Chapter 23 Taxes on Risk Taking and Wealth

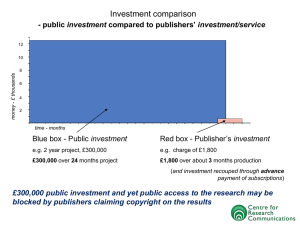

advertisement

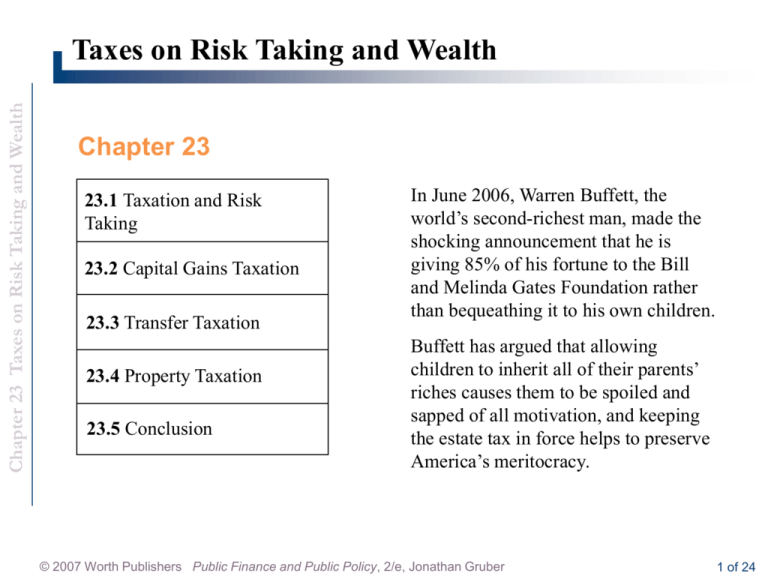

Chapter 23 Taxes on Risk Taking and Wealth Taxes on Risk Taking and Wealth Chapter 23 23.1 Taxation and Risk Taking 23.2 Capital Gains Taxation 23.3 Transfer Taxation 23.4 Property Taxation 23.5 Conclusion In June 2006, Warren Buffett, the world’s second-richest man, made the shocking announcement that he is giving 85% of his fortune to the Bill and Melinda Gates Foundation rather than bequeathing it to his own children. Buffett has argued that allowing children to inherit all of their parents’ riches causes them to be spoiled and sapped of all motivation, and keeping the estate tax in force helps to preserve America’s meritocracy. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 1 of 24 23 . 1 Chapter 23 Taxes on Risk Taking and Wealth Taxation and Risk Taking Basic Financial Investment Model expected return The return to a successful investment times the odds of success, plus the return to an unsuccessful investment times the odds of failure. E(Ret) = P1( R1) + 1-P(R2 ) © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 2 of 24 23 . 1 Chapter 23 Taxes on Risk Taking and Wealth Taxation and Risk Taking Basic Financial Investment Model © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 3 of 24 23 . 1 Chapter 23 Taxes on Risk Taking and Wealth Taxation and Risk Taking Real-World Complications Less-Than-Full Tax Offset tax loss offset The extent to which taxpayers can deduct net losses on investments from their taxable income. Redistributive Taxation The idealized model of risk taking also assumes a constant rate of tax on investment income. In reality, tax systems are typically progressive, with higher marginal tax rates as income rises. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 4 of 24 23 . 1 Chapter 23 Taxes on Risk Taking and Wealth Taxation and Risk Taking Evidence on Taxation and Risk Taking There is no clear prediction about how taxation will affect risk taking in the real world. Ultimately, what the effect of taxes is on risk taking is an empirical question. There is very little evidence about the effect of capital income taxation on risk taking. Labor Investment Applications Financial investments are not the only risky investments individuals make—they can also invest in human capital through education or other job training. Investing in human capital is risky because individuals are making an up-front sacrifice in return for some expectation of higher earnings in the future. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 5 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation Current Tax Treatment of Capital Gains capital gain The difference between an asset’s purchase price and its sale price. taxation on accrual Taxes paid each period on the return earned by an asset in that period. taxation on realization Taxes paid on an asset’s return only when that asset is sold. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 6 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation Current Tax Treatment of Capital Gains “Step-up” of Basis at Death basis The purchase price of an asset, for purposes of determining capital gains. Exclusion for Capital Gains on Housing The tax code in the United States has traditionally featured an exclusion for capital gains on houses. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 7 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation Current Tax Treatment of Capital Gains Capital Gains Tax Rates Through the Years Even with this long list of tax preferences for capital gains, this form of income has traditionally borne lower tax rates than other forms of income: 1. From 1978 through 1986, individuals were taxed on only 40% of their capital gains on assets held for more than six months. 2. The Tax Reform Act of 1986 ended this difference and treated capital gains like other forms of income for tax purposes, with a top tax rate of 28%. 3. The Tax Reform Act of 1993 raised top tax rates on other forms of income to 39% but kept the tax rate on capital gains at 28%. 4. The Taxpayer Relief Act of 1997 reduced the top rate on long-term capital gains to 20% (though certain items, like collectibles such as art and coins, are still taxed at 28%). 5. The 2003 Jobs and Growth Act reduced the top rate further, to 15%, for gains realized after May 5, 2003 (collectibles are still taxed at 28%). © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 8 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation Current Tax Treatment of Capital Gains Capital Gains Tax Rates Through the Years © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 9 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation What Are the Arguments for Tax Preferences for Capital Gains? Although it may not seem fair to tax capital gains at a rate that is much lower than rates on other forms of income, three major arguments are commonly made for these lower tax rates: Protection Against Inflation Improved Efficiency of Capital Transactions lock-in effect In order to minimize the present discounted value of capital gains tax payments, individuals delay selling their capital assets, locking in their assets. Encouraging Entrepreneurial Activity prospective capital gains tax reduction Capital gains tax cuts that apply only to investments made from this day forward. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 10 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation What Are the Arguments for Tax Preferences for Capital Gains? Evidence on Taxation and Capital Gains © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 11 of 24 23 . 2 Chapter 23 Taxes on Risk Taking and Wealth Capital Gains Taxation What Are the Arguments Against Tax Preferences for Capital Gains? There are two arguments against the existing favoritism shown to capital gains income in most nations: First, capital gains taxes are very progressive. Capital gains income accrues primarily to the richest taxpayers in the United States. Second, lower tax rates on capital gains violate the Haig-Simons principle for tax systems. The goal of taxation should be to provide a level playing field across economic choices, not to favor one choice over another, unless there is some equity or efficiency argument for doing so (such as a positive externality that justifies a tax preference). © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 12 of 24 23 . 3 Chapter 23 Taxes on Risk Taking and Wealth Transfer Taxation transfer tax A tax levied on the transfer of assets from one individual to another. gift tax A tax levied on assets that one individual gives to another in the form of a gift. estate tax A tax levied on the assets of the deceased that are bequeathed to others. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 13 of 24 23 . 3 Chapter 23 Taxes on Risk Taking and Wealth Transfer Taxation © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 14 of 24 23 . 3 Chapter 23 Taxes on Risk Taking and Wealth Transfer Taxation Why Tax Wealth? Arguments for the Estate Tax There are at least three arguments for taxing wealth. The first is that this is an extremely progressive means of raising revenue. The second argument is that wealth taxes are necessary to avoid the excessive concentration of wealth and power in society in the hands of a few wealthy dynasties. A third issue that has often been raised by supporters of the estate tax is the claim that allowing children of wealthy families to inherit all their parents’ wealth saps them of all motivation to work hard and achieve their own success. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 15 of 24 23 . 3 Chapter 23 Taxes on Risk Taking and Wealth Transfer Taxation Arguments Against the Estate Tax There are four major arguments made against the estate tax as it is levied in the United States. A “Death Tax” Is Cruel The Estate Tax Amounts to Double Taxation Administrative Difficulties Compliance and Fairness © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 16 of 24 23 . 5 Chapter 23 Taxes on Risk Taking and Wealth Conclusion The impact of the tax code on decisions about how much to save, and in what form to save it, will always be central to debates over tax reform. Taxation doesn’t necessarily reduce, and under certain assumptions definitely increases, risk taking. The strongest arguments for the preferential tax treatment of capital gains are that: (a) lower capital gains tax rates will “unlock” productive assets, and (b) lower capital gains taxes will encourage entrepreneurship. The existing evidence on the former suggests that such unlocking is not large in the long run. The theoretical discussion suggests that the predictions for entrepreneurship are unclear. Even if lower capital gains taxation promotes risk taking and entrepreneurship, it does so at the very high cost of providing large subsidies to previous investments. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 17 of 24 Chapter 23 Taxes on Risk Taking and Wealth © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 18 of 24 Chapter 23 Taxes on Risk Taking and Wealth Corporate Taxation Chapter 24 24.1 What Are Corporations and Why Do We Tax Them? 24.2 The Structure of the Corporate Tax 24.3 The Incidence of the Corporate Tax 24.4 The Consequences of the Corporate Tax for Investment 24.5 The Consequences of the Corporate Tax for Financing 24.6 Treatment of International Corporate Income To its detractors, the corporate tax is a major drag on the productivity of the corporate sector, and the reduction in the tax burden on corporations has been a boon to the economy that has led firms to increase their investment in productive assets. To its supporters, the corporate tax is a major safeguard of the overall progressivity of our tax system. By allowing the corporate tax system to erode over time, supporters of corporate taxation argue, we have enriched capitalists at the expense of other taxpayers. 24.7 Conclusion © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 19 of 24 Chapter 23 Taxes on Risk Taking and Wealth Corporate Taxation © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 20 of 24 Chapter 23 Taxes on Risk Taking and Wealth What Are Corporations and Why Do We Tax Them? Corporations are distinct entities Corporations have special priviliges Corporate tax protects the integrity of the income tax system © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 21 of 24 24 . 1 Chapter 23 Taxes on Risk Taking and Wealth What Are Corporations and Why Do We Tax Them? shareholders Individuals who have purchased ownership stakes in a company. Ownership Versus Control agency problem A misalignment of the interests of the owners and the managers of a firm. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 22 of 24 Chapter 23 Taxes on Risk Taking and Wealth APPLICATION Executive Compensation and the Agency Problem A number of corporate executives have made the news in recent years for receiving compensation packages that seem wildly out of proportion to the executives’ actual value. How can executives receive such high compensation? There are two possible reasons: First, they may be worth it: after all, these individuals are running some of the most important companies in the world. Nonetheless, this high compensation doesn’t seem to be related to superior performance in many cases. The second possible reason is that owners of firms have a hard time keeping track of the actual compensation of the firm’s managers, and the managers exploit this limitation to compensate themselves well. Owners of corporations try to keep control of executive mismanagement through the use of a board of directors. board of directors A set of individuals who meet periodically to review decisions made by a firm’s management and report back to the broader set of owners on management’s performance. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 23 of 24 Chapter 23 Taxes on Risk Taking and Wealth APPLICATION Executive Compensation and the Agency Problem © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 24 of 24 24 . 1 Chapter 23 Taxes on Risk Taking and Wealth What Are Corporations and Why Do We Tax Them? Firm Financing debt finance The raising of funds by borrowing from lenders such as banks, or by selling bonds. bonds Promises by a corporation to make periodic interest payments, as well as ultimate repayment of principal, to the bondholders (the lenders). equity finance The raising of funds by sale of ownership shares in a firm. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 25 of 24 24 . 1 Chapter 23 Taxes on Risk Taking and Wealth What Are Corporations and Why Do We Tax Them? Firm Financing dividend The periodic payment that investors receive from the company, per share owned. capital gain The increase in the price of a share since its purchase. retained earnings Any net profits that are kept by the company rather than paid out to debt or equity holders. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 26 of 24 24 . 1 Chapter 23 Taxes on Risk Taking and Wealth What Are Corporations and Why Do We Tax Them? Why Do We Have a Corporate Tax? Pure Profits Taxation economic profits The difference between a firm’s revenues and its economic opportunity costs of production. accounting profits The difference between a firm’s revenues and its reported costs of production. Retained Earnings © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 27 of 24 24 . 2 Chapter 23 Taxes on Risk Taking and Wealth The Structure of the Corporate Tax The taxes of any corporation are: Taxes = ([Revenues – Expenses] × τ ) – Investment tax credit Revenues These are the revenues the firm earns by selling goods and services to the market. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 28 of 24 24 . 2 Chapter 23 Taxes on Risk Taking and Wealth The Structure of the Corporate Tax Expenses depreciation The rate at which capital investments lose their value over time. depreciation allowances The amount of money that firms can deduct from their taxes to account for capital investment depreciation. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 29 of 24 24 . 2 Chapter 23 Taxes on Risk Taking and Wealth The Structure of the Corporate Tax Expenses Economic Depreciation economic depreciation The true deterioration in the value of capital in each period of time. Depreciation in Practice depreciation schedules The timetable by which an asset may be depreciated. expensing investments Deducting the entire cost of the investment from taxes in the year in which the purchase was made. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 30 of 24 Chapter 23 Taxes on Risk Taking and Wealth APPLICATION What Is Economic Depreciation? The Case of Personal Computers Personal computers are an excellent example of the difficulties in defining economic depreciation. Doms et al. (2003) gathered data on the market value of personal computers and modeled it as a function of the age of the PC. They found that the depreciation period for a PC is very rapid, on the order of only five years. Moreover, the depreciation during this period is exponential, not linear. The researchers also reached another important conclusion: most of the depreciation of PC value is not due to actual wear and tear on the machine but to the revaluation of the product as microprocessors improve. Economic depreciation is a subtle concept that goes far beyond physical depreciation of the actual machine. Tax policy makers face a daunting task in setting depreciation schedules appropriately across the wide variety of physical assets employed by firms in the United States. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 31 of 24 24 . 2 Chapter 23 Taxes on Risk Taking and Wealth The Structure of the Corporate Tax Corporate Tax Rate © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 32 of 24 24 . 