Crisis

advertisement

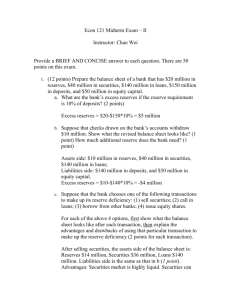

Understanding the Policy Response to the Financial Crisis Macroeconomic Theory Honors EC 204 Key Problems in the Crisis Bank Solvency Declining home prices and rising mortgage defaults put banks in danger of insolvency. Policy Response: TARP and Regulatory Reform. Credit Market Illiquidity Failure of major financial institutions (Bear Stearns, Lehman, AIG, GSEs) precipitates freezing-up of credit markets. Policy Response: Fed gets creative: TAF, TSLF, CPFF, AMLF, TALF, etc… Bank Solvency It’s all about balance sheets… Firstbank's Balance Sheet Assets Liabilities ________________________________________________ | Reserves $200 |Deposits $1,000 | Loans $800 | | Secondbank's Balance Sheet Assets Liabilities ________________________________________________ | Reserves $160 |Deposits $800 | Loans $640 | | Bank Solvency More accurate representation of a typical bank…Owners have to put up some equity! Assets Liabilities and OwnersΥEquity ________________________________________________ | Reserves $200 |Deposits $750 | Loans $500 |Debt $200 | Securities $300 | Capital (OwnerΥs Equity) $50 Bank Solvency Banks make money through leverage. Leverage ratio = Assets/Bank Capital. Example has leverage ratio of 1000/50 = 20. For every dollar of capital, the bank has 20 dollars of assets and 19 dollars of deposits and debt. Implication: Bank can lose much of its capital quickly. Bank Solvency Consider a drop of 5% in value of its assets. This represents $50. But this is the total value of the bank’s capital. A leverage ratio of 20 leads mean a 5% fall in asset value will wipe out the bank’s capital! Bank Solvency: Transmission of the Crisis Securities held by banks included mortgage-backed securities and other risky assets. As defaults on these securities rose, bank capital came under pressure: Assets Liabilities and OwnersΥEquity ________________________________________________ | Reserves $200 |Deposits $750 | Loans $500 |Debt $200 | Securities $300 | Capital (OwnerΥs Equity) $50 Bank Solvency: Transmission of the Crisis Insurance contracts on these securities bring additional parties into the crisis. Debt of the troubled financial institutions in turn becomes a problem for other investors and institutions… Assets Liabilities and OwnersΥEquity ________________________________________________ | Reserves $200 |Deposits $750 | Loans $500 |Debt $200 | Securities $300 | Capital (OwnerΥs Equity) $50 Bank Solvency - The Policy Response As Treasury Secretary Geithner has said: “Its all about capital, capital, capital…” (1) TARP - Troubled Asset Relief Program ($700B) Phase I: Putting capital directly into the banks Phase II: Entice investors to buy the bad assets (2) Regulatory reform (3) Support housing market - expand GSE lending, loan modification programs, tax incentives Bank Solvency - The Policy Response: TARP TARP I: Add to capital TARP II: Remove bad securities/add some capital Assets Liabilities and OwnersΥEquity ________________________________________________ | Reserves $200 |Deposits $750 | Loans $500 |Debt $200 | Securities $300 | Capital (OwnerΥs Equity) $50 Bank Solvency - The Policy Response: TARP II TARP II: Deals with two sorts of troubled assets Risky home loans: FDIC will lend 85% of cost to investor, additional 7.5% in Treasury equity, investor comes up with just 7.5% equity. Government and investor split any capital gain on asset. Government gets interest on loan. Loan is “Non-recourse.” Risky mortgage-backed securities: Asset managers provide 25% equity stake, Treasury matches this with equal amount of equity, and provides loan for remaining 50%. Loan is non-recourse. Some TARP funds also to be used as credit protection to expanded Federal Reserve lending facility for ABS. Bank Solvency - The Policy Response: Regulatory Reform Create a Systemic Regulator Transparency for derivatives and other exotic securities Oversight of hedge funds, insurance companies, money market funds Capital ratios Ability to takeover financial