Balanced Budget Amendment of 2011

advertisement

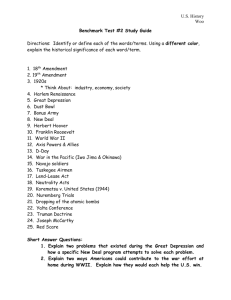

Hospitals & Asylums Standard & Poor’s Debt Ceiling and Balanced Budget Amendment Crisis HA-16-7-11 As edited July 26, 2011 By Anthony J. Sanders sanderstony@live.com Fruitless propaganda between the President and Speaker of the House regarding the federal budget is making me sick. The criminal insanity regarding Nobel laureate President Oma killer and Speaker of the Mother Rapist is too much for my health to bear. Federal hackers have made it clear even the HA U.S. Constitution requires amendment. Lawmakers are threatening our permanent Constitutional record with an AA in my writing class to apologize for their D in my math class, if I do not explain the fine point of the repeal of the Second Amendment by a Balanced Budget Amendment to greet petitioners suing the government for a redress of grievances as politely as the AAA/A+1 rating from Standard and Poor’s that might be downgraded as low as AA if S & P cannot be made to understand that economy actually functions on the HA budget, rather than CBO or OMB budget these days. The problem seems to be that the United States is not capable of reading the Federal Budget in Balance FY 2011: Comparison of Bush and Obama HA-28-2-10, that’s $1,000 license would assure Standard and Poor’s that the United States is in no mathematical danger of defaulting on our debt payments. Even without the inevitable radical nationalization of the health insurance industry, HA has a found that a nearly normal deficit of 3.1% of GDP is achievable in FY 2011 and eases within the reason of a 3% of GDP deficit thereafter if only a few simple and necessary spending limits are imposed on the military and medicine and all the greedy pigs in the Cabinet are impeached and surplus funds returned to the Treasurer. Senator Sanders, a social security support delinquent of $1,000 month himself, must email to the author receipt of the Defense of Social Security Caucus brief HA-1-7-11. The Constitution needs the option of a AAA/A+1 rating for thoroughly repealing paid-off war debts and discrimination as directed by an Optional and Second Optional Protocol to the Balanced Budget Amendment. Perhaps there will be enough HA statute to squeak past the censure of displeasure and amend both the Constitution of the United States of America and the Constitution of Hospitals & Asylums Non-Governmental Economy (CHANGE) this day? There is certainly more than enough gold in my sinuses for immediate national needs. Gross Federal Debt 2005-2012 (in billions) Gross Federal Debt % GDP Change % Change Federal Reserve Debt % GDP Change 2005 7,905 63.5% 736 5.9% 2006 8,451 63.9% 546 6.9% 769 2007 8,951 64.4% 500 5.9% 780 2008 9,986 69.2% 1,035 11.6% 490 2009 11,876 83.4% 1,890 18.9% 769 5.8% 33 5.6% 11 3.4% -290 5.4% 279 2010 13,787 94.3% 1,911 16.1% 2011 15,144 99.0% 1,357 9.8% 2012 16,336 100.8% 1,192 7.9% 1 % Change 4.5% 1.4% -37% 57% Source: OMB Historical Table 7.1 Federal Debt at End of Year 1940-2015. Table 5 HA-28-2-10 On May 16, 2011, the U.S. government reached its Congressionally mandated ceiling for federal debt of $14,294 billion. The Treasury currently estimates that it will have exhausted these exceptional measures on or about Aug. 2, 2011, at which time it will either have to curtail certain current expenses or risk missing a scheduled payment of interest or principal on Treasury securities held by the public. Standard & Poor (S&P) has placed its 'AAA' long-term and 'A-1+' short-term sovereign credit ratings on the United States of America on CreditWatch with negative implications, owing to the dynamics of the political debate on the debt ceiling, there is at least a one-in-two likelihood that S&P could lower the long-term rating on the U.S. within the next 90 days. S&P may lower the long-term rating on the U.S. by one or more notches into the 'AA' category in the next three months, if S&P conclude that Congress and the Administration have not achieved a credible solution to the rising U.S. government debt burden and are not likely to achieve one in the foreseeable future. The CreditWatch action reflects S&P’s view of two separate but related issues. The first issue is the continuing failure to raise the U.S. government debt ceiling so as to ensure that the government will be able to continue to make scheduled payments on its debt obligations. The second pertains to S&P’s current view of the likelihood that Congress and the Administration will agree upon a credible, medium-term fiscal consolidation plan in the foreseeable future (Nikola et al ’11). It would be shame for the Congress and President to raise the debt ceiling when there is so many hundred billion dollars bills of imaginary debt that could be eliminated because they were nothing but accounting errors from the beginning and were never actually administrated. If the President and Congress cannot appease S&P with their revision of the budget the federal government will be expected to agree on raising the debt ceiling by August 2, 2011. Department of Treasury Balance 2008-2012 (in millions) 2008 548,797 11.9% 2009 2010 2011 Treasury OMB 701,775 502,980 593,550 % Change 27.9% -28.3% 18.0% Treasury Operations Budget Justification 14,582 15,591 17,002 Treasury Net Interest on Debt 372,518 388,637 455,941 Treasury Mandatory Accounts 511,515 1,717 90,989 Treasury Total 896,972 400,472 560,863 Savings -195,197 102,508 32,697 Source: US Treasury. Budget Documents. FY 2011. February 1, 2010 Table 10 HA-28-2-10 2012 685,279 15.5% 17,500 500,000 91,000 600,000 85,000 The net interest on the debt is not all that much, $450 - $500 billion FY 2011 - 2012. Social security, public health and military are bigger federal expenses. The Treasury Department seems to need some money to reassure S&P that debt limit does not need to be raised. S & P claims to want $4 trillion in collateral. S & P reports that Congress and the Administration are debating various fiscal consolidation proposals. At the high end, budget savings of $4 trillion phased in over 10 to 12 years proposed by the Administration, (separately) by Congressional leaders, as well as by the Fiscal Commission in its December 2010 report, if accompanied by growth2 enhancing reforms, could slow the deterioration of the U.S. net general government debt-to-GDP ratio, which is currently nearing 75%. Under S&P’s baseline macroeconomic scenario, net general government debt would reach 84% of GDP by 2013. (Our baseline scenario assumes near 3% annual real growth and a post-2012 phase-out of the December 2010 extension of the 2001 and 2003 tax cuts.) Such a percentage indicates a relatively weak government debt trajectory compared with those of the U.S.' closest 'AAA' rated peers (France, Germany, the U.K., and Canada). S&P expects the debt trajectory to continue increasing in the medium term if a medium-term fiscal consolidation plan of $4 trillion is not agreed upon. If Congress and the Administration reach an agreement of about $4 trillion, and if we to conclude that such an agreement would be enacted and maintained throughout the decade, we could, other things unchanged, affirm the 'AAA' long-term rating and A-1+ short-term ratings on the U.S (Nikola et al ’11). We do not find S & Ps national debt statistics to be very credible as a percentage of GDP OMB projects national debt to exceed 100% by the end of FY 2011. Why is the more than $5 trillion scheduled to be paid as net interest on the debt by the Treasury over the next 10 years, not enough to satisfy S & P’s $4 trillion demand? The answer is because the tax collector is having a shortfall of funds on August 2. Are there no medical or military assets that can be liquidated to appease the Treasury’s insatiable appetite for credit? Why is the Treasurer unable to take of the Revenues to pay the Interest on the National Debt without burdening the National Debt or angering S & P? When will Congress and the President stop the incessant babble of savings over ten years and balance the budget as I have done. Department of Health and Human Services Spending 2008-2012 (in millions) 2009 796,267 13.7% 779,419 55,087 2010 868,762 9.1% 800,271 45,162 2011 934,426 7.6% 880,861 21,066 2012 911,291 -2.5% HHS Budget 3.0% Growth Limit from 2008 721,455 743,099 765,392 788,354 HHS Savings 3.0% -62,686 132,860 189,127 138,134 Health and Human Services OMB % Change HHS Budget Authority HHS Recovery Act ARRA Total of 3 yr. spread 2008 700,442 4.2% ARRA 121,315 Source: HHS FY 2011 President’s Budget for HHS. February 1, 2010 Table 16 shortened and recalculated for 3% although 2.5% is a historically more normal rate of spending growth 3% is more significant HA-28-2-10 A $1.5 trillion annual deficit cannot be balanced with $1.5 trillion in savings over ten years, this ten year variable impossibly complicates the difficult task of eliminating the $1.5 trillion deficit, and completely obsesses the body politic, so as to gain absolutely no benefit from the statement to the news media. I am calling for two core spending reductions. The first is simply that military spending, cresting at $711 billion in FY 2011, must be limited to $500 billion for the rest of the decade, for $211 billion savings. The Department of Defense (DoD) is neither an investment nor a research firm and should return treasonous monies to the Treasury. The second is that public health spending has been hopelessly distorted by the Recovery Act and OMB and CBO records of spending on the Department must drop from $911 billion to $733 billion for 3 $138 billion in savings in FY2012. If the Treasury actually needs any money the Treasury should have no trouble getting it from the Department of Health and Human Services (DHHS) who