HR Payroll Audit

advertisement

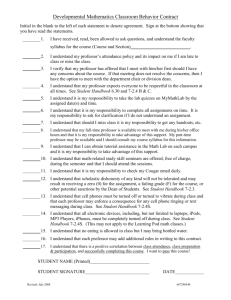

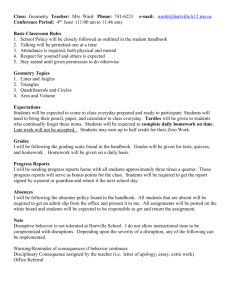

HR and Payroll Review Detail Audit Procedure A. AUDIT OBJECTIVES 1. Payroll expenses are for valid services performed in the ordinary course of business that are recorded correctly as to account, amount and period. 2. Payroll services are properly described and disclosed in the income statement. 3. Payroll services are properly classified whether for current or future events. 4. To provide a general review of human resource issues, including adequacy of company employee handbook, proper structure and content of employee personnel files, and appropriate documentation of disciplinary actions or employee terminations. B. AUDIT PROCEDURES 1. Update the procedure memo. Identify key controls to be relied on. Reference key controls to assertion control matrix. Examine the matrix to determine that all assertions are adequately tested. Determine whether planned audit procedures are adequate based on preliminary evaluation of controls. Reference controls from the control matrix to the audit program step where the controls are tested and comment on control weaknesses. 2. Review the structure of personnel files to ensure that: a. File information is appropriately segregated into three files as required by law: I-9, Medical, and Personnel. Access to the medical file is restricted to certain people who need to know such as the Safety department and supervisor. b. Appropriate information, which is required by law or company procedure, is included in personnel files and is in good order. c. Inappropriate information is not included in personnel files. 3. Review company procedures for evaluating employees; including frequency of evaluations, documentation of evaluation, etc. a. ADA compliant job description in file that identifies essential and non-essential functions has a statement signed by the employee indicating that they have read and understood the material contained, and a disclaimer clearly preserving “at-will” employment. b. Company has established above and below the line criteria such as: 60% avg., 10% unsatisfactory, 15% above avg., and 15% outstanding. c. Policy and procedures established to ensure company is consistent in evaluating. 4. Determine if the company has defined the employee workweek, and appropriately follows this for paying of overtime, etc. 5. Judgmentally select one employee directly associated with the payroll process and four other employees from the employee listing. Select one pay period in 1999 to test and perform the following: a. Agree the authorized time card to the payroll distribution report. b. Recompute gross and net pay. c. Agree the department total gross pay (per payroll register) to the general ledger; note proper classification and cut-off. d. Review application for employee signature and release. e. Agree to authorization for hire and current wage rate. f. Agree withholding status to form W-4 and check completeness. g. Agree other employee deductions to authorization in the personnel file. h. Review I-9 for completeness and separate filing. i. Review ADA compliant job description defining essential and non-essential job functions, noting employee signature (see 3a). j. Review evaluations to ensure they are specific, timely (at least annually), complete, and appropriate. k. Review evaluation criteria for consistency with job descriptions. l. Review for completion of “Conflict of Interest Statement”, and that such statement is adequate. m. Review for application of employment, resume, documentation of reference checks, etc. n. Select a sample of time records, and determine if overtime is correctly calculated. o. Determine if the basis for employee being exempt vs. non-exempt is justified according to the law. Determine the company’s vacation carryover policy, and whether it is being properly applied according to state employment law. q. Determine if for each new version of the handbook, the employee has signed a document indicating they have received the most current version. Discuss problem employees with management, and compare to recent evaluations. This would be done to assist in improving the evaluation process. Review employee jobs descriptions and compare to criteria on which employees are evaluated. This would be done to ensure that job descriptions are up-to-date, and to help ensure that inappropriate criteria are not being used to evaluate employee performance. Review recent terminations and evaluate the adequacy of documentation for termination. Identify voluntary vs. involuntary terminations. Determine if exit interviews are performed and exit interview forms are completed. Document the process for terminations. Review the hiring process in an effort to provide suggestions as to hiring practices, and matching personnel to job requirements. Determine if job openings are properly advertised and in compliance with ADA and EEOC. Evaluate the need for an employee handbook and if need exists, review for the following: a. Determine whether handbook creates a contract, express or implied. b. A statement that the handbook is not all-inclusive, and is only a set of guidelines. c. The handbook does not alter the “at-will” relationship between employer and employee. d. The handbook does not guarantee employment for any definite period of time. e. The handbook applies to all employees, and that no category of employees is excluded. f. The handbook supersedes any previous handbook or written policies. g. The handbook can only be changed in writing, by authorized representatives of the organization, and that no other person is authorized to make any statements that contradict the handbook. h. That the handbook can be changed by the organization unilaterally, at any time. i. Determine the date of the last revision to the employee handbook. Determine if the company has the following policies, and that they are appropriate: a. “Violence in the Workplace” policy, which outlines zero tolerance. b. “Sexual harassment” policy, with two avenues of reporting sexual harassment identified and in other ways meeting the legal requirements. c. “Guns in the workplace” policy. Review employment applications for propriety, and any evidence of inappropriate requests for information, etc. Observe that the proper employee disclosures are posted and document how the company ensures that the disclosures are kept current and employees are made aware of their rights. Review the files and paperwork for those individuals who have taken leave under the Family Medical Leave Act. Determine if proper notifications were made, that the leave was properly administered, that the company makes contact with the employee on leave, and in other ways comply with the law. Document the procedures for compliance with the American with Disabilities act. Determine if there are any employees utilizing ADA, and test the process. p. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15.