companies that present dangers to the system Intended to provide better understanding of overall risk to financial system and to ensure adequate capital to cover potential risks. Bank Solvency - The Policy Response: Regulatory Reform Again, can use the simple balance sheet to understand how such reforms would work… Assets Liabilities and OwnersΥEquity ________________________________________________ | Reserves $200 |Deposits $750 | Loans $500 |Debt $200 | Securities $300 | Capital (OwnerΥs Equity) $50 Bank Solvency - The Policy Response: Housing Market Attempts to support housing market and stem rise in default rate on mortgages: Expand GSE lending Loan modification programs Tax Incentives Fed purchases of long-term securities -- bring down mortgage rates Evidence that mortgage market has responded, as rates continue at low levels. But high unemployment represents a strong headwind. Credit Market Illiquidity Federal Reserve has responded in three key ways to the breakdown in the credit system. Traditional role as lender of last resort - both using OMO and new approaches. Provision of liquidity directly to borrowers and investors in key credit markets. Support for specific institutions (AIG, Citi, BoA). Credit Market Illiquidity Lender of last resort: Cut federal funds rate from 5.25 to near zero Extended repayment period for discount window borrowing Term Auction Facility - all 7000+ commercial banks eligible -- broader types collateral Facilities for lending to primary dealers - lengthen term and allow broader types of collateral Credit Market Illiquidity Provision of credit to markets: Commercial paper market Money market mutual funds Asset-backed loan markets -- consumer, credit card, auto, student, business loans (nonrecourse) -- Expanded to include GSE debt, other MBS and L.T. Treasuries Credit Market Illiquidity Loans for Specific Institutions: Begun with Bear Stearns workout AIG Citi BoA Credit Market Illiquidity Implications of Fed policy response: Balance sheet of Federal Reserve has changed drastically Both composition and size Banks holding large amounts of excess reserves Huge decline in money supply multiplier The Fed’s Balance Sheet: July 2007 Assets Treasury Securities Liabilities Currency $790.6 781.4 Repurchase Agreements 16.8 Loans 42.4 30.3 Commercial Bank Reserves 0.2 U.S. Treasury Deposits and Official Foreign Liabilities Foreign Exchange 20.8 Other 5.7 Gold 11.0 Capital 34.1 Other Total Assets 27.5 880.4 Total Liabilities Plus Capital 880.4 The Fed’s Balance Sheet: March 2009 Assets Treasury Securities 898.0 $422.7 Liabilities Currency Mortgage-Bkd Securities 795.7 237.0 Commercial Bank Reserves Loans 278.0 Liabilities 913.0 U.S. Treasury Deposits and Official Foreign CB Liquidity Swaps Gold 328.0 11.0 Other factors Absorbing Reserves 1307.3 Capital and other liabilities 55.0 Total Assets of the Federal Reserve Since the beginning of the financial market turmoil in August 2007, the Federal Reserve's balance sheet has grown in size and has changed in composition. Total assets of the Federal Reserve have increased significantly from $869 billion on August 8, 2007. Selected Assets of the Federal Reserve The increase in the size of the Federal Reserve's balance sheet has been accompanied by a change in the composition of the assets held. The level of securities held outright has declined, on net, while the various liquidity facilities have added a host of other assets. 25 26 Credit Extended through Federal Reserve Liquidity Facilities Among the liquidity facilities, the largest changes in assets have resulted from credit extended through the Term Auction Facility, the Commercial Paper Funding Facility, and the central bank liquidity swap lines. 28 Selected Liabilities of the Federal Reserve On the liabilities side of the Federal Reserve's balance sheet, the amount of currency increased somewhat, but reserve balances (deposits of depository institutions) have increased dramatically, as have Treasury's deposits with the Federal Reserve. 30 31 32 33 34 35 36