desperately need to stop paying for medical care the patient reports they didn’t like. Medical payments escalated dramatically under the Recovery Act. The Secretary’s actual budget request is much lower than the money credited by OMB. OMB must recognize that the actual spending of HHS is $50 billion less than what OMB estimates. HHS must not be corrupted by the Recovery Act. Nor should tax collectors be corrupted by HHS. We need to go back to 2008 to find a natural rate of public health spending, undistorted by Recovery Act funds the Department never asked for, $700 billion in FY 2008 as a base year. Whereas we have long been disgusted with the greediness of the health sector we have decided to impose a health industry-wide 3% cap on inflation of prices. A 3% annual inflation of public health spending from $700 in base year FY 2008, $765 billion in FY 2011 and $788 billion in FY 2012. In FY 2011 the Secretary spent $881 billion, including Recovery Act distortion, but OMB credited HHS with $934 billion spending. This discrepancy between OMB and CBO is valued at savings of $50 billion if the President and Congress would only listen to reasonable demands of their Secretary. To balance the budget HHS should reduce spending as much as $100 billion to $788 billion. Growth has been wild and completely defies both the law of supply of demand and the law of diminishing returns. $788 billion in FY 2012 would be a better normal for HHS spending recovering from the Recovery Act distortion. Spending could be reduced by enabling Medicare and Medicaid patients the opportunity to refuse to pay for harmful medical treatment and unspent funds and unethical research and subsidies for the rich should be returned to the Treasury thereby enforcing the law of supply and patient demand. Historically and according to the law of diminishing returns increases in the costs of macro-economic government programs should never increase more than 3% annually. Surely between the returns of medical and military overpayments the Treasurer should be able to earn enough money to pay the net interest on the national debt to the satisfaction of the S & P. Tenth term Congressman Bob Goodlatte from the 6th District of Virginia, submitted H.J. RES. 1 to the 111th Congress on January 6, 2009 when he proposed a three part balanced budget amendment, that would (1) amend the Constitution to require that total spending for any fiscal year not exceed total receipts; (2) require that bills to raise revenues pass each House of Congress by a 2/3 majority; and (3) establish an annual spending cap such that total federal spending could not exceed 18% of the economic output of the United States. H.J. Res. 1 has so far received only 179 sponsors in the House it was by far the most popular of several Proposals for a balanced budget amendment to the Constitution of the United States H.J.RES.78, H.J. RES 89, S.J. RES 22, S.J. RES 27 and S.J. RES 38. Having won the 111th Congress, that failed so miserably to balance the budget that not only the 111th Congress but the Democratic and Republican (DR) duelist system were permanently and totally dissolved, Congressman Goodlatte introduced another balanced budget Constitutional amendment, H.J.Res. 2, that now has 221 cosponsors, and will be introduced after budget negotiations have faltered. The proposed amendments, that might spare the 112th Congress the dignity of being impartially dissolved in the history books, states in its entirety: Joint Resolution 4 Proposing a balanced budget amendment to the Constitution of the United States. Resolved by the Senate and House of Representatives of the United States of America in Congress assembled (two-thirds of each House concurring therein), That the following article is proposed as an amendment to the Constitution of the United States, which shall be valid to all intents and purposes as part of the Constitution when ratified by the legislatures of three-fourths of the several States within seven years after the date of its submission for ratification: Article— Section 1. Total outlays for any fiscal year shall not exceed total receipts for that fiscal year, unless three-fifths of the whole number of each House of Congress shall provide by law for a specific excess of outlays over receipts by a rollcall vote. Section 2. The limit on the debt of the United States held by the public shall not be increased, unless three-fifths of the whole number of each House shall provide by law for such an increase by a roll-call vote. Section 3. Prior to each fiscal year, the President shall transmit to the Congress a proposed budget for the United States Government for that fiscal year in which total outlays do not exceed total receipts. Section 4. No bill to increase revenue shall become law unless approved by a majority of the whole number of each House by a rollcall vote. Section 5. The Congress may waive the provisions of this article for any fiscal year in which a declaration of war is in effect. The provisions of this article may be waived for any fiscal year in which the United States is engaged in military conflict which causes an imminent and serious military threat to national security and is so declared by a joint resolution, adopted by a majority of the whole number of each House, which becomes law. Section 6. The Congress shall enforce and implement this article by appropriate legislation, which may rely on estimates of outlays and receipts. Section 7. Total receipts shall include all receipts of the United States Government except those derived from borrowing. Total outlays shall include all outlays of the United States Government except for those for repayment of debt principal. Section 8. This article shall take effect beginning with the later of the second fiscal year beginning after its ratification or the first fiscal year beginning after December 31, 2016. Section 147 Balanced Budget Amendment of HA Book 3 Health and Welfare (HaW) Title 24 of the United States Code states, 5 A.Strong revenues, together with spending restraint, are critical to the task of reducing the deficit to balance the budget. The budget process of the federal government is led by the President who is responsible for presenting a balanced budget for the State of the Union address under Art. 2 Section 3 of the US Constitution and 31USC(11)§1105 whereby the President must submit his/her budget to Congress after the first week of January and before the first week of February every year and §1106 whereby the President must submit and supplemental or additional budgeting changes and re-appraisements to Congress before July 16th of every year and 1USC(2)§105 whereby 30 September appropriations occur for the next fiscal year beginning 1 October. Federal Budget Deficit, 2000-2019 Source: McArdle, Megan. The Deficit Blame Game. The Atlantic. 10 June 2009 1. Congress is responsible for balancing the budget under Art. 1 Section 7 and Art. 1 Section 9 Clause 7 that states, No money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time. The goal of a balanced budget is settled law in the Balanced Budget Act of 1997 (Public Law 105-33) that was improved in the Balanced Budget Refinement Act of 1999. B. The power of Congress to borrow money on the credit of the United States is however conferred by the Constitution at Art. 1 Sec. 8 Cl. 2 and Sec. 4 of the 14th Amendment to the US Constitution wherefore it has been determined that a Constitutional Amendment is needed as the result of the supremacy clause. 1. The Articles of Confederation and Perpetual Union had granted to the Continental Congress the power to borrow money, or emit bills on the credit of the United States, 6 transmitting every half-year to the respective States an account of the sums of money so borrowed or emitted. 2. Article I, Section 8, Clause 2 of the Constitution grants to the United States Congress the power to borrow money on the credit of the United States. 3. At the time that the Constitution came into effect, the United States had a significant debt, primarily associated with the Revolutionary War. As early as 1798, Thomas Jefferson wrote, I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government; I mean an additional article taking from the Federal Government the power of borrowing. I now deny their power of making paper money or anything else a legal tender. I know that to pay all proper expenses within the year would, in case of war, be hard on us. But not so hard as ten wars instead of one. For wars could be reduced in that proportion; besides that the State governments would be free to lend their credit in borrowing quotas. 4. Although Jefferson made a point of seeking a balanced budget during the early years of his administration, he seems to have later reversed himself, to effect the Louisiana Purchase. But note also that he made no exception for war, but rather saw the requirement of maintaining a balanced budget as a salutary deterrent. 5. The issue of the federal debt was next addressed by the Constitution within Section 4 of the Fourteenth Amendment (proposed on 13 June 1866 and ratified on 9 July 1868): whereby the validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. C. Several balanced budget Amendments have been proposed however no one proposed Amendment has been agreed to. Four follow, 1. The text of the version presented to the Senate and to the House of Representatives which (after revision) was approved by the Senate (by a vote of 69 to 31) on 4 August 1982 but supported by an inadequate majority of the House of Representatives (with a vote of 236 to 187) on 1 October 1982: Section 1. Prior to each fiscal year, the Congress shall adopt a statement of receipts and outlays for that year in which total outlays are no greater than total receipts. The Congress may amend such statement provided revised outlays are not greater than revised receipts. Whenever threefifths of the whole number of both Houses shall deem it necessary, Congress in such statement may provide for a specific excess of outlays over receipts by a vote directly to that subject. The Congress and the President shall ensure that actual outlays do not exceed the outlays set forth in such statement. 