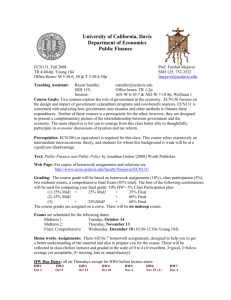

Department of Economics - University of California, Davis

advertisement

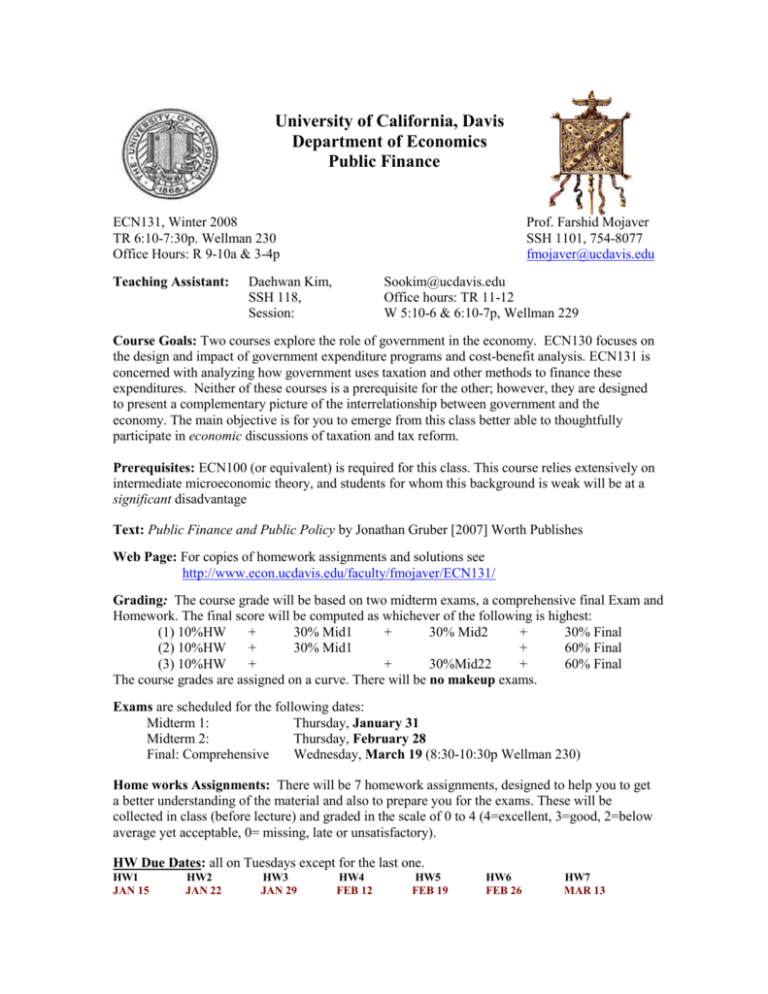

University of California, Davis Department of Economics Public Finance ECN131, Winter 2008 TR 6:10-7:30p. Wellman 230 Office Hours: R 9-10a & 3-4p Teaching Assistant: Prof. Farshid Mojaver SSH 1101, 754-8077 fmojaver@ucdavis.edu Daehwan Kim, SSH 118, Session: Sookim@ucdavis.edu Office hours: TR 11-12 W 5:10-6 & 6:10-7p, Wellman 229 Course Goals: Two courses explore the role of government in the economy. ECN130 focuses on the design and impact of government expenditure programs and cost-benefit analysis. ECN131 is concerned with analyzing how government uses taxation and other methods to finance these expenditures. Neither of these courses is a prerequisite for the other; however, they are designed to present a complementary picture of the interrelationship between government and the economy. The main objective is for you to emerge from this class better able to thoughtfully participate in economic discussions of taxation and tax reform. Prerequisites: ECN100 (or equivalent) is required for this class. This course relies extensively on intermediate microeconomic theory, and students for whom this background is weak will be at a significant disadvantage Text: Public Finance and Public Policy by Jonathan Gruber [2007] Worth Publishes Web Page: For copies of homework assignments and solutions see http://www.econ.ucdavis.edu/faculty/fmojaver/ECN131/ Grading: The course grade will be based on two midterm exams, a comprehensive final Exam and Homework. The final score will be computed as whichever of the following is highest: (1) 10%HW + 30% Mid1 + 30% Mid2 + 30% Final (2) 10%HW + 30% Mid1 + 60% Final (3) 10%HW + + 30%Mid22 + 60% Final The course grades are assigned on a curve. There will be no makeup exams. Exams are scheduled for the following dates: Midterm 1: Thursday, January 31 Midterm 2: Thursday, February 28 Final: Comprehensive Wednesday, March 19 (8:30-10:30p Wellman 230) Home works Assignments: There will be 7 homework assignments, designed to help you to get a better understanding of the material and also to prepare you for the exams. These will be collected in class (before lecture) and graded in the scale of 0 to 4 (4=excellent, 3=good, 2=below average yet acceptable, 0= missing, late or unsatisfactory). HW Due Dates: all on Tuesdays except for the last one. HW1 JAN 15 HW2 JAN 22 HW3 JAN 29 HW4 FEB 12 HW5 FEB 19 HW6 FEB 26 HW7 MAR 13 Topics I. Introduction: Issues, Tools and Measurement Labor Supply and Behavioral Effects of Taxes Empirical Tools of Public Finance Reading Assignments Gruber Ch 2 Gruber Ch 3 II. The structure of taxes in the US Gruber Ch 18 Overview of types of taxes Structure of individual income taxes in the US Measuring the fairness of tax systems Defining the tax base and the appropriate unit for taxation III. Who Pays? (Tax Incidence) The economics of tax incidence Tax incidence extensions General equilibrium analysis of tax incidence Actual incidence of taxation in the U.S. Gruber Ch 19 IV. Taxation and Efficiency Elasticities and inefficiency Deadweight loss and efficient tax systems Optimal commodity taxes Optimal Income taxes Gruber Ch 20 V. Taxes on labor supply Theory: How do taxes affect work behavior? Measuring the effects of taxes on labor supply Earned Income Tax Credit Child Care Tax Credits Gruber Ch 21 VI. Taxes on savings Theory and evidence on taxes and savings Retirement savings and taxes Gruber Ch 22 VII. Taxes on risk taking and wealth Gruber Ch 23 Theory and evidence on taxes, investment and wealth Capital gains taxation Estate taxes Property Taxes VIII. Corporate Taxes in the US Details & Structure Incidence of the corporate tax Effects on Behavior Gruber Ch 24 IV. Fundamental Tax Reform in the US Gruber Ch 25