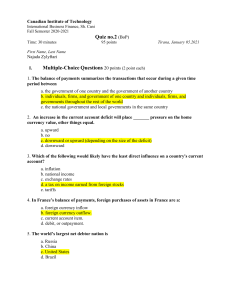

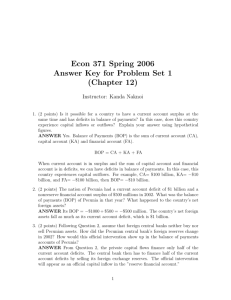

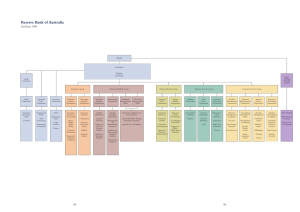

The Balance of Payments Unit 3 Chapter 3.3-Glanville Chapter Objective: The role of BoP; debt items/credit items; the three components of the balance of payments, relations between components (i.e. THE CURRENT ACCOUNT = CAPITAL ACCOUNT + FINANCIAL ACCOUNT); the impact of BoP on forex (eg. i. current account deficit and, ii. current account surplus) Balance of Payments Accounts The Current Account The Capital Account The Financial Account External Balance and the Exchange Rate Balance of Payments Trends in Major Countries ** 1 Balance of Payments The Balance of Payments is (another def’n) “a statistical record/statement of a country’s international economic transactions over a certain period of time” -- presented in the form of double-entry bookkeeping (zero sum). Why is it useful ? The BOP provides detailed information about where the supply & demand of/for a country’s currency originates The trade statistics in the Current Account, for example, show the composition of trade – what a country imports and what it exports. The Capital Account shows inflows and outflows of capital goods in various categories. Financial Account shows how funds invested in real assets (businesses, commercial real estate AND financial assets move (a nation to RoW) Viewed over time, BOP data can help explain important developments in a country’s comparative advantage and 2 international competitiveness. Balance of Payments IMF def’n of BoP: the statistical statement that summarizes, for a specific time period, the economic transactions of an economy with the rest of the world eg. …trade in goods and services (i.e. commodities), inter-national capital transfers and financial transactions involving the ownership of assets (i.e. foreign direct investment; bond/debt purchases etc. etc.) 3 Balance of Payments Accounts They are composed of the following: The Current Account The Capital Account The Financial Account “Official Reserve Account” the foreign currency and securities held by the government, usually by its central bank, and used to balance the payments from year to year (fall = sell reserves) WHEN ALL THREE ADD TO > O -- OFFICIAL RESERVES RISE WHEN ALL THREE ADD TO <O --OFFICIAL RESERVES FALL *Current + Capital + Financial Accounts + Change in reserves = 0 4 Balance of Payments Accounts Current Account *EACH of these 4 has a + AND a (-) entry Records flows of funds between a nation and the RoW for : exports, imports, investment income, and international financial transfers. Trade in Goods (aka Merchandise trade) – export and import of tangible goods –the visible account … the invisible account (3 parts below) Trade in Services – payments and receipts for legal and consulting fees, royalties, tourist expenditures Income from investments (aka Primary Income) – payments and receipts of interest, dividends, and other income on foreign investments (rent, profit) Transfers which are current (aka Secondary Income) – “unrequited” payments, ‘free money’ (e.g. Foreign/military/food aid and remittances aka ‘current transfers’ of wages sent by workers to their home country ). If the debits (-) exceed the credits, then a country is running a trade deficit. If the credits (+) exceed the debits, then a country is running a trade surplus. 5 Remittances can be HUGE ! 6 Balance of Payments --current account: transfer balances (remittances) Large transfers from one country to another give the receiving country the ability to import more from abroad (i.e. foreign workers sending money home leads to increased forex in their home nations) similarly…later we’ll see types of ‘tied aid’ where donor countries transfer THEIR OWN CURRENCY to another country … and require the aid be spent on the donor-nation’s own goods (i.e. official transfers can actually harm domestic producers/markets in poor nations– when donations/spending ends up supporting foreign producers) 7 Balance of Payments --current account: persistent deficits Effect on foreign ownership: BoP must equal zero…negative current account is offset by surplus in capital & financial account –if the money does not return to buy G & S then it will buy real assets…or held in reserves of the central bank ..export foreign ownership. To what extent is this a threat to sovereignty? Effect on interest rates: to protect the currency from massive depreciation much higher interest rates maybe be required (the interest rate effect)… i.e. deficit countries need to offset this with financial account surpluses …BUT higher borrowing costs slow domestic growth (i.e. low C & I in AD…impact X in l-run) Effect on indebtedness: foreign ownership of domestic government bonds and debt...central bank of another nation buys bonds from the nation which it has a large surplus with--debts get paid with INTEREST 8 Balance of Payments --current account: persistent deficits (US and China) Why has the USA avoided the ‘interest rate effect’ and not had to raise r-rates 2008—2017? Zero interest rates (C-bank) with persistent current account deficits is the result of the macro conditions in the USA. Deflation posed the bigger threat (esp. 2008-2011) so that fear led to continued high demand for US debt (gov’t bonds). August 2010: Chinese central bank held $868 Billion in US treasury securities. Total US debt (to all foreign nations) was $4.2 trillion –about 40% of total national debt …about 25% of the USA’s total GDP (by 2011). (17 min) https://www.youtube.com/watch?v=cg17YTtsk2U 9 Balance of Payments Accounts The Capital Account AND Financial Account (‘K’) Capital Account: records sales to foreigners of (i.e. Canadian) capital assets and (i.e. Canadian) purchases from foreigners of capital assets (build a hospital overseas?) AND payments (+/-) for licenses, patents, trademarks Financial Account is composed of Foreign Direct Investment (FDI), portfolio investments, and reserve assets (like a balancing item?) Direct investment involves acquisitions of controlling interests in foreign businesses. Portfolio investment represents investment in foreign shares and bonds that do not involve acquisitions of