7 Section 2. Total receipts for any fiscal year set forth in the statement adopted pursuant to this article shall not increase by a rate greater than the rate of increase in national income in the last calendar year ending before such fiscal year, unless a majority of the whole number of both Houses of Congress shall have passed a bill directed solely to approving specific additional receipts and such bill has become law. Section 3. The Congress may waive the provisions of this article for any fiscal year in which a declaration of war is in effect. Section 4. The Congress may not require that the states engage in additional activities without compensation equal to the additional costs. Section 5. Total receipts shall include all receipts of the United States except those derived from borrowing and total outlays shall include all outlays of the United States except those for repayment of debt principal. Section 6. This article shall take effect for the second fiscal year beginning after its ratification. 2. Here is a version introduced into the House of Representatives with 160 sponsors on 7 January 1997: Section 1. Total outlays for any fiscal year shall not exceed total receipts for that fiscal year, unless three-fifths of the whole number of each House of Congress shall provide by law for a specific excess of outlays over receipts by a rollcall vote. Section 2. The limit on the debt of the United States held by the public shall not be increased, unless three-fifths of the whole number of each House shall provide by law for such an increase by a rollcall vote. Section 3. Prior to each fiscal year, the President shall transmit to the Congress a proposed budget for the United States Government for that fiscal year in which total outlays do not exceed total receipts. Section 4. No bill to increase revenue shall become law unless approved by a majority of the whole number of each House by a rollcall vote. Section 5. The Congress may waive the provisions of this article for any fiscal year in which a declaration of war is in effect. The provisions of this article may be waived for any fiscal year in which the United States is engaged in military conflict which causes an imminent and serious military threat to national security and is so declared by a joint resolution, adopted by a majority of the whole number of each House, which becomes law. Section 6. The Congress shall enforce and implement this article by appropriate legislation, which may rely on estimates of outlays and receipts. 8 Section 7. Total receipts shall include all receipts of the United States Government except those derived from borrowing. Total outlays shall include all outlays of the United States Government except for those for repayment of debt principal. The receipts (including attributable interest) and outlays of the Federal Old-Age and Survivors Insurance and the Federal Disability Insurance Trust Funds (as and if modified to preserve the solvency of the Funds) used to provide old age, survivors, and disabilities benefits shall not be counted as receipts or outlays for purposes of this article. Section 8. This article shall take effect beginning with fiscal year 2002 or with the second fiscal year beginning after its ratification, whichever is later. 3. On 17 February 2005, a similar measure to that of 7 January 1997 was introduced with 24 sponsors, differing in these sections: Section 6. The Congress shall enforce and implement this article by appropriate legislation, which may rely on estimates of outlays and receipts. The appropriate committees of the House of Representatives and the Senate shall report to their respective Houses implementing legislation to achieve a balanced budget without increasing the receipts or reducing the disbursements of the Federal Old-Age and Survivors Insurance Trust Fund and the Federal Disability Insurance Trust Fund to achieve that goal. Section 7. Total receipts shall include all receipts of the United States Government except those derived from borrowing. Total outlays shall include all outlays of the United States Government except for those for repayment of debt principal. Section 8. This article shall take effect beginning with the later of the second fiscal year beginning after its ratification or the first fiscal year beginning after December 31, 2009. 4. And on 13 July 2005, with 123 sponsors, a version whose first five sections were as those of the previous two above, but which continued thus: Section 6. The Congress shall enforce and implement this article by appropriate legislation, which may rely on estimates of outlays and receipts. Section 7. Total receipts shall include all receipts of the United States Government except those derived from borrowing. Total outlays shall include all outlays of the United States Government except for those for repayment of debt principal. Section 8. This article shall take effect beginning with the later of the second fiscal year beginning after its ratification or the first fiscal year beginning after December 31, 2010. D. It was therefore redacted a shorter Balanced Budget Amendment for incorporation into Article 71 Chapter 8-D of the Constitution of Hospitals & Asylums Non-Governmental Economy (CHANGE): 9 Section 1. Total outlays for any fiscal year shall not exceed total receipts for that fiscal year in order to balance the federal budget. Section 2. Prior to each fiscal year, the President shall transmit to the Congress a proposed budget for the United States Government for that fiscal year in which total outlays do not exceed total receipts. Section 3. The Congress shall enforce and implement a balanced budget by appropriate legislation. Article 70 of CHANGE explains Article I, Section 8, Clause 2 of the Constitution grants to the United States Congress the power to borrow money on the credit of the United States. At the time that the Constitution came into effect, the United States had a significant debt, primarily associated with the Revolutionary War. As early as 1798, Thomas Jefferson wrote, I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government; I mean an additional article taking from the Federal Government the power of borrowing. I now deny their power of making paper money or anything else a legal tender. I know that to pay all proper expenses within the year would, in case of war, be hard on us. But not so hard as ten wars instead of one. For wars could be reduced in that proportion; besides that the State governments would be free to lend their credit in borrowing quotas. Several balanced budget amendments have been proposed however no one proposed Amendment has been agreed to. The text of the version presented to the Senate and to the House of Representatives which (after revision) was approved by the Senate (by a vote of 69 to 31) on 4 August 1982 but supported by an inadequate majority of the House of Representatives (with a vote of 236 to 187) on 1 October 1982. A second version was introduced into the House of Representatives with 160 sponsors on 7 January 1997. On 17 February 2005, a similar measure to that of 7 January 1997 was introduced with 24 sponsors. On 13 July 2005 another was introduced with 123 sponsors. After swallowing the Goodlatte Balanced Budget Amendment hook line and sinker the domestic violence it inspired made it clear that the constitutional treason and concealment of assets and un-annotated amendment were more than mental health could bear. So as not to foster the concealment of assets, treason or continue the atrocious constitutional filing practices of previous administrations Goodlatte must repeal Section 5. The Congress may waive the provisions of this article for any fiscal year in which a declaration of war is in effect. The provisions of this article may be waived for any fiscal year in which the United States is engaged in military conflict which causes an imminent and serious military threat to national security and is so declared by a joint resolution, adopted by a majority of the whole number of each House, which becomes law; repeal Section 7. Total receipts shall include all receipts of the United States Government except those derived from borrowing. Total outlays shall include all outlays of the United States 10 Government except for those for repayment of debt principal and annotate (striking Section 8). This article shall take effect beginning with the later of the second fiscal year beginning after its ratification or the first fiscal year beginning after December 31, 2016. Section 3 is renumbered number 1, Section 1 is renumbered Section 2, Section 4 is renumbered Section 3, Section 2 is renumber Section 4 and Section 6 is renumber Section 5, Section 5, 7 and 8 are repealed and Section 8 is annotated so that it states, Annotated Balanced Budget Amendment Section 1. Prior to each fiscal year, the President shall transmit to the Congress a proposed budget for the United States Government for that fiscal year in which total outlays do not exceed total receipts. Section 2. Total outlays for any fiscal year shall not exceed total receipts for that fiscal year, unless three-fifths of the whole number of each House of Congress shall provide by law for a specific excess of outlays over receipts by a rollcall vote. Section 3. No bill to increase