problem as it is now easier to monitor firms by accessing their information through internet. b. Can the internet compound some information problems? Yes. Because it is cheap to put on the internet all kinds of information, including false and unverified information, and it is costly to extract true information from noises. C. On which problem would the Internet have a greater impact, adverse selection or moral hazard? A greater impact on adverse selection problem because it is now relatively easier to access information on young firms new on the market. Internet can serve some monitoring function, but far from perfect. 5. (6 points) If lower money growth is associated with lower future inflation and if announced money growth turns out to be extremely low but is still higher than the market expected, what do you think would happen to long-term bond prices? According to the efficient market hypothesis, prices reflect all publicly available information. The bond prices have already reflected the market’s expectation of low money growth. However, if the money growth turns out to be higher than the market expected, that implies a higher unexpected inflation, which will reduce the long-term bond prices. 6. (5 points) Provide a statement of the efficient market hypothesis. Explain one piece of evidence for and one piece of evidence against the efficient market hypothesis (1 point for the statement, each piece of evidence worth 2 points). The statement can be either: Securities prices reflect all publicly available information (Note that “publicly” is the key word, you lose 0.5 point for missing that.) Or: There are no unexploited profitable opportunities on the market. Evidence for: dart-board experiment (details in the book) Evidence against: Small firm effect, January effect, over-reaction as detailed in the textbook.