Chapter 6 Test Bank - Holy Family University

advertisement

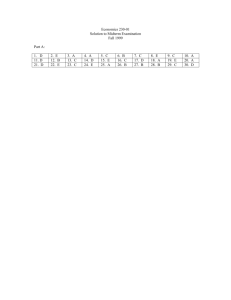

Chapter 6: The Economics of Interest-Rate Spreads and Yield Curves 1) A change in the risk of a bond affects the bond’s risk premium. 2) A change in the relative return of a bond affects the bond’s risk premium. 3) A change in the profit opportunities of a company affects the risk premium of that company’s bonds. 8) An increase in the price of gold would have an ambiguous effect on the risk premium of corporate bonds. 9) If a positive liquidity premium is included in the formula for the term structure, a downward sloping yield curve is impossible. (F) 10) The liquidity premium is included in calculations of the yield curve to account for interest rate risk. 11) The liquidity premium is included in calculations of the yield curve to account for default risk. 14) The U.S. Federal government has never defaulted on its bonds. 16) No country has ever defaulted on its bonds. 18) A blue chip bond has greater default risk than a high yield corporate bond. 19) Positive spreads (long term rates – short term rates) indicate a possible future recession. 20) An AAA bond has lower default risk than a BBB bond. 21) A CCC bond has higher interest rate risk than a BBB bond. 22) Ceteris paribus, a blue chip bond has a lower risk premium than other bonds. 23) Ceteris paribus, a junk bond has a lower risk premium than other bonds. 24) Ceteris paribus, a junk bond has a higher yield and higher risk premium than other bonds. Multiple Choice 1) Which of the following factors could explain difference in yields on bonds with the same time to maturity? © 2012 Flat World Knowledge, Inc. a) b) c) d) default risk tax considerations liquidity all of the above 2) Which of the following factors could explain difference in yields on bonds with the same time to maturity? a) the risk that the issuer will not make future payments b) differences in the taxation of the bonds c) ease of finding buyers and sellers of a bond d) all of the above 3) Which of the following factors could explain difference in yields on bonds with the same time to maturity? a) default risk b) interest rate risk c) credit risk d) all of the above 5) Municipal bonds tend to have lower yields than other bonds, ceteris paribus, due to a) higher default risk. b) lower taxes. c) higher liquidity. d) none of the above. 6) Municipal bonds tend to have lower yields than other bonds, ceteris paribus, due to a) higher default risk. b) higher taxes. c) higher liquidity. d) none of the above. 7) The recent increase in U.S. government debt could lead to a(n) _____ in yields due to an increase in a) increase; default risk. b) decrease; default risk. c) increase; liquidity. d) decrease; liquidity. 8) If a company gets concessions from labor in union negotiations, one would expect a(n) _____ in yields on its bonds due to an increase in a) increase; default risk. b) decrease; default risk. c) increase; liquidity. d) decrease; liquidity. © 2012 Flat World Knowledge, Inc. 11) If S&P upgrades a corporate bond its yield will _____ and its risk premium will a) rise; rise. b) rise; fall. c) fall; rise. d) fall; fall. 12) If S&P upgrades a corporate bond the _____ for the bond will shift and its risk premium will a) demand; rise. b) demand; fall. c) supply; rise. d) supply; fall. 20) Microsoft issues bonds to invest in improving its search engine. This change will shift _____ Microsoft bonds and _____ the risk premium. a) demand for; increase b) demand for; decrease c) supply of; increase d) supply of; decrease 23) Ratings from Moody’s and S&P measure a) liquidity risk. b) interest rate risk. c) default risk. d) all of the above. 25) Default risk is measured by the a) term premium. b) risk premium. c) credit premium. d) none of the above. 26) Junk bonds tend to have a) higher risk premia. b) higher yields. c) higher default risk. d) all of the above. 27) Blue chip bonds tend to have a) higher yields. b) higher risk premia. c) both of the above. d) None of the above. © 2012 Flat World Knowledge, Inc. 29) Term structure models the yields of bonds with a) with the same times to maturity. b) with different times to maturity. c) both of the above. d) neither of the above. 30) The yield curve indicates a possible future recession if it is a) upward sloping. b) flat. c) downward sloping. d) none of the above. Short Answer 1) What is the difference between risk and term structure? Risk structure explains differing yield for bonds with the same maturity, while term structure explains the relationship between yield and time to maturity. 2) If Moody’s upgrades a corporate bond to AAA, explain the impact on the risk premium. 3) If a corporate bond loses its listing on a centralized exchange, explain the effect on the risk premium in terms of the supply and demand for bonds. 14) Does the information in the table about the yield curve indicate a possible recession? Years to maturity 1 2 3 4 5 Yield 2% 2% 3% 5% 8% 15) Does the information in the table about the yield curve indicate a possible recession? Years to maturity 1 2 3 4 5 Yield 9% 8% 6% 5% 3% © 2012 Flat World Knowledge, Inc.