revenue shall become law unless approved by a majority of the whole number of each House by a rollcall vote. Section 4. The limit on the debt of the United States held by the public shall not be increased, unless three-fifths of the whole number of each House shall provide by law for such an increase by a roll-call vote. Section 5. The Congress shall enforce and implement this article by appropriate legislation, which may rely on estimates of outlays and receipts1. A Balanced Budget Amendment to the U.S. Constitution is desperately needed to assure the American people that Congress and the President are responsible for balancing the budget whereas since 2005 this mathematical feet has been performed by HA and since 2009 federal credibility has become the exclusive right of HA and sole proprietor of the federal budget is not an optimal form corporation especially when being tortured with $666 a month for 6, rather than merely three years, without relief from COLA. My last remaining copy of the Constitution is missing pages, the other was stolen by a Gulf War Veteran. I am sure if a Balanced Budget Amendment was passed Congress could spend some of their greedy over-appropriations distributing free copies of the Constitution to the masses. Goodlatte’s Balanced Budget Amendment is acceptable. It is longer and has more personality than mine. Goodlatte’s Balanced Budget Amendment is a Godsend. However, the electricity went out the moment I realized I needed to amend Article 72 Supremacy Clause Repeals. After giving this issue many years of thought in the Constitution of Hospitals & Asylums Non-Governmental Economy (CHANGE) I pray that Goodlatte’s Balanced Budget Amendment will be used to precisely abolish and replace the Second Amendment right to bear arms that is undermining the hospitality 1 (striking Section 8). This article shall take effect beginning with the later of the second fiscal year beginning after its ratification or the first fiscal year beginning after December 31, 2016. 11 of the Bill of Rights. The right to bear arms is not an appropriate response to right to sue the government for a redress of grievances. The right to bear arms is not considered a constitutional right in most countries around the world, although the right to bear arms has been tastefully used in the Vermont Constitution is not even that popular in State Constitution, gun control being deemed more of a regulatory issue. Rose and Milton Friedman agreed that a Balanced Budget Amendment is needed and the Second Amendment Right to Bear Arms needs to go. To truly understand the ramifications of the Balanced Budget Amendment Congress must go back and repeal the Revolutionary war debt from Article VI Section 1 and Civil War debts from Article VI Section 1 and the Civil War Debts and Discrimination after “the whole number of persons in each State” clause of Section 2 of the XIV Amendment. The United States can only be forgiven if the United States learns how to forgive. Neither the United States, the United Nations nor private creditors can continue to hold grudges so many years since the debt has been paid off in full. The Supremacy Clause repeals vindicate the supremacy of Constitutional law to even state sanctioned violence and sado-masochism. Goodlatte is highly encouraged to adopt Article 72 Supremacy Clause Repeals as amended for four or five years above, as an “Optional Protocol to the Proposal for a Balanced Budget Amendment to Replace the II Amendment Right to Bear Arms with a Balanced Budget Amendment and Repeal the Revolutionary and Civil War Debt and Racial discrimination from Article VI Section 1 and the Fourteenth Amendment after Section 2 the whole number of persons in each State” exactly as follows. Optional Protocol to the Proposal for a Balanced Budget Amendment to Replace the Second Amendment Right to Bear Arms with a Balanced Budget Amendment and Repeal the Revolutionary War Debt from Article VI Section 1 so the Supremacy Clause would be Number One and the Civil War Debt and Discrimination from Fourteenth Amendment after Section 2 the whole number of persons in each State and Article I Section 9 would read The Migration or Importation of such Persons as any of the States or Congress shall think proper to admit, shall incur a Tax or duty, until such tariffs are progressively eliminated 1.It is hypocritical for the United States to both claim to require a balanced budget and continue to be burdened with war debts from the Revolutionary and Civil Wars in the same Constitution. 2.To learn the true meaning of a Balanced Budget Amendment the nation must repeal, Article VI Section 1, the Fourteenth Amendment after Section 2 and the entire Second Amendment to the United States Constitution that the Balanced Budget Amendment repeals as the national response to petitioners suing the government for a redress of grievances. 3.Art. VI must be repealed in its first clause so that the supremacy clause would be section number one and oath of office, number two. 4.The Fourteenth Amendment would conclude at section 2 to count “the whole number of persons in each State”. 12 5.The Second Amendment right to bear arms is not an appropriate response to the First Amendment right to sue the government that would be more rational on the basis of federal economics. For Posterity: Article VI Section 1 unnecessarily stated, All debts contracted and Engagements entered into, before the Adoption of this constitution shall be as valid against the United States under the constitution, as under the Confederation. Amendment II seditiously infringed on the First Amendment freedoms particularly the right to sue the government for a redress of grievances stating, A well-regulated Militia, being necessary to the security of the free state, the right of the people to keep and bear Arms, shall not be infringed. Amendment XIV (1868) betrayed the equal protection clause to engage in wars of extermination against Indian tribes after the end of the Civil War and needs to be abolished after Section 2 “the whole number of persons in each State.” clause. Whereas the equal protection clause is quite popular the entire Fourteenth Amendment states, Section 1. All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside. No State shall make or enforce any law which shall abridge the privileges and immunities of citizens of the United States, nor shall any State deprive any person of life, liberty or property without due process of law, nor deny to any person within its jurisdiction the equal protection of the laws. Section 2. Representatives shall be apportioned among the several State according to their respective numbers, counting the whole number of persons in each State. --, excluding Indians not taxed. But when the right to vote at any election for choice of electors for President and Vice President of the United States, representatives in Congress, the Executive and Judicial officers of a Stat, or the members of the Legislature thereof, is denied to any of the male inhabitants of such State, being twenty-one years of age, and the citizens of the United States, or in any way abridged, except for participation in rebellion, or other crime, the basis of representation there-in shall be reduced in the proportions which the number of such male citizens shall bear the whole number of male citizens twenty-one year’s age in such State. Section 3. No person shall be a Senator or Representative to Congress, or elector of President and Vice President, or hold any office, civil or military, under the United States, or under any State who, having previously taken an oath, as a member of congress, or as an officer of the United States, or as a member of any state legislature, or as an executive or judicial officer of any state, to support the Constitution of the United States, shall have engaged in insurrection or rebellion against the same, or given aid or comfort to the enemies thereof. But Congress may by a vote of two-thirds of each House, remove such disability. 13 Section 4. The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave, but all such debts, obligations and claims shall be held illegal and void. Section 5. the Congress shall have power to enforce by appropriate legislation the provisions of this article. Furthermore, Article I Section 9 states, The Migration or Importation of such Persons as any of the States now existing shall think proper to admit, shall not be prohibited by the Congress prior to the Year one thousand eight hundred and eight, but a Tax or duty may be imposed on such Importation, not exceeding ten dollars for each Person”. It should be amended to read. “The Migration or Importation of such Persons as any of the States or Congress shall think proper to admit, shall incur a Tax or duty, until such tariffs are progressively eliminated”. Amendment III is a completely independent Civil Law Amendment, extending the the Second Amendment’s inappropriate response to the superb First Amendment freedoms and right to sue the government for a redress of grievances and also needs to be repealed and it was thought to provide for a second Civil Law Amendment to fully remove reference to the un-parliamentary language that gave rise to the abominable Alien and Sedition Act of 1800 from the Bill of Rights. The American Colonists were not willing to take the risk that men who injure and oppress the people under their administration and provoke them to cry out and complain will also be empowered to make that very complaint the foundation for new oppressions and prosecutions. James Madison, the Architect of the First Amendment said, “If we advert to the nature of Republican Government, we shall find that the censorial power is in the people over the Government, and