Lecture 1

advertisement

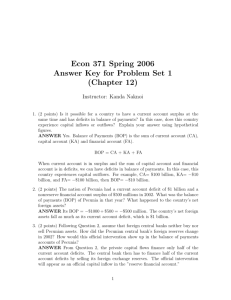

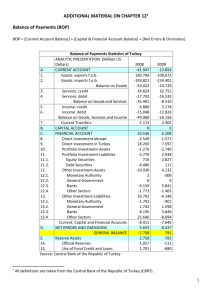

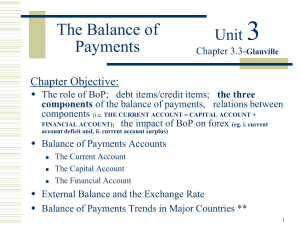

Lecture 1 National Income, BOP Accounting and Central Banking 1. National Income Accounting Y = C + I + G + CA S=Y–C–G Sp = I + CA – Sg = I + CA – (T – G) = I + CA + (G – T) Private saving (Sp): The part of disposable income that is saved rather than consumed T is the government's “income” (its net tax revenue) Sg is government savings (T-G) 4 different ways to describe the current account: a. change in net foreign assets (CA B * B*1 ) b. national saving net of investment (CA S I ) c. income minus absorption (CA Y A) d. trade balance plus net factor payments from abroad (CA X IM NF ) absorption approach, elasticity approach Issues: Causes of current account deficit? Sachs, J and F. Larrain (1993), Chapter 6: Saving, Investment, and the Current Account, in Macroeconomics in the Global Economy, Prentice-Hall.149-187. 2. BOP Accounting CA + FA CA + FA + OSA CA + FA = BOP CA + FA + = KA 0 + = S&O 0 + OSA = 0 Taiwan’s BOP: simple, detailed, and in IMF form. THE BALANCE OF PAYMENTS is a record of all transactions between domestic residents and the rest of the world. Examples: goods and services, license fees, interest income, dividends, real assets (factories, land), financial assets (stocks, bonds, bank deposits, loans), unilateral transfers (foreign aid, private gifts). Rule: Sell something to rest of world, receive payment enters as credit (+). Buy something from rest of world, make payment enters as debit (-). Think: all international transactions require foreign currency. All credit transactions give rise to supply of foreign exchange. All debit transactions give rise to demand for foreign exchange. Foreign exchange is foreign currency. We state the exchange rate as the domestic currency price (dollar price) of foreign money. When the exchange rate goes up, the home (foreign) currency goes down (up) in value. It is zero because balance of payments accountants follow the practice of double entry bookkeeping. For every credit transaction, there is an offsetting debit transaction. Economist (2003), “Facts behind the figures,” in A Survey of the World Economy, Sep. 20th, 2003. (1)(1a)(1b)(1c)(1c) Fieleke, Norman (1996), What is Balance of Payment? Federal Reserve Bank of Boston. (2) Gandolfo, Giancarlo(2001), International Finance and open-Economy Macroecnomics, Springer, LBE163446. Chapter 5: the balance of payments, 52-68 CA: 4 components: Commodity Service Factor Income Unilateral Transfer Issues: Net international investment position (ex. USA) Negative 5% is the threshold for currency crisis Persistent, sustainable, excessive, and solvent A mirror of FA International risk portfolio diversification Stock and flow view of CA Holman, Jill (2001), “Is the Large U.S. Current Account Deficit Sustainable?” Economic Review, Federal Reserve Bank of Kansas City, 86 (1), 5-23. (3) Pakko, M. (1999), “The United States Trade Deficit and the ‘New Economy’,” Federal Reserve Bank of St. Louis Review, September/October 1999. 81(5), 11-20. (4) Tille, Cedric (2003), “The Impact of Exchange Rate on U.S. Foreign Debt,”Current Issues in Economics and Finance, Federal Reserve Bank of New York, Vol. 9, No.1. (5) FA: 3 components: Foreign Direct Investment Portfolio Investment (stock and bond) Other Investment (bank loans) Issues: Liberalization of FA (ex. Taiwan’s QFII, qualified Foreign Institutional Investors) Pace, sequence, volume of capital mobility Policy response to capital inflow Economic growth and types of capital flow Components of FA and its effect on CA (S & I) M&A (Merger and Acquisition) Pension fund, mutual fund, and hedge fund Capital account crisis Economist (1998), “A Hitchhiker’s Guide to Hedge Funds,” Finance & Economics, June 11th, 1998. (6) Higgins, Matthew and Thomas Klitgaard (1998), “Viewing the Current Account Deficit as a Capital Inflow,” Current Issues in Economics and Finance, Federal Reserve Bank of New York, Vol. 4, No. 13. (7) OSA: Change of foreign reserves Issues: Over-holding of foreign reserves (3-6 months of imports): cost and benefit (ex. Asian countries after crisis) Flow and stock (total reserves minus gold) Economist (2003), “Fear of floating,” Asian Currency, Jul 10th, 2003. (8) 3. Central Bank Balance Sheet B D NFAcb B: monetary base, includes currency and commercial bank reserves or deposits at the central bank. D: domestic credit, includes US treasury debt and discount lending NFAcb : foreign exchange reserves Issues: Central Bank’s Balance Sheet Holding reserves Foreign exchange market intervention Sterilization Monetization of government debt Economist (2003), “Fix or float?” Economics Focus, Sep 11th, 2003. (9) Economist (2003), “Rocky Mountain High,” Economics Focus, Sep. 6th, 2003. (10) Gavin, William and William Poole (2003), “What Should a Central Bank Look Like?” The Regional Economist, Federal Reserve Bank of Saint Louis, July, 5-9. (11)