control (i.e. small & BIG POTS OF $$: c/b financial firms, sovereign wealth funds, insurance co., pension funds etc.) RESERVE ASSETS: includes bank deposits, currency investment, trade credit and the like (e.g. HOT MONEY—banking flows in forex mkts) 10 Balance of Payments Accounts The Capital Account ( DETAILS) Capital Transfers: (+) Canada gives $2 million to Tanzania MoEd. to build schools—money transferred from Canada to Tanzania …a capital account CREDIT for Tanzania (-) US development agency USAID finances a new port in Liberia –money recorded as a DEBIT in the US…a transfer of income from USA to a foreign country Debt Forgiveness: The capital account records a CREDIT for the lender when forgiven (a debit for the forgiven debtor nation) Exchanges of non-produced, non-financial assets: the purchase OR sale of ‘non-productive’ assets such as patents, copyrights, franchises/licenses and the purchases of land by a government or international org.11 Balance of Payments Accounts Net BoP is always going to be zero. If there is a deficit/surplus the central bank buys/sells for-ex (reserve account) * …this happens after all ‘accounts’ are added up. Re - the Reserve Account (central bank) The Reserve Account of BOP records changes in the amount of “official” reserve assets held by the Bank (of Canada). Official reserves assets include gold, foreign currencies …and SDRs with any other reserve positions in the IMF. * If a country must make net payment to foreigners because of BOP deficit, the country could either run down its official reserve assets or borrow anew (again) from foreigners. 12 Balance of Payments Accounts Statistical Discrepancy (S.D.) There’s going to be some omissions and mis-recorded transactions—so we use a “plug” figure to get things to balance. pp. 384 shows a discrepancy of $ (-)5 billion (HL practice Q.) How to calculate? BP = 0 when all known transactions are accounted for, so the S.D. is the "residual" value that will balance the books. 13 The Balance of Payments Identity (HL) BCA + BKA + BRA = 0 where BCA = balance on current account BKA = balance on capital account BRA = balance on the reserves account Under a pure flexible exchange rate regime, where the CB does not maintain any official reserves, a CA surplus or deficit must be matched by KA deficit or surplus: BCA + BKA = 0 Under the fixed exchange rate regime, the combined balance on the current and capital accounts will be equal in size, but opposite in sign, to the change in the official reserves: BCA + BKA = +/- BRA (8:30) Tutor4U video summary: https://www.youtube.com/watch?v=KjqjEYJFefg 14 Balance of Payments Fixed Exchange Rate BOP determines necessity of government intervention Can help forecast devaluation/revaluation of currencies Floating Exchange Rate Government has no responsibility as ForeX rates are determined by market forces Managed Floats Focus of government is on interest rates 15 Balance of Payments (re-determinants of exchange rates) 1. Differentials in Inflation – generally, low inflation leads to rising currency values 2. Differentials in Interest Rates - higher rates offer lenders higher returns (money flows in c.p.) 3. Current-Account Deficits- deficits mean the country requires more foreign exchange –excessive demand lowers rates 4. Public Debt- large debt encourages inflation – if it is too high then the debt gets paid off in lower (real) value $ in future 5. Terms of Trade- the ratio of export prices to import prices; rising exports leads to increased demand for currency 6. Political Stability and Economic Performance- political turmoil leads to uncertainty currency confidence drops (QC in 85, 95) 16 Balance of Payments Trends in Major Countries From 1982-2000, U.S. has had continual annual trade deficits (CA) with the rest of the world (ROW), along with annual capital surpluses in roughly equal annual amounts. U.S. has been a "net debtor" nation over this period. Over the same period, Japan has had annual trade surpluses with ROW, along with annual capital outflows, also in roughly equal amounts. Japan is a "net creditor" nation, investing its trade surplus in foreign stocks, bonds, real estate, government debt (Tbonds, etc.), businesses (FDI), art, etc. Japan has been accused of "mercantilism," i.e. erecting trade barriers, or protectionist trade policies to restrict or limit imports. Japan is STILL the largest holder of US debt !! China (gov’t) actually owns more US assets though (i.e. the US mortgage agencies) 17 Do monetary and fiscal policies affect the exchange rates and BOP components? • Monetary Policy: An unanticipated shift to expansionary monetary policy will lead to more rapid economic growth, accelerated inflation and lower real interest rates • BOP effects: Higher income and higher domestic prices stimulate imports and discourage exports. Lower real rates discourage foreign and domestic investment at home. • Exchange rate effects : The adverse impact of the country’s current account will increase the supply of currency in the fx markets; causing the currency to depreciate. The adverse impact of the country’s financial account will decrease demand for the country’s currency, causing it to depreciate. 18 Do monetary and fiscal policies affect the exchange rates and BOP components? Fiscal Policy: An unanticipated shift to more expansive fiscal policy will result in budget deficits, increase in aggregate demand, inflation and an increase in real interest rates. BOP effect:Increase demand will encourage imports & discourage exports, which moves the current account towards deficit. Meanwhile, the higher interest rates attract foreign investment and discourage domestic investment from leaving the country, moving the financial account surplus. Exchange rate effects: The adverse impact of the current account will increase the SUPPLY of the country’s currency, causing the currency to depreciate. The positive impact of the KA will increase demand causing the currency to appreciate. 19 What about monetary and fiscal policies? So what do you think is the net effect? The overall effect is mixed, but the interest rate effect will likely dominate in the short term leading the exchange rate appreciation. 20