DCF_assignment

advertisement

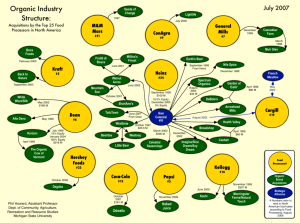

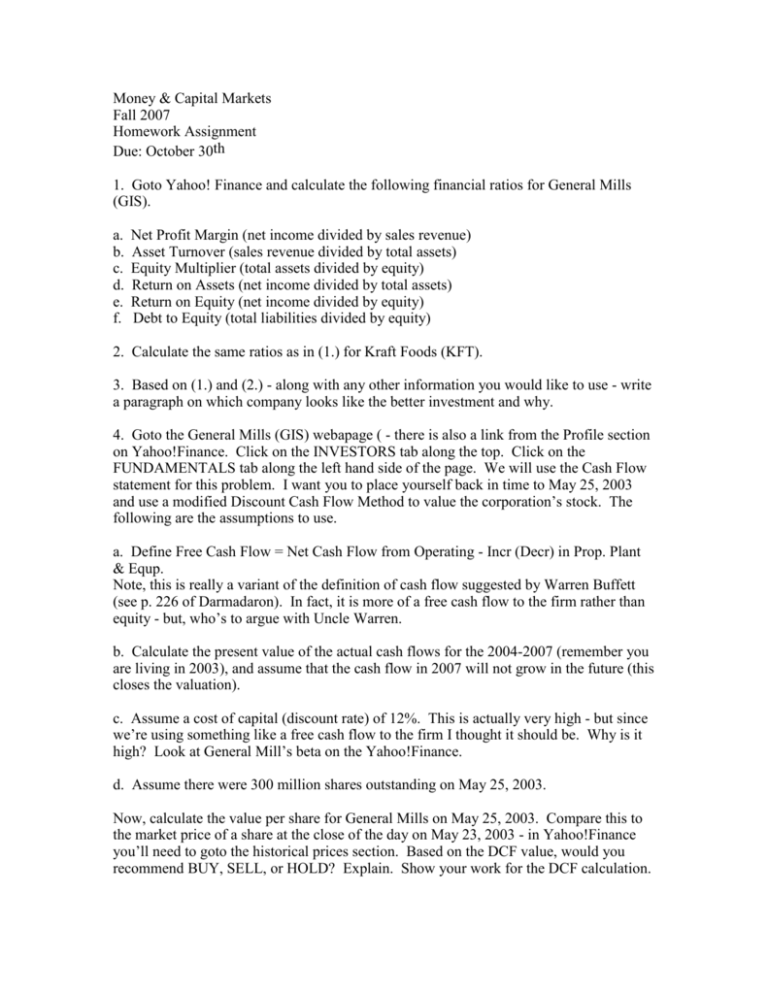

Money & Capital Markets Fall 2007 Homework Assignment Due: October 30th 1. Goto Yahoo! Finance and calculate the following financial ratios for General Mills (GIS). a. b. c. d. e. f. Net Profit Margin (net income divided by sales revenue) Asset Turnover (sales revenue divided by total assets) Equity Multiplier (total assets divided by equity) Return on Assets (net income divided by total assets) Return on Equity (net income divided by equity) Debt to Equity (total liabilities divided by equity) 2. Calculate the same ratios as in (1.) for Kraft Foods (KFT). 3. Based on (1.) and (2.) - along with any other information you would like to use - write a paragraph on which company looks like the better investment and why. 4. Goto the General Mills (GIS) webapage ( - there is also a link from the Profile section on Yahoo!Finance. Click on the INVESTORS tab along the top. Click on the FUNDAMENTALS tab along the left hand side of the page. We will use the Cash Flow statement for this problem. I want you to place yourself back in time to May 25, 2003 and use a modified Discount Cash Flow Method to value the corporation’s stock. The following are the assumptions to use. a. Define Free Cash Flow = Net Cash Flow from Operating - Incr (Decr) in Prop. Plant & Equp. Note, this is really a variant of the definition of cash flow suggested by Warren Buffett (see p. 226 of Darmadaron). In fact, it is more of a free cash flow to the firm rather than equity - but, who’s to argue with Uncle Warren. b. Calculate the present value of the actual cash flows for the 2004-2007 (remember you are living in 2003), and assume that the cash flow in 2007 will not grow in the future (this closes the valuation). c. Assume a cost of capital (discount rate) of 12%. This is actually very high - but since we’re using something like a free cash flow to the firm I thought it should be. Why is it high? Look at General Mill’s beta on the Yahoo!Finance. d. Assume there were 300 million shares outstanding on May 25, 2003. Now, calculate the value per share for General Mills on May 25, 2003. Compare this to the market price of a share at the close of the day on May 23, 2003 - in Yahoo!Finance you’ll need to goto the historical prices section. Based on the DCF value, would you recommend BUY, SELL, or HOLD? Explain. Show your work for the DCF calculation.