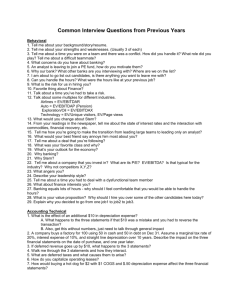

TECHNICAL QUESTIONS (2)

advertisement

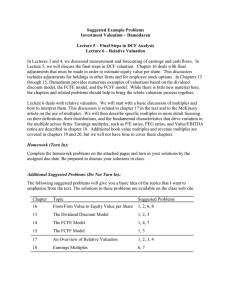

Basic: DCF: Walk through DCF Terminal value methods (gordon growth, and multiples method) and how to discount cash flows Know WACC formula CAPM formula What does the WACC tell us Formula for unlevered free cash flow Valuation: Walk through three common methods (comparables, precedents, DCF) Common multiples (EV/EBITDA, EV/Sales, P/E ratio), what does a p/e ratio tell us differences between p/e ratio and ev/ebitda ratios Enterprise Value/Equity Value: Know formula for enterprise value, why you add/subtract each item in EV formula, how to get from enterprise value to price per share Accounting: Walk through all three financial statements mentioning common line items, how changes in depreciation flow through three statements, how statements are linked M&A: Know a recent M&A transaction and be able to discuss at a high level w/multiples and metrics if possible Advanced: M&A: Walk through a merger model and understand key balance sheet adjustment in an M&A transaction, understand differences and reasons for financing a deal through cash, debt, or stock and how it ultimately affects accretion/dilution LBO: Walk through an LBO and understand how common variables affect IRR (entry multiple, exit multiple, margin expansion, leverage levels etc.) Know sources and uses, debt paydown schedule, dividence recap etc.