"ARTHIA PLUS SCHEME"

advertisement

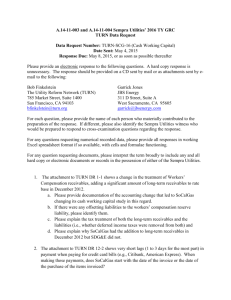

"ARTHIA PLUS SCHEME" Objective Eligibility Nature of Facility Amount of loan Margin Rate of Interest To cater to the financial needs of Commission Agents/ Aratiahs against their book debts/ receivables, from farmers Commission Agents / Aratiahs dealing in agricultural produce viz. Crops, Vegetables, Fruits etc. Enjoying good reputation in the market and having sufficient experience in the line of their business. CC / OD against book debts/ receivables (not older than 6 months). Eight times of the Net Brokerage/ Commission (after taxes) of the previous year or `.50.00 lakh, whichever is less. However, the drawing power will be subject to 60% of the outstanding Book Debts / Receivables which should not be older than 6 months. Upto `.25.00 lac Above `.25.00 lac Security Stock Statement Processing Charges Inspection Charges Others 40% 1.75% above Base Rate i.e. 12% P A As applicable to C&I advances subject to credit rating. Primary: Assignment of book debts i.e. the outstanding dues against the farmers not older than six months, including stocks, if any. Collateral: Tangible collateral security of adequate value (other than agriculture land). Realizable value of collateral security should be at least 133% of the amount of loan sanctioned. The statement of eligible receivables is to be obtained at half yearly intervals. The statement will be verified from borrowers' books of accounts or audited financial statements or C A Certificate. 50% of normal applicable charges. 50% of normal applicable charges. i. To be liquidated twice in a year or within one month of harvesting of crop (Rabi / Kharif). ii. Borrower should have sound financial standing. iii. Rate of interest on loans above `.25.00 lakh will be based on the credit rating of the borrower.