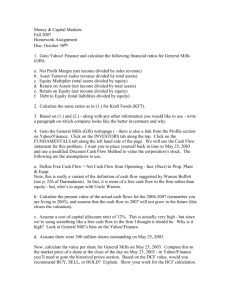

BEFORE THE

advertisement