Term Structure of Interest Rates

advertisement

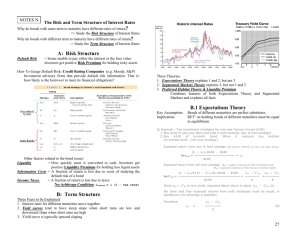

Term Structure of Interest Rates FNCE 4070 Financial Markets and Institutions Same Maturity Different Yields Default Risk • The spread between the interest rates on bonds with default risk and default-free bonds, called the risk premium, indicates how much additional interest people must earn in order to be willing to hold that risky bond. • A bond with default risk will always have a positive risk premium, and an increase in its default risk will raise the risk premium. Credit Rating Agencies • These companies rate securities according to how likely they are viewed to default. • A rating of Baa (BBB) or above is referred to as Investment Grade • A bond with a rating below this is known as a junk bond or high yield bond. Bond Ratings Liquidity • Another attribute of a bond that influences its interest rate is its liquidity; a liquid asset is one that can be quickly and cheaply converted into cash if the need arises. The more liquid an asset is, the more desirable it is (higher demand), holding everything else constant. Income Tax Considerations • Interest payments on municipal bonds are exempt from federal income taxes, a factor that has the same effect on the demand for municipal bonds as an increase in their expected return. • Treasury bonds are exempt from state and local income taxes, while interest payments from corporate bonds are fully taxable. Yield Curve and Term Structure • Yield Curve – a collection of yields to maturity on bonds with differing maturities but the same risk, liquidity and tax considerations • Term Structure – the relationship between the different yields to maturity for a given yield curve. Criteria for Term Structure Theories • The goal of a term structure theory is to explain – Why interest rates on bonds of different maturities move together – When short-term interest rates are low, yield curves are more likely to have an upwards slope; when short term rates are high, yield curves are more likely to have a downwards slope and be inverted. – Yield curves almost always have an upwards slope. Yield Curve Models • Interest rates for different maturities move together. Term Structure Theories • Expectations theory – The interest rate on a long-term bond will equal an average of the short-term interest rates that people expect over its life. • Market Segmentation theory – The markets for different-maturity bonds as completely separate and segmented – An extension of this theory is the Preferred Habitat theory which proposes that investors and borrowers may stray away from their preferred market segment if there are relatively better rates to compensate them • Liquidity Premium theory – The interest rate on a long-term bond will equal the average of the short term interest rates expected to occur over the life of the long term bond plus a liquidity premium that responds to the supply-anddemand conditions for that bond. Discount Factor • A discount factor is the value today of 1 dollar paid at a specific time in the future. PV(cashflow) = cashflow ´ df • In our standard interest rate formula we have df (r, t) = • Note 1 (1+ r ) t df (t0, t2 ) = df (t0, t1 ) * df ( t1, t2 ) Treasury Note • Maturity 2-10 years • Auctioned monthly in the same way as Treasury Bills • Semi-annual coupons of ½ the interest rate • These are auctioned using a semi-annual yield to maturity • The coupon rate on the bond is set to the largest rate divisible by 0.125% such that the premium on the bond is less than par. The rate is floored at 0.125%. Expectations Theory • 1 – Interest rates move together – as long term rates are an average of short term rates movements in short term rates will imply movements in long term rates • 2 – Yield curves tend to have an upward slope when short term rates are low and when short term rates are high the yield curve is generally inverted. If one thinks that rates revert to some sort of mean then if short term rates are low we will see long term rates much higher and vice versa. • 3 – The theory does not explain why yield curves are generally upward sloping. The typical upward slope of yield curve implies that short-term interest rates are generally expected to increase. Liquidity Premium theory • This theory extends the Expectations theory to account for the fact that yield curves are generally upward sloping. – If the expectations theory were true then short term interest rates would generally rise. • The Liquidity premium theory adds a positive premium to compensate investors for the additional risk of longer term bonds. Liquidity Premium Theory • Approximation: int = e i et + it+1 + + it+e (n-1) n + lnt Where int is the interest rate on an n-period bond starting at time t. • More precisely: (1+ int ) n = (1+ ite ) (1+ i et+1 ) ( ) 1+ it+e (n-1) + lnt Important Point • The liquidity premium in the two formulas on the previous slide do not have the same meaning. • IF YOU USE THE FIRST FORMULA FOR THE HOMEWORK OR MIDTERM YOU WILL GENERALLY GET THE ANSWER WRONG!!!! – My daughter chose the formatting Liquidity Premium Theory • Explains the third fact that yield curves are generally upward sloping – Even if short term rates are expected to stay high on average you expect longer term rates to be higher – A Yield curve will only become inverted if short term rates are expected to decrease very rapidly. Forecasting Interest Rates • Expectations Theory 1+ i0,2 ) ( i1,2 = -1 (1+ i0,1 ) n+1 1+ i0,n+1 ) ( in,n+1 = -1 n (1+ i0,n ) 2 Forecasting Interest Rates • Liquidity Premium Theory 1+ i0,2 ) - l0,1 ( i1,2 = -1 (1+ i0,1 ) n+1 1+ i0,n+1 ) - l0,n+1 ( in,n+1 = -1 n (1+ i0,n ) - l0,n 2