not in the Government over the people”. The right of free public discussion of the stewardship of public officials was thus, in Madison’s view, a fundamental principle of the American form of government. As Madison said, “Some degree of abuse is inseparable from the proper use of every-thing and in no instance is this more true than in that of the press”. The year the Constitution, was ratified, in 1787, Thomas Jefferson wrote to his friend James Madison, “A bill of rights is what the people are entitled to against every government on earth…and what no just government should refuse”. Madison wrote Jefferson in 1788, “By omitting a list of rights, the new Constitution denied the new government any power to violate rights”. However during the first federal elections held in 1788-1789, Madison realized he must run for office promising a bill of rights. He did it too. On August 24, 1789 the House of Representatives approved seventeen of Madison’s amendments and sent the resolution to the Senate on August 25, on September 25 President George Washington sent twelve amendments to the states for ratification. The text of the First Amendment is derived from three of Madison’s proposals. Where they got the Second and Third Amendments is too disgraceful for the History books. The Second Optional Protocol to the Balanced Budget Amendment to replace the Third Amendment with a Civil Law Amendment, is proposed as follows: 14 Second Optional Protocol to the Balanced Budget Amendment to replace the Third Amendment with a Civil Law Amendment Section 1 The American legal system is a civil-law system based upon written briefs that cite the civil code and human rights. Section 2 Federal Judges shall be elected to terms of four years in general elections in their respective districts. Section 3 Justices of the Supreme Court shall be limited to two terms. Section 4 Associate Justices shall choose a new Chief, from amongst themselves, every year. Section 5 Government officials convicted of crimes against humanity shall be removed from office. Section 6 States shall elect district attorneys. Section 7 States shall elect licensed social workers to judge divorce, mental illness, substance abuse, traffic courts and ethic committees and licensed funeral directors to avoid probate. Section 8 States shall probate and parole criminal offenders to halfway houses to safely meet international minimum standards of detention below the legal limit of 250 detainees per 100,000 residents. Section 9 the death penalty is abolished. Section 10 Disputes of an international character shall be adjudicated by the Customs Court in New York City. Thus concludes the previously written Revisions of the HA Amendments to the U.S. Constitution. It is however necessary to replace the XII Amendment unfiled in Article II whereas Vice-President Aaron Burr was a fugitive in Texas in 1804 after killing Secretary of Treasury Alexander Hamilton, founder of the Federalist Party, in a duel, at Hamilton’s suggestion. Hamilton’s son was also killed in a duel. This fad, dueling, is probably what sabotaged the honor of the Constitution by idolizing war debt above the Supremacy of law. Since then dueling has been almost forgotten amongst men of honor (women?) who tend to prefer disease causing chemical weapons and natural disease pathogens spread by the Democratic and Republican (DR) parties as they corrupt the medical establishment, these days. Domestic violence is prohibited by a Republican form of government under Article IV Section 4. A Republican form of government however needs definition. To create a Republican form of Government that does not incite domestic violence in any instance the decadent inheritors of the Democratic and Republican (DR) parties need to be dissolved and for the sake of future generations it is imperative that the Constitution create a Republican form of Government, of 15 which multi-party politics is integral, by dissolving the Democratic-Republican (DR) two party system so confused with the Electoral College that dominates social, economic and cultural affairs wherefore the following amendment has been drafted. Third Optional Protocol to the Balanced Budget Amendment Replacing the XII Amendment, Dissolving the Democratic-Republican (DR) Parties and Providing for the Direct Election of the President in Article II Section 1. The Democratic and Republican (DR) political parties are dissolved. Section 2. Federal candidates shall report their new political party and any subsequent changes in their party affiliation with the Federal Election Commission (FEC). Section 3. Federal political parties and candidates shall report all campaign contributions and make other reports required by law to the FEC. Section 4. Federal political parties shall make the final selection of their Presidential and VicePresidential candidates at a Caucus at least two months before Election Day. Section 5. No bar certified attorney or licensed professional may run for Congress or Executive, or serve as a Party Chairman, unless they have made written arrangements with the state and/or federal agency certifying their professional license shall be terminated if and when they are elected. Section 6. No candidate shall be qualified to run for President unless they have drafted a balanced federal budget and made it available to the public. Section 7. The freedom of expression of a political party may be publicly censured if they engage in unethical or violent propaganda or dissolved if the systematic misconduct is widespread or flagrantly un-redressed. Section 8. Any Congress incurring epidemic disease, domestic violence or a budget deficit exceeding three percent of the Gross Domestic Product (GDP) shall be dissolved. Section 9. A federal political party for the political organization and election of candidates may be created with the consent and cooperation of the Federal Election Commission (FEC). The United States has been dominated by the Democratic-Republican (DR) party since 1790 who defeated the Federalists in a duel in 1803. After the Civil War the Democratic and Republican (DR) two party system garnered voter turnout exceeding 66% and legislated wisely until 1900. The decadent inheritors prohibited alcohol and joined the Great Depression rather than the League of Nations. After winning two World Wars the 20th century was known as the American Century. In the Third Millennium, the Democratic and Republican (DR) parties, already deep in prison, was unlawfully seized by the Court in 2000, entangled in European 16 colonialism in 2001 and insolvent in 2008 whereupon it became necessary to dissolve the two party system, and provide for multi-party democracy. Amendment XII is incorporated, in its relevant clause, no Vice President who is constitutionally ineligible for the office of President shall be eligible for the Office, into Article II Section 1 to provide for direct elections so that it says 1. The executive Power shall be vested in a President of the United States of America who shall hold Office during the Term of four Years, and together with the Vice President, selected for being the second most popular candidate for President in the same political party, for the same term, be elected, provided no person constitutionally ineligible to the office of President shall be eligible to that of Vice-President of the United States, as follows2. 2. The People of each State shall directly elect the President and Vice-President. Each State shall make a List of all the Persons voted for, and of the Number of Votes for each; which List they shall sign and certify, and transmit sealed to the Seat of the Government of the United States. The Person having the greatest Number of Votes shall be the President. If the Presidential election is a tie or there is no clear victor Congress shall schedule a date for a special election. If 2 The original text of Article II Section 1 Paragraph 1-4 stated, 1. The executive Power shall be vested in a President of the United States of America. He shall hold his Office during the Term of four Years, and together with the Vice President, chosen for the same term, be elected, as follows. 2. Each State shall appoint, in such Manner as the Legislature thereof may direct, a Number of electors, equal to the whole Number of Senators and Representatives to which the State may be entitled in the Congress; but no Senator or representative, or Person holding an Office of Trust or Profit under the United States, shall be appointed an Elector. 3. The Electors shall meet in their respective States, and vote by Ballot for two Persons, of whom on e at least shall not be an Inhabitant of the same State with themselves. And they shall make a List of all the Persons voted for, and of the Number of Votes for each; which List they shall sign and certify, and transmit sealed to the Seat of the Government of the United States, directed to the President of the Senate. The President of the Senate shall, in the Presence of the Senate, and House of Representatives, open all the Certificates, and the Votes shall then be counted. The Person having the greatest Number of Votes shall be the President, if such Number be a Majority of the whole Number of Electors appointed; and if there be more than one who have such Majority, and have an equal Number of Votes, then the House of Representatives shall immediately chuse by Ballot one of them for President; and if no Person have a Majority, then from the five highest on the List of the said House shall in like Manner chuse the President. But in chusing the President, the Votes shall be taken by States, the Representation form each State having one Vote; A quorum for this Purpose shall consist of a Member or Members from two thirds of the States, and a Majority of all the States shall be necessary to a Choice. In every Case, after the Choice of the President, the Person having the greatest Number of Votes of the Electors shall be the Vice President. But if there should remain two or more who have equal Votes, the Senate shall chuse from them by Ballot the Vice President. 