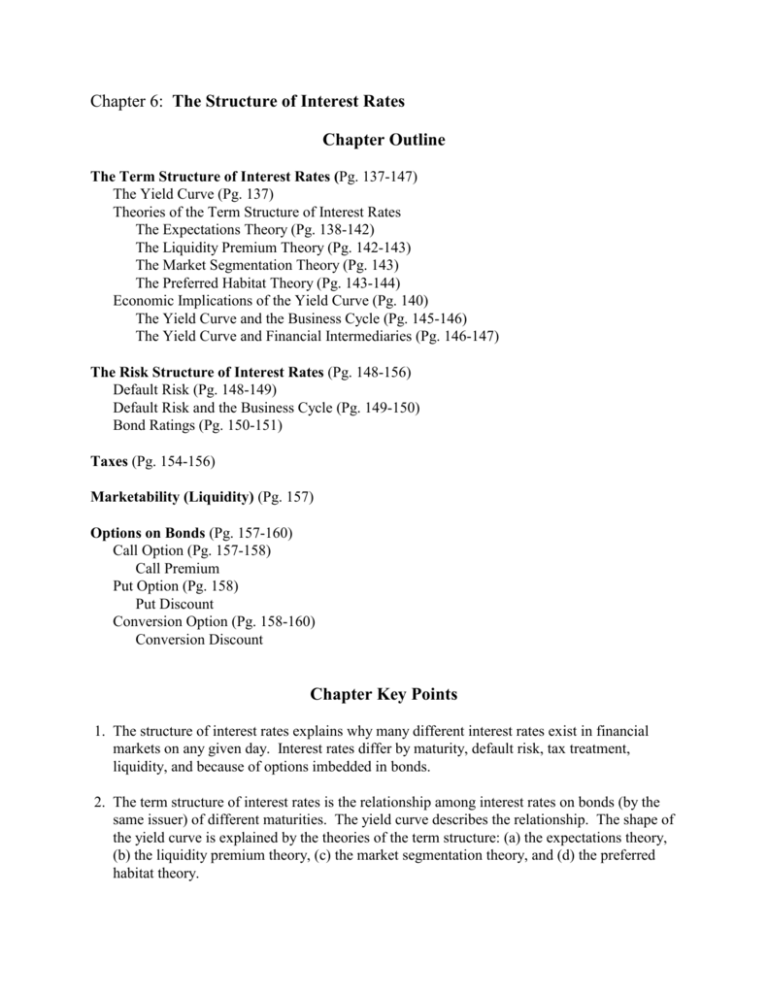

Chapter 6: The Structure of Interest Rates

advertisement

Chapter 6: The Structure of Interest Rates Chapter Outline The Term Structure of Interest Rates (Pg. 137-147) The Yield Curve (Pg. 137) Theories of the Term Structure of Interest Rates The Expectations Theory (Pg. 138-142) The Liquidity Premium Theory (Pg. 142-143) The Market Segmentation Theory (Pg. 143) The Preferred Habitat Theory (Pg. 143-144) Economic Implications of the Yield Curve (Pg. 140) The Yield Curve and the Business Cycle (Pg. 145-146) The Yield Curve and Financial Intermediaries (Pg. 146-147) The Risk Structure of Interest Rates (Pg. 148-156) Default Risk (Pg. 148-149) Default Risk and the Business Cycle (Pg. 149-150) Bond Ratings (Pg. 150-151) Taxes (Pg. 154-156) Marketability (Liquidity) (Pg. 157) Options on Bonds (Pg. 157-160) Call Option (Pg. 157-158) Call Premium Put Option (Pg. 158) Put Discount Conversion Option (Pg. 158-160) Conversion Discount Chapter Key Points 1. The structure of interest rates explains why many different interest rates exist in financial markets on any given day. Interest rates differ by maturity, default risk, tax treatment, liquidity, and because of options imbedded in bonds. 2. The term structure of interest rates is the relationship among interest rates on bonds (by the same issuer) of different maturities. The yield curve describes the relationship. The shape of the yield curve is explained by the theories of the term structure: (a) the expectations theory, (b) the liquidity premium theory, (c) the market segmentation theory, and (d) the preferred habitat theory. 2 3. The four term structure theories are not to be considered in isolation of one another. In fact, each of the hypotheses concerning the relationship between yield and maturity can be thought of special cases of the preferred habitat theory, which considers expected return, as well as price and reinvestment risks, as determinants of the term structure. (a) Under the expectations theory, only expected return is important in determining the term structure. It assumes that investors are risk neutral, so that short- and long-term bonds are perfect substitutes, and investors are indifferent between them. The yield curve is solely determined by expectations of future interest rates, where long-term rates are the (geometric) average of the current and expected short-term rates. (b) The liquidity premium theory also considers price risk as an important determinant of the term structure. Since long-term bonds have more price risk than short-term bonds, longtem rates will embody a risk premium, resulting in an upward-biased yield curve. (c) The market segmentation theory considers only risk, and not expected return, to determine the term structure. It assumes that short- and long-term bonds are not substitutes at all, and their rates are determined by supply and demand for each maturity independently of one another. (d) The preferred habitat theory assumes that short- and long-term bonds are substitutes, but not perfect substitutes, and that investors will leave their preferred maturity (habitat) if they are adequately compensated for the additional (price and reinvestment) risks. A Summary of the Theories of the Term Structure Hypothesis Considers Expected Return Expectations Yes Liquidity Premium Yes Market Segmentation No Preferred Habitat Yes Considers Interest Rate Risk No Yes Yes Yes Considers Reinvestment Risk No No Yes Yes 6. The default risk premium varies over the business cycle. Bond rating is a measure of default risk. 7. The impact of different tax treatments on bond yield explains how the tax status of a financial institution (or individual) affects investment decisions. For example, property/casualty insurance companies usually purchase municipal rather than corporate bonds because municipals provide a higher after-tax yield. 8. The impact of liquidity risk (and default risk) on bond yields explains the yield differential between Treasury and similar bonds. 3 9. Bond options provide the holder (put) or issuer (call) the ability to terminate the bond at a specified price within a defined period. Yields on callable, putable, or convertible bonds differ from bonds without options. 10. A conversion option allows a bond to be redeemed for a certain number of shares of the firm’s common stock over a specified period. When a firm issues a convertible bond, it is in essence writing a call option to the bondholder. A conversion option is included (a) as a “sweetner” by providing something of value to the bond holder (a chance to share in the price appreciation of stock) in return for a lower borrowing cost; or (b) as a form of delayed equity financing, i.e., the firm ultimately wants to raise new capital by issuing common stock but for some reason does not feel that the current time is advantageous for a stock issue.