2 Chapter 23 Taxes on Risk Taking and Wealth The Structure of the Corporate Tax Investment Tax Credit investment tax credit (ITC) A credit that allows firms to deduct a percentage of their annual qualified investment expenditures from the taxes they owe. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 33 of 24 24 . 3 Chapter 23 Taxes on Risk Taking and Wealth The Incidence of the Corporate Tax The burden of the corporate tax is shared by consumers, workers, corporate investors, and noncorporate investors in some proportion. Unfortunately, we have little convincing empirical evidence on the incidence of corporate taxation. The true incidence of the corporate tax remains one of the primary mysteries of public finance. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 34 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Theoretical Analysis of Corporate Tax and Investment Decisions © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 35 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Theoretical Analysis of Corporate Tax and Investment Decisions The Effects of a Corporate Tax on Corporate Investment © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 36 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Theoretical Analysis of Corporate Tax and Investment Decisions The Effects of Depreciation Allowances and the Investment Tax Credit on Corporate Investment © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 37 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Theoretical Analysis of Corporate Tax and Investment Decisions Effective Corporate Tax Rate effective corporate tax rate The percentage increase in the rate of pre-tax return to capital that is necessitated by taxation. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 38 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Theoretical Analysis of Corporate Tax and Investment Decisions Effective Corporate Tax Rate More generally, the effective corporate tax rate (ETR) is measured as: With depreciation and the ITC, the effective tax rate is: © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 39 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Negative Effective Tax Rates With a large enough z and ITC a, the effective corporate tax rate could be negative. Policy Implications of the Impact of the Corporate Tax on Investment For any given corporate tax rate, the tax system can be designed to offer very different incentives for investment. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 40 of 24 Chapter 23 Taxes on Risk Taking and Wealth APPLICATION The Impact of the 1981 and 1986 Tax Reforms on Investment Incentives Two of the most important pieces of government legislation of the 1980s were the major tax reform acts of 1981 and 1986. The 1981 tax act introduced a series of new incentives to spur investment by corporate America. Depreciation schedules were made much more rapid and an investment tax credit was introduced. Contributing to the low effective tax rates in the early 1980s were active tax avoidance and/or evasion strategies by corporations. The Tax Reform Act of 1986 made three significant changes to the corporate tax code: First, it lowered the top tax rate on corporate income from 46% to 34%. Second, it significantly slowed depreciation schedules and ended the ITC. Finally, the 1986 act significantly strengthened the corporate version of the Alternative Minimum Tax (AMT). Corporate use of legal loopholes in the tax codes seems to have rebounded in the late 1990s and continues to the present day. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 41 of 24 24 . 4 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Investment Evidence on Taxes and Investment There is a large literature investigating the impact of corporate taxes on corporate investment decisions. The conclusion of recent studies is that the investment decision is fairly sensitive to tax incentives, with an elasticity of investment with respect to the effective tax rate on the order of –0.5: as taxes lower the cost of investment by 10%, there is 5% more investment. This sizeable elasticity suggests that corporate tax policy can be a powerful tool in determining investment and that the corporate tax is very far from a pure profits tax. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 42 of 24 24 . 5 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Financing The Impact of Taxes on Financing © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 43 of 24 24 . 5 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Financing Why Not All Debt? © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 44 of 24 24 . 5 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Financing The Dividend Paradox Empirical evidence supports two different views about why firms pay dividends, as reviewed by Gordeon and Dietz (2006). The first is an agency theory: investors are willing to live with the tax inefficiency of dividends to get the money out of the hands of managers who suffer from the agency problem. The second is a signaling theory: investors have imperfect information about how well a company is doing, so the managers of the firm pay dividends to signal to investors that the company is doing well. How Should Dividends Be Taxed? An important ongoing debate in tax policy concerns the appropriate tax treatment of dividend income. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 45 of 24 Chapter 23 Taxes on Risk Taking and Wealth APPLICATION The 2003 Dividend Tax Cut One of the measures President Bush signed into law on May 28, 2003, under the Jobs and Growth Tax Relief Reconciliation Act, was a reduction in the rate at which dividends are taxed. The 2003 law reduced both the dividend and capital gains rates to 15%, making dividends significantly more attractive for investors. Proponents of the dividend tax cut believed it would both stimulate the economy and end what they perceived as the unfair practice of taxing corporate income and then taxing it again when that income was paid out in the form of dividends. Opponents of the dividend tax cut argued, however, that dividends are primarily received by higher income households and that such a tax cut would both worsen the country’s fiscal balance and make the tax burden less progressive. Several recent papers have studied the impacts of the 2003 tax reduction and there has been a clear rise in dividend payouts. The key question of whether this tax cut actually raised investment, however, remains unanswered. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 46 of 24 24 . 5 Chapter 23 Taxes on Risk Taking and Wealth The Consequences of the Corporate Tax for Financing Corporate Tax Integration corporate tax integration The removal of the corporate tax in order to tax corporate income at the individual (shareholder) level. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 47 of 24 24 . 6 Chapter 23 Taxes on Risk Taking and Wealth Treatment of International Corporate Income multinational firms Firms that operate in multiple countries. subsidiaries The production arms of a corporation that are located in other nations. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 48 of 24 24 . 6 Chapter 23 Taxes on Risk Taking and Wealth Treatment of International Corporate Income How to Tax International Income territorial tax system A tax system in which corporations earning income abroad pay tax only to the government of the country in which the income is earned. global tax system A tax system in which corporations are taxed by their home countries on their income regardless of where it is earned. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 49 of 24 24 . 6 Chapter 23 Taxes on Risk Taking and Wealth Treatment of International Corporate Income How to Tax International Income foreign tax credit U.S.-based multinational corporations may claim a credit against their U.S. taxes for any tax payments made to foreign governments when funds are repatriated to the parent. Foreign Dividend Repatriation repatriation The return of income from a foreign country to a corporation’s home country. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 50 of 24 Chapter 23 Taxes on Risk Taking and Wealth APPLICATION A Tax Holiday for Foreign Profits The proper taxation of foreign profits was the focus of the debate around the passage of the American Jobs Creation Act of 2004. The bill was intended to rejuvenate the economy and create jobs. One of its most important provisions was a one-year reduction of the tax rate on repatriated profits from 35% to 5.25%. Critics of the bill voiced a number of concerns. One of these was the difficulty in controlling how companies would spend the repatriated money. Others were skeptical of the bill’s ostensible intention of stimulating the economy. By October 2005, U.S. companies had announced the repatriation of roughly $206 billion—an amount representing nearly $37 billion in lost revenues due to the lower tax rate. However, it was clear that the expected surge in hiring and job creation was not materializing. As of this writing, a final evaluation of the bill’s effects has not yet been compiled because many companies operate according to the fiscal calendar and thus have been able to extend the deadline for repatriation well into 2006. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 51 of 24 24 . 6 Chapter 23 Taxes on Risk Taking and Wealth Treatment of International Corporate Income How to Tax International Income Transfer Pricing transfer prices The amount that one subsidiary of a corporation reimburses another subsidiary of the same corporation for goods transferred between the two. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 52 of 24 24 . 7 Chapter 23 Taxes on Risk Taking and Wealth Conclusion Despite the declining importance of the corporate tax as a source of revenue in the United States, it remains an important determinant of the behavior of corporations in the United States. The complicated incentives and disincentives that the corporate tax creates for investment appear to be significant determinants of a firm’s investment decisions. And both corporate and personal capital taxation substantially, although not completely, drive a firm’s decisions about how to finance its investments. The United States faces a difficult set of decisions about how to reform its corporate tax system. Despite repeated calls for ending “abusive corporate tax shelters,” there has been little movement to end the types of corporate tax loopholes that cause such activity. This lack of interest should not be surprising: corporate tax breaks have highly concentrated and powerful supporters, with only the diffuse taxpaying public to oppose them. © 2007 Worth Publishers Public Finance and Public Policy, 2/e, Jonathan Gruber 53 of 24