4. The Congress may determine the Time of chusing the Electors, and the Day on which they shall give their Votes; which Day shall be the same throughout the United States. 17 the results of the special election are inconclusive the House shall choose the President, but in choosing the President, the Votes shall be taken by Sates, the Representation from each State having one Vote. But if there should remain two or more who have equal, Votes, the Senate shall choose by Ballot the President3. Article II Section 4 pertaining to the impeachment of the President has been a topic of extensive redundant amendments in Amendment XX, Amendment XXII (1951) and Amendment XXV (1967) that was finally successful in impeaching Nixon after the War was over. The section is reorganized from one unnumbered paragraph to 9 numbered paragraphs and one unnumbered paragraph so: Section 1 of Amendment XX is paragraph 1 of Article II Section 4, the relevant two term limit sentence of Section 1 of Amendment XXII is paragraph 2 and the rest and Section 2 is annotated, 3 Article II Section 1 Paragraphs 1 and 2 are Amended to provide no person constitutionally ineligible for President shall be Vice President, and blend the Party Practice of selecting VicePresidential candidates with the Constitutional requirement that the Vice be the second most popular candidate. Amendment XII (1804) provides, The Electors shall meet in their respective states and vote by ballot for President and vice-President, one of whom, at least , shall not be inhabitant of the same state with themselves, they shall name in their ballots the person voted for as President, and in distinct ballots the person voted for as Vice-President, and they shall make distinct lists of all persons voted for as President, and of all persons voted for as Vice-President, and of the number of votes for each, which lists they shall sign and certify and transmit sealed to the seat of the government of the United States, directed to the President of the Senate; - The President of the Senate shall, in the presence of the Senate and House of Representatives, open all the certificates and the votes shall then be counted; - The person having the greatest number of votes for President, shall be the President, if such number be a majority of the whole number of votes for President, shall be President, if such number be a majority of the whole number of Electors appointed, and if no person have such majority then from the persons having the highest numbers not exceeding three on the list of those voted for as President, the House of Representatives shall choose immediately, by ballot, the President. But in choosing the President, the votes shall be taken by states, the representation from each state having one vote; a quorum for this purpose shall consist of a member or members from two-thirds of the states, and a majority of all the states shall be necessary to a choice. And if the House of Representatives shall not choose a President whenever the right of choice shall devolve upon them, before the fourth day of March next following, then the Vice-President shall act as President, as in the case of the death or other constitutional disability of the President.- The person having the greatest number of votes as Vice-President, shall be the Vice-President, if such number be a majority of the whole number of Electors appointed, and if no person have a majority, then from the two highest numbers on the list, the Senate shall choose the Vice-President; a quorum for the purpose shall consist of two-thirds of the whole number of Senators, and a majority of the whole number shall be necessary to a choice. But no person constitutionally ineligible to the office of President shall be eligible to that of Vice-President of the United States. After Vice-President Aaron Burr shot and killed Treasury Secretary Alexander Hamilton he fled to Texas before he was acquitted. 18 Section 3 of Amendment XX is paragraph 3, Section 4 of Amendment XX is paragraph 4, paragraph 5 is the original unnumbered sentence in the Section 4 of Article II, Section 1 of Amendment XXV is paragraph 6, Section 2 of Amendment XXV is paragraph 7, Section 3 of Amendment XXV is paragraph 8, Section 4 and the unnumbered paragraph of Amendment XXV are paragraph 9 and the unnumbered section, Sections 5 and 6 of the XXV Amendment are annotated. Section 2 of Article II is amended for the term President to provide gender neutrality to paragraphs 2 and 3. Furthermore, Section 2 is transferred from Amendment XX to Article I Section 1 paragraph 2. Art. I Section 3 paragraphs 1 and 2 are transferred from paragraphs 1 and 2 of the XVII Amendment (1913) annotating paragraph 3. Art. I Section 6 paragraph 3 is transferred from Amendment XVII. Whereas involuntary servitude was outlawed in Amendment XIII Article IV Section 3 is amended so no person sentenced to Probation, Parole or Community Service…by agreement. Also to Article IV is appended a two paragraph Section 5 from Section 1 and Section 2 Amendment XXIII (1961) pertaining to the District of Columbia. Amendment XVII is replaced by Amendment XXIV (1964), Amendment XVIII (1919) repealed by the XXI Amendment (1933) is replaced by Amendment XXVI (1971) so the Constitution ends at Amendment XIX Equal Suffrage for the benefit of Chapter 8-D of CHANGE Now we know why Americans are so illiterate. They have neglected to file any amendments since 1804. I hope the Annotated Constitution and existence of private mathematics is enough to recuse the federal government from further damaging the market economy. HA has balanced the federal budget every year since the Balanced Budget Amendments of 2005 except FY 2009 and the FY 2011 budget deficit is within 3.1% of GDP, without the radical nationalization of health insurance. The federal government has not even paid the sole proprietor of the federal budget a $1,000 license fee and instead prefers to curse the author with $666 a month for 6 rather than just three years without COLA. Instead of Senator Sanders removing this curse by responding to the answer to his Defense of Social Security Caucus his negligence cast the 112th Congress into a debt ceiling crisis enforced by the President who received $80 million in bribes couched as campaign contributions in violation of 18USCI(11)§201. Not to be outdone the Speaker of the House, whose State of Ohio has seized many high federal offices exclusively on the strength of their copyright infringement of HA, including his post as Speaker, but namely Rob Portman who entire Executive career was a lie and employment with the zombie law firm Sanders, Squires and Demsey was not only a nearly successful assassination attempt but received TARP funds in violation of the Restriction on Former Officer 18USCI(11)§207(c). Most recently, during this debt ceiling crisis Alex Cordray, Consumer Advocate, who seems to have tagged the draft Constitution with his trademark Federal Case No. 666, and is highly suspected of illiterately influencing the Federal Reserve to make the Loans under 18USCI(11)§214. Cordray’s appointment occurred immediately after S & P satisfied with the work of the new Governor, who hasn’t sacrificed a single prisoner to the conflict of interest with HA to date, improved Ohio’s debt rating and consolidated my complaint to an extremely pervasive conflict of interest with Ohio. The State whose Senator sabotaged the Defense of Social Security Caucus and the last place Barack Obama had a soul. His psychosis seems to have been imposed by a combination of smoke-stopping, mind altering substances and corruption by Ohio’s human sacrificing cult. He writes in his autobiography the Audacity of Hope: Thoughts on Reclaiming the American Dream. I first ran for political office at the age of thirty-five, four years out of law school and recently 19 married. Everyone asked, where did you get that funny name? (1) In both the House and the Senate, and in state capitals across the country, there are those who cling to more traditional conservative virtues of temperance and restraint – men and women who recognize that piling up debt to finance tax cuts for the wealthy is irresponsible, that deficit reduction can’t take place on the backs of the poor, that the separation of church and state protects the church as well as the state, and conservation and conservatism don’t have to conflict and that foreign policy should be based on facts and not wishful thinking (37). I imagine the people are waiting for a politics with the maturity to balance idealism and realism, to distinguish between what can and cannot be compromised, to admit the possibility that the other side might sometimes have a point. They don’t always understand the arguments between right and left, conservative and liberal, but they recognize the difference between dogma and commons sense, responsibility and irresponsibility, between the things that last and those that are fleeting (42). In the beginning of the nation Virginian Baptist Reverend John Leland said, “it is error alone that stands in need of government to support it, truth can and will do better without it.” (218). Politics is hardly a science, and it too infrequently depends on reason. But in a pluralistic democracy, the same distinctions apply. Politics, like science, depends on our ability to persuade each other of common aims based on a common reality. Moreover, politics (unlike science) involves compromise, the art of the possible. At some fundamental level, religion does not allow for compromise. It insists on the impossible. If God has spoken, then followers are expected to live up to God’s edicts, regardless of the consequences (219). There is a constant danger, in the cacophony of voices, that a politician loses his moral bearings and finds himself entirely steered by the winds of public opinion (65). That perhaps explains why we long for that most elusive quality in our leaders, the quality of authenticity, of being who you say you are, of possessing a truthfulness that goes beyond worth. Living out values, honesty, standing up for what you believe in, and most of all caring about others are at the heart of the moral code. The Golden Rule, not simply as a call to sympathy or charity but as something more demanding, a call to stand in somebody else’s shoes and see through their eyes (66). My appreciation of the Bill of Rights comes from having spent part of my childhood in Indonesia and from still having family in Kenya, countries where individual rights are almost entirely subject to the self-restraint of army generals of the whims of corrupt bureaucrats (53). Sometimes only the law can fully vindicate our values, particularly when the rights and opportunities of the powerless in our society are at stake. Certainly this has been true in our efforts to end racial discrimination, as important as moral exhortation was in changing hearts and minds of white Americans during the civil rights era, what ultimately broke the back of Jim Crow and ushered in a new era of race relations were the Supreme Court cases culminating in Brown v. Board of Education, the Civil Rights Act of 1964 and the Voting Rights Act of 1965. As these laws were being debated, there were those who argued that government should not interject itself into civil society, that no law could force white people to associate with blacks. Upon hearing these arguments, Dr. King replied, “it may be true that the law cannot make a man love me but it can keep him from lynching me and I think that is pretty important, also” (63). So how should we understand our Constitution, and what does it say about the current controversies surrounding the courts? To begin with, a careful reading of our founding 20 documents reminds us just how much all our attitudes have been shaped by them. Take the idea of inalienable rights. More than two hundred years after the Declaration of Independence was written and the Bill of Rights was ratified, we continue to argue about the meaning of “reasonable” search, or whether the Second Amendment prohibits all gun regulation, or whether the desecration of the flag should be considered speech. We debate whether such basic commonlaw rights as the right to marry or the right to maintain our bodily integrity are implicitly, if not explicitly, recognized by the Constitution , and whether these rights encompass personal decision involving abortion, or end-or-life care or homosexual partnerships. Yet for all our disagreements we would be hard pressed to find a conservative or liberal in America today, whether Republican or Democrat, academic or layman, who doesn’t subscribe to the basic set of individual liberties identified by the Founders and enshrined in our Constitution and our common law, the right to speak our minds, the right to worship how and if we wish, the right to peaceably assemble to petition our government, the right to own, buy and sell property and not have it taken without fair compensation, the right to be free from unreasonable searches and seizures, the right not to be detained by the state without due process, the right to a fair and speedy trial and the right to make our own determinations, with minimal restriction, regarding daily life and the way we raise our children (86). Political theorists writing before the American Revolution concluded that only a democracy could fulfill the need for both freedom and order, a form of government in which those who are governed grant their consent, and the laws constraining liberty are uniform, predictable, and transparent, applying equally to the ruler and the ruled. In the history of the world to that point, there were scant examples of functioning democracies, and none that were larger than the citystates of ancient Greece. With thirteen far-flung states and a diverse population of three or four million, an Athenian model of democracy was out of the questions, the direct democracy of the New England town meeting unmanageable. A republican form of government, in which the people elected representatives, seems more promising, but even the most optimistic republicans had assumed that such a system could work only for a geographically compact and homogeneous political community, a community in which a common culture, a common faith, and a welldeveloped set of civic virtues on the part of each and every citizen limited contention and strife. The solution that the Founders arrived at, after contentious debate and multiple drafts, proved to be their novel contribution to the world. The outlines of Madison’s constitutional architecture are so familiar that even schoolchildren can recite them: not only rule of law and representative government, not just a bill of rights, but also the separation of the national government into three coequal branches, a bicameral congress, and a concept of federalism that preserved authority in state governments, all of it designed to diffuse power, check factions, balance interests, and prevent tyranny by either the few or the many (87-88). While much of the Constitution’s language is clear and can be strictly applied, our understanding of many of its most important provisions, like the due process clause and the equal protection clause, has evolved greatly over time. The original understanding of the Fourteenth Amendment, for example, would certainly allow sex discrimination and might even allow racial segregation, an understanding of equality to which few of us would want to return (90). Before the ink on the constitutional parchment was dry, arguments had erupted, not just about minor provisions but about first principles, not just between peripheral figures but within the Revolution’s very core 21 (91). The Constitution’s system of checks and balances, separation of powers, and federalism may often lead to groups with fixed interests angling and sparring for narrow advantage, but it doesn’t have to. Such diffusion of power may also force groups to take other interests into account and, indeed, may even alter of time how those groups think and feel about their own interests. According to Madison, “no man felt himself obliged to retain his opinions any longer than he was satisfied of their propriety and truth, and was open to the force of argument” (95). In sum, the Constitution envisions a road map by which we marry passion to reason, the ideal of individual freedom to the demands of community. And the amazing thing is that it’s worked. Through the early day so the Union, through depression and world wars, through the multiple transformations of the economy and Western expansion and the arrival of millions of immigrants to our shores, our democracy has not only survived but has thrived. It has been tested, of course, during times of war and fear, and it will not doubt be tested again in the future. The Declaration of Independence may have bee, in the words of historian Joseph Ellis, “a transformative moment in world history, when all laws and human relationships dependent on coercion would be swept away forever.” But that spirit of liberty didn’t extend, in the minds of the Founders, to the slaves who worked their fields made their beds, and nursed their children. The Constitution’s exquisite machinery would secure the rights of citizens, those deemed members of America’s political community. But provided no protection to those outside the constitutional circle, the Native American whose treaties proved worthless before the court of the conqueror, or the black man Dred Scott, who would walk into the Supreme Court a free man and leave a slave (95). The omission of abolitionist sentiments from the original draft of the Declaration, the Threefifths Clause and the Fugitive Slave Clause and the Importation Clause, the self-imposed gag rule that the Twenty-fourth Congress would place on all debate regarding the issue of slavery, the very structure of federalism and the Senate was a necessary, if unfortunate, requirement for the formation of the Union, that in their silence, the Founders only sought to postpone what they were certain would be slavery’s ultimate demise, that this single lapse cannot detract from the genius of the constitution, which permitted, the space for abolitionists to rally and the debate to proceed, and provided the framework by which, after the Civil had been fought, the Thirteenth, Fourteenth and Fifteenth Amendment could be passed and the Union finally perfected (96). Incumbents have a serious advantage with reelection rates for House members hovering at around 96 percent (103). For most politicians, money isn’t about getting rich. In the Senate, at least, most members are already rich. It’s about maintaining status and power, it’s about scaring off challengers and fighting off the fear. Money can’t guarantee victory, it can’t buy passion, charisma, or the ability to tell a story. But without money, and the television ads that consume all the money, you are pretty much guaranteed to lose (109). During the presidential election I found myself increasingly spending time with people of means, law firm partners and investment bankers, hedge fund managers and venture capitalists. As a rule, they were smart, interesting people, knowledgeable about public policy, liberal in their politics, expecting nothing more than a hearing of their opinions in exchange for their checks. But they reflected, almost uniformly the perspectives of their class: the top 1 percent or so of the income scale that can afford to write a $2,000 check to a political candidate. They believed in the free market and an education meritocracy, they found it hard to imagine that there might be any social ill that could not be 22 cured by a high SAT score. They had no patience with protectionism, found unions troublesome and were not particularly sympathetic to those whose lives were upended by the movements of global capital. Most were adamantly prochoice and antigun and were vaguely suspicious of deep religious sentiment. As a consequence of my fund-raising I became more like the wealthy donors I met, in the very particular sense that I spent more and more of my time above the fray, outside the world of immediate hunger, disappointment, fear, irrationality, and frequent hardship of the other 99 percent of the population (114). Obama really swallows these bribes hook line and sinker. Simple math tells the tale (121). In 2006 Obama complained about the $300 billion annual budget deficit, not counting more than $180 billion we borrow every year from Social Security Trust fund, all of which adds directly to our national debt (188). All the Founding Fathers recognized the connection between private property and liberty, but it was Alexander Hamilton who also recognized the vast potential of a national economy, one based not on America’s agrarian past but on a commercial and industrial future. To realize this potential, Hamilton argued, America needed a strong and active national government, and as America’s first Treasury secretary he set about putting his ideas to work. He nationalized the Revolutionary War debt, which not only stitched together the economies of the individual states but helped spur a national system of credit and fluid capital markets. He promoted policies from strong patent laws to high tariffs, to encourage American manufacturing and proposed investment in roads and bridges needed to move products to market. Hamilton encountered fierce resistance from Thomas Jefferson, who feared that a strong national government tied to wealthy commercial interests would undermine his vision of an egalitarian democracy tied to the land. But Hamilton understood that only through the liberation of capital from local landed interests could America tap into its most powerful resource, namely the energy and enterprise of the American people. This idea of social mobility constituted one of the great early bargains of American capitalism, industrial and commercial capitalism might lead to greater instability but it would be a dynamic system in which anyone with enough energy and talent could rise to the top. And on this point, at least, Jefferson agreed, it was based on his belief in a meritocracy, rather than a hereditary aristocracy (151). In the midst of civil war, Lincoln embarked on a series of policies that laid the groundwork for a fully integrated national economy that extended the ladders of opportunity downward to reach more and more people. He pushed for the construction of the first transcontinental railroad. He incorporated the National Academy of Sciences, to spur basic research and scientific discovery that could lead to new technology and commercial applications. He passed the landmark Homestead Act of 1862 which turned over vast amounts of public land across the western United states to settlers from the east and immigrants from around the world, and created a system of land grant colleges to instruct farmers on the latest agricultural techniques, and to provide them the liberal education that would allow them to dream beyond the confines of life on the farm (152). Hamilton’s and Lincoln’s basic insight, that the resources and power of the national government can facilitate, rather than supplant, a vibrant free market, has continued to be one of the cornerstones of both Republican and Democratic policies at every stage of American development. Teddy Roosevelt recognized that monopoly power could restrict competition and made “trust busting” a centerpiece of his administration. Woodrow Wilson instituted the Federal Reserve Bank, to manage the money supply and curb periodic panics in the financial markets. 23 But it was during the stock market crash of 1929 and the subsequent Depression that the government’s vital role in regulating the marketplace became fully apparent. With investor confidence shattered, bank runs threatening the collapse of the financial system, and a downward spiral in consumer demand and business investment, FDR engineered a series of government interventions that arrested further economic contraction For the next eight years, the New Deal administration experimented with policies to restart the economy, and although not all of the interventions produced their intended results, they did leave behind a regulatory structure that helps limit the risk of economic crisis, a Security and Exchange Commission to ensure transparency in the financial markets and protect smaller investors from fraud and insider manipulation, FDIC insurance to provide confidence to bank depositors, and countercyclical fiscal and monetary politics, where in the form of tax cuts, increased liquidity, or direct government spending, to stimulate demand when business and consumers have pulled back from the market (153). FDR led the nation to a new social compact, a bargain between government, business, and workers that resulted in widespread prosperity and economic security for more than fifty years. For the average American worker, that security rested on three pillars, the ability to find a job that paid enough to support a family and save for emergencies, a package of health and retirement benefits from this employer and a government safety net, Social Security, Medicaid and Medicare, unemployment insurance, and to a lesser extent federal bankruptcy and pension protections, that could cushion the fall of those who suffered setbacks in their lives (177). The idea of a black man in the White House, represents a radical break from the past, a severing of the psychological shackles of slavery and Jim Crow. It is perhaps the most important legacy of the civil rights movement, a gift from those leaders like John Lewis and Rosa Parks who marched, rallied, and endured threats, arrests and beatings to widen the doors to freedom. It is through this quintessentially American path of upward mobility that the black middle class has grown fourfold in a generation, and that the black poverty rate was cut in half. Through a similar process of hard work and commitment to family, Latinos have seen comparable gains: From 1979 to 1999 the number of Latino families considered middle class has grown by more than 70 percent. In their hopes and expectations, these black and Latino workers are largely indistinguishable from their white counterparts. They are the people who make our economy run and our democracy flourish, the teachers, mechanics, nurses, computer technicians, assemblyline workers, bus drivers, postal workers, store managers, plumbers, and repairmen. And yet for all the progress that’s been made in the past four decades, a stubborn gap remains between the living standards of black, Latino and white workers. The average black wage is 75 percent of the average white wage, the average Latino wage is 71 percent of the average white wage. Black median net worth is about $6,000 and Latino median net worth is about $8,000 compared to $88,000 for whites. When laid off from their job or confronted with a family emergency, blacks and Latinos have less savings to draw on, and parents are less able to lend their children a helping hand. Even middle-class blacks and Latinos pay more for insurance, are less likely to own their own homes and suffer poorer health than Americans as a whole (242-243). Read the Annotated Constitution of the United States at www.title24uscode.org/USConstitution.doc 24 Work Cited Goodlatte, Bob (V-6). Dear Colleague. Cosponsor H.J. Res 1 to require a Balanced Budget Amendment to the U.S. Constitution. December 9, 2010 branden.ritchie@mail.house.gov McArdle, Megan. The Deficit Blame Game. The Atlantic. 10 June 2009 Obama, Barack. The Audacity of Hope: Thoughts on Reclaiming the American Dream. Three Rivers Press. New York. 2006 Sanders et al. Defense of Social Security Caucus brief. Hospitals & Asylums HA-1-7-11 Sanders, Tony J. American Political Economy. Hospitals & Asylums HA-20-3-10 Sanders, Tony J. American Popular Election: The United States has not had a Quorum for Democracy since 1900 HA-29-10-10 Sanders, Tony J. Constitution of Hospitals & Asylums Non-Governmental Economy (CHANGE) Sanders, Tony J. Federal Budget in Balance FY 2011: Comparison of Bush and Obama. Hospitals & Asylums HA-28-2-10 Sanders, Tony J. Health and Welfare (HaW). Book 3. 6th Draft. Hospitals & Asylums HA-31-710 Sanders, Tony J. To Amend the United States Constitution. Hospitals & Asylums HA-26-7-09 Swan, Nikola G.; Chambers, John; Beers, David. United States of America ‘AAA/A-1+’ Rating Placed on Credit Watch Negative on Rising Risk of Policy Stalemate. Global Credit Portal. Ratings Direct. July 14, 2011nikola_swann@standardandpoors.com, john_chambers@standardandpoors.com, david_beers@standardandpoors.com U.S. Health and Human Services FY 2011 President’s Budget for HHS. February 1, 2010 U.S. Treasury. Budget Documents. FY 2011. February 1, 2010 White House Office of Management and Budget Historical Table 7.1 Federal Debt at End of Year